April 2019

Fed Pivot Slows Advent of Cycle’s End

U.S. Fixed Income

Michael Keough | Follow Portfolio Manager

Michael Keough | Follow Portfolio Manager Mayur Saigal | Follow Portfolio Manager

Mayur Saigal | Follow Portfolio Manager Darrell Watters | Follow Head of US Fundamental Fixed Income | Portfolio Manager

Darrell Watters | Follow Head of US Fundamental Fixed Income | Portfolio Manager

The U.S. Fixed Income team discusses how the Fed’s newfound patience could help stabilize the U.S. economy and extend the economic and credit cycles.

Key Takeaways

- Fourth quarter market volatility stemmed from the Fed’s dogmatic approach to tightening, as markets feared policy error amid an already slowing economy.

- The central bank’s pivot to a more neutral policy stance has helped to alleviate market volatility and ease financial conditions year to date.

- As the end of the Fed tightening cycle becomes more apparent and geopolitical headwinds moderate, we expect business confidence, corporate earnings growth and the overall health of the U.S. economy to stabilize at lower levels.

The market volatility of the fourth quarter has generally blown over, and risk asset valuations are climbing again. The Federal Reserve (Fed), in our view, is at the very center of this shift. The Fed’s recent pivot to a more dovish stance has effectively calmed market volatility and will, in our view, further extend the economic and credit cycles.

Hawkish Talk Sends Markets Tumbling

Just a few months ago, the Fed was working hard to replenish its coffers in preparation for the next downturn. Monetary policy was still “a long way from neutral” in October, according to Chairman Jerome Powell, and despite slowing growth in the U.S. and abroad, the Fed raised interest rates in December. It was the ninth hike in the current tightening cycle, raising the Fed’s benchmark rate to the 2.25% to 2.50% range from 0% to 0.25% in 2015. Mr. Powell touted the strength of the U.S. economy and forward guidance suggested we’d see at least two additional interest rate increases this year, when markets saw rationale for none.

The fourth quarter also marked peak velocity for the central bank’s balance sheet runoff, wherein approximately $50 billion worth of Treasuries and government agency mortgage-backed securities now mature without reinvestment each month. Deemed quantitative tightening, this roll-off of assets reduces excess reserves in the banking system, forcing banks to find alternative funding, which should ultimately drive short-term lending rates higher. Mr. Powell stated that the balance sheet runoff was on “automatic pilot” in December, further disappointing markets.

The cumulative effect of the Fed’s tightening thus far, coupled with fear of policy error, brought on a fast and furious bout of volatility at year-end. Equity markets plunged and corporate bond spreads widened dramatically over the yields of their comparable risk-free benchmarks, driving equity and debt funding costs higher. As financial conditions tightened, many investors – us included – began to question how much longer the economic and credit cycles could continue.

A Dovish Pivot

Despite GDP growth advancing an annualized 2.2% in the fourth quarter, and corporate earnings growth registering a multi-year high, 93% of assets generated a negative total return for 2018 in U.S. dollar terms, according to a Deutsche Bank study. The market’s reaction to Fed policy did not go unnoticed.

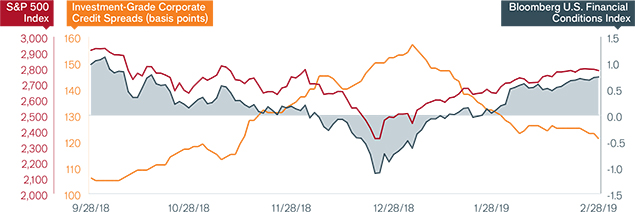

Fed Talk Moves Markets

Hawkish talk sends markets tumbling in 4Q, dovish pivot sends them climbing again in 2019.

Source: Bloomberg, as of 2/28/19.

Notes: Corporate spreads represent the Bloomberg Barclays U.S. Aggregate Corporate average option-adjusted spread (OAS). OAS measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option. 100 basis points equals 1%. Financial conditions represents the Bloomberg U.S. Financial Conditions Index. The Bloomberg U.S. Financial Conditions Indextracks the overall level of financial stress in the U.S. money, bond and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms.

On January 3, Mr. Powell acknowledged markets were “sending signals of concern” despite generally positive U.S. economic data. In a dovish pivot, Mr. Powell added that the Fed “will be patient” as it watches the economy evolve. January’s meeting of the Federal Open Market Committee, the Fed’s policy making body, reiterated the central bank’s newfound patience, implying that it might not raise interest rates at all in 2019. Meeting minutes also disclosed that Fed officials are ready to stop culling the central bank’s balance sheet this year, which is roughly two years earlier than expected and $1 trillion shy of what was anticipated. In March, the Fed confirmed it would remain on pause this year, and that it would cease its balance sheet runoff in September.

We would argue this shift harkens back to the Fed’s unspoken mandate of financial market stability. Maximum employment and stable prices – the central bank’s stated mandates – are in hand, with the unemployment rate at 3.8% (February, Bureau of Labor Statistics) and inflation just below the Fed’s 2% target (December, Bureau of Economic Analysis). What was clearly not in hand in December was market stability – a key element of consumer confidence. As the Fed seeks to engineer a soft landing for this economic cycle, the fact that consumer spending represents approximately 70% of U.S. GDP (4Q18, Bureau of Economic Analysis) is surely top of mind.

We would be remiss not to mention the sheer volume of outstanding debt, which likely also weighs on the minds of Fed officials. U.S. national debt represents approximately 9% of the $236 trillion of global debt outstanding (3Q18, Bank of International Settlements) – a figure that has ballooned amid low borrowing costs and stimulative monetary policy. Economic growth is crucial to servicing and paying down debt. Without growth, those figures could take a recession scenario from bad to worse.

The likelihood is high that the full impact of the Fed’s tightening has not yet come to pass, which begs the question: How much more volatility would we see if the Fed pushed on with its normalization program? We believe that the combination of these factors spurred the Fed’s 180-degree turn. Without inflation knocking, the Fed can afford to pause, take stock of U.S. economic conditions and assuage investor fears. So far this year, it has done all three.

Financial conditions have eased as market participants sigh with relief that the Fed is paying attention to asset prices. In the first three months of the year, U.S. equities generated double-digit returns and retraced much of the fourth quarter’s losses. Credit spreads that had blown out to levels last seen in 2016 are once again encroaching on the tightest levels of this credit cycle. The Bloomberg Barclays U.S. Credit Index returned close to 5%, and the Bloomberg Barclays U.S. High Yield Corporate Index returned over 7%.

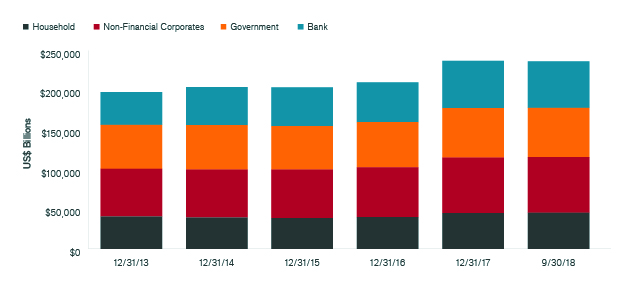

Global Debt Growth

Amid low borrowing costs and stimulative monetary policy, global debt loads have increased considerably since the end of the Global Financial Crisis.

Source: Bank of International Settlements, as of 9/30/18.

What About the Inversion?

As for the yield curve, an inversion (in which longer-dated securities yield less than shorter-dated securities) should not be taken lightly, given each of the last major recessions was preceded by one. However, an inversion does not necessarily portend recession. Inversion indicates a view of a slowing economy and a lower path for future rates, but it is only one factor, among many, that must be analyzed in terms of a recession watch.

The recent inversion of the 3-month to 10-year portion of the yield curve was primarily attributable to the rapid repricing of the path of forward rates. The Fed’s March affirmation of its plans to hold rates steady – which suggests its current hiking cycle is complete – put downward pressure on the long end of the curve, while the front end remains pinned by the federal funds rate. A notion that inflation is generally contained supports the view that the Fed can remain on pause, and that rates can remain range-bound to lower. Further pressure on the long end of the curve is emanating from low-to-negative yields abroad. U.S. rates remain relatively attractive versus global yields, a circumstance that is holding down rates more so than in the past.

These factors, coupled with other currently constructive market indicators, including the aforementioned momentum in credit spreads and equities, lead us to believe that the U.S. economy still has room to run, albeit at a slower pace.

Stabilization Pending

We don’t expect the U.S. economy to reaccelerate, but as fears of a Fed policy error recede, growth could feasibly stabilize in the 2% to 2.5% range. Given that the best days of both the economic and the business cycle are likely behind us, more tempered growth would be appropriate, particularly when we consider that part of last year’s robust corporate performance was due to a late-cycle U.S. fiscal stimulus. While 2018 was the strongest year for top-line growth since 2010, President Trump’s tax package is credited for roughly 40% of it.

A flurry of debt-funded stock buybacks also fueled higher earnings growth over the last few years. As risk premiums return, borrowing costs have risen, and we expect management teams to exhibit a more restrained approach to buybacks, which would further moderate earnings growth. Indeed, analysts are projecting S&P 500® Index earnings growth to be negative in Q1, flat for Q2 and just 3.7% for calendar year 2019 versus 20.5% for 2018 (March 2019, FactSet). Clearly, earnings estimates are accounting for slowing conditions. However, fundamentals remain constructive and once the full scope of the Fed’s tightening has worked through the system, we anticipate earnings growth will stabilize again. The rally in the 10-year, which declined over 80 basis points, or 0.80%, from early November to end of March, should also create a tailwind for housing and other rate-sensitive sectors. Additionally, the consumer remains in a healthy spot amid a strong jobs market and modest wage pressure.

Positive developments on the geopolitical front could lend further support to the U.S. outlook. China’s slowing economy, unresolved U.S.-China trade disputes and the impact of both on global growth stressed markets last year. However, Beijing’s recent stimulus package coupled with a stall in planned tariff increases on Chinese goods entering the U.S. could help to stabilize China’s slowdown, as could a favorable resolution to trade negotiations. The avoidance of a hard Brexit, a scenario in which the UK would leave the European Union’s single market, also appears more likely and would be positive for trade and global growth. Monitoring these developments and their impact on global purchasing managers’ indices (PMIs) will be critical in the months ahead to see whether global and U.S. growth can truly stabilize.

Vigilance Still Required

While there are many factors to keep an eye on, benign inflation and an accommodative Fed should help U.S. economic growth to stabilize at a relatively healthy level, which should in turn help to extend the economic and credit cycles and keep the threat of recession at bay, at least in the near term. Amid this constructive but more reserved backdrop, we anticipate a range-bound marketplace, but we are mindful that corporate valuations generally already reflect these positive developments. Further, timing a recession is inherently challenging and investors must remain vigilant for signs of late-cycle stress.

At this stage of the cycle, we believe there is benefit to considering broad diversification across fixed income asset classes and a more conservative securitized and corporate credit allocation, as opposed to the earlier stages of the cycle when both fundamentals and valuations tend to be tailwinds. When seeking to capitalize on attractively valued potential sources of excess return within corporate credit, we believe it prudent to focus on companies committed to balance sheet improvement, while avoiding those that continue to exhibit more equity-friendly behavior, such as engaging in debt-funded buybacks or mergers and acquisitions. This is also the time in the cycle to look to more defensive business models that have the potential to generate consistent free cash flow, even if a downturn unfolds.

Global Fixed Income Compass

More from Our Investment Professionals

Combating Bond Market Volatility with Global Diversification

Co-Head of Global Bonds Nick Maroutsos explains why investors should be mindful of where they hold duration exposure in light of a flattening yield curve

How Did They Miss it? Central Bankers and the Global Economic Downturn

Jenna Barnard, Co-Head of Strategic Fixed Income, explains how and why so many major central banks have been wrong-footed on economic growth in their countries and around the globe.