Defined Contribution Redefined

-

Phil Collins

Phil Collins

Account Manager

Key Takeaways

- Auto-enrollment, auto-escalation and qualified default investment alternatives (QDIAs) have helped increase defined contribution assets from $3.0T in 2007 to $5.3T in 2017

- About seven in 10 plans use auto-enrollment, but the vast majority of these fund only pre-tax accounts

- Although the use of auto-escalation is increasing, the majority of companies set their annual increase at only 1%

- While most plans use target-date funds as their default, studies have found that users of managed accounts are more engaged and save more for retirement

- As student debt in America reaches $1.5T in 2018, one employer is finding ways to incentivize employees to pay off debt while still saving for retirement

Since the enactment of the Pension Protection Act of 2006 (PPA), automatic features have become common within Defined Contribution plans such as 401(k)s, 403(b)s and 457s. Specifically, auto-enrollment, auto-escalation and qualified default investment alternatives (QDIAs) have helped increase DC assets from $3.0 trillion in 2007 to $5.3 trillion in 20171. This legislation introduced a number of new plan design features to help employees save for their futures. Over the last several years, plan sponsors that have adopted these features have been praised, and rightfully so, for breaking through the inertia that previously kept many employees on the sidelines. Now that these automatic and default features have gained widespread acceptance, it may be time to consider additional steps to further enhance participant retirement preparedness. This briefing will offer five forward-thinking suggestions for how plan sponsors can build upon their plan’s existing automatic features and further enhance participant retirement readiness.

Even if you’re on the right track, you’ll get run over if you just sit there.” – Will Rogers (1879-1935)

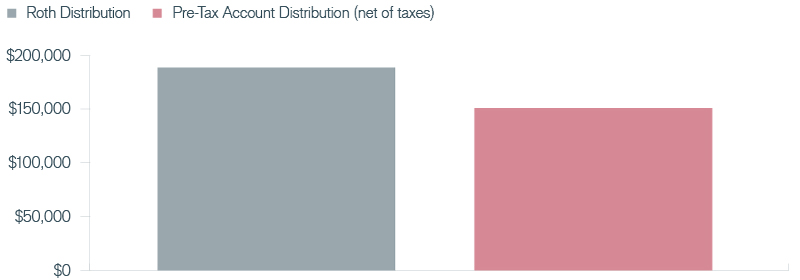

1. Combine Auto-Enrollment with Pre-Tax and Roth Accounts

According to Callan’s 2018 Defined Contribution Trends Survey, among nongovernmental plans, automatic enrollment is used in about seven of 10 plans (71.4%). Most plans with auto-enrollment offer it to new hires (94.5%), while approximately one-quarter (25.4%) have auto-enrolled existing employees either as a one-time sweep or periodic sweep. Of those plans that do not automatically enroll employees, nearly one in 10 is very likely to implement this feature in 2018. At the same time, 77.3% of plans offer a Roth feature.

Anecdotally, we find that the vast majority of auto-enrollment programs fund only pre-tax accounts. For younger, lower-income employees, the Roth account may be a more appropriate long-term option. While contributions are made with after-tax dollars, the earnings can potentially accumulate tax free for many years. Further, younger, lower-paid employees are likely in a lower tax bracket, so the tax advantages of pre-tax deferrals are muted.

Consider a 25-year-old in a 20% effective federal tax bracket. Contributions of $2,500 a year for 10 years will grow to $32,951, assuming a 6% annual rate of return. If no additional contributions are made, the balance will grow to $189,253 by the time the investor reaches age 65. Distributions from a Roth will be tax free, while distributions from a tax-deferred account will result in an after-tax distribution of $151,403. In this case, the Roth provides a more valuable retirement benefit, even after accounting for the annual $5,000 tax savings over 10 years ($2,500 x 20% = $500/year).

Exhibit 1: Roth vs. Pre-Tax Accounts

The example provided is hypothetical and used for illustration purposes only.

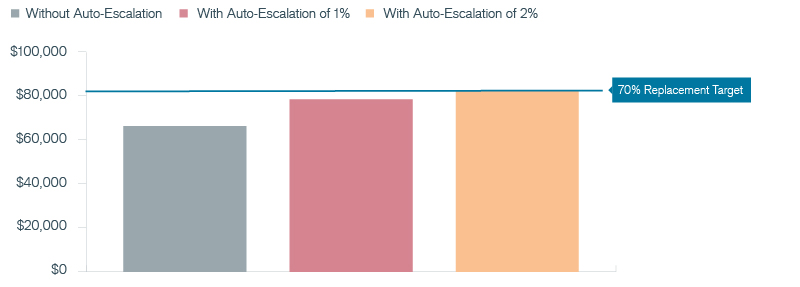

2. Tie Auto-Escalation to Retirement Income Replacement

Callan’s survey shows that approximately 70% of all nongovernmental plans offer auto-escalation, up from 48% in 2014. Further, the number of plans that use an opt-out approach also grew from 52.8% in 2014 to 70.8% in 2017. The vast majority of plans automatically increase deferrals by 1% per year (86%), with a median cap of 15% of compensation. About half of companies selected their cap because it was likely to be most palatable to participants or limit opt-outs, while one-third felt it would maximize the likelihood participants reach their retirement goals.

While automatically increasing deferrals annually should help participants accumulate larger balances at retirement, a uniform 1% approach may not help some participants adequately replace their preretirement income. For example, older employees have fewer years to accumulate savings. If these employees do not have substantial account balances, they may require both a higher starting deferral rate and more aggressive annual increases to meet their retirement goals. Even younger employees may fall short unless prompted by their employer to increase deferrals at a faster rate.

Assume a plan sets a goal of a 70% preretirement income replacement ratio. This ratio is based on a number of factors, including employee demographics, Social Security retirement projections and comparable plans within the same industry. The plan provides a dollar-for-dollar match up to $1,000 that is immediately vested. A 45-year-old participant with an $80,000 salary has a $300,000 balance and contributes 3% annually, or $2,400 ($3,400 with the matching contribution). Let’s assume a 6% annual rate of return, 2% inflation rate, expected retirement at age 65 and life expectancy of age 90. Without auto-escalation, the participant is on target to receive inflation-adjusted income in the first year of retirement of $66,414. Adding a 1% auto-escalation with a 15% cap brings the first year income up to $78,540. A more aggressive auto-escalation schedule that increases annual deferrals by 2% until the cap is reached, however, will result in first-year retirement income of $82,330, meeting the plan’s 70% replacement target.

Exhibit 2: Auto-Escalation

Inflation-Adjusted Income (First Year)

The example provided is hypothetical and used for illustration purposes only.

Plan sponsors are encouraged to revisit their auto-escalation rates and consider a more customized approach based on preretirement income replacement ratios. Employees who are on track using the traditional 1% increase can stay the course, but for those employees well below their target, a 2% or even 3% escalation may be appropriate. At a minimum, employees who are weighing a more aggressive escalation strategy might consider an opt-out approach for the traditional 1% increase but an opt-in approach for the higher, customized rate. While employees would have to take affirmative action to elect the higher rate, these employee-specific suggestions can send a strong signal that unless additional contributions are made, employees might fall well short of their retirement income expectations.

3. Use Multiple Qualified Default Investment Alternatives

Among nongovernmental plans, Callan found 85.2% of plans in 2017 used a target-date fund as their default for nonparticipant-directed monies. The second most popular default was a managed account with 5.2% adoption, up from 2.5% in 2016. The primary advantages of a target-date fund are simplicity, publicly available data and ratings and low cost. While managed accounts offer participants a more customized solution, the primary disadvantage is cost. Fees for managed accounts vary but typically range from “free” to as much as 50 basis points (0.5%). Of course, these fees are in addition to the internal operating expenses that are embedded in the underlying funds recommended as part of the asset allocation service.

While most plans use target-date funds as their default, 75.2% offer a managed account option. In these cases, the vast majority (92.6%) offer it as an opt-in feature whereby participants must proactively elect to use the feature similar to any other investment decision. According to Callan, only 13.3% of sponsors pay for the managed account fee, with the majority assessing the costs directly to the participant or shared by the sponsor and participant. Given the sensitivity to the additional cost of a managed account, it is understandable why many sponsors have elected to use a target-date fund as their plan’s default option.

In the 2017 paper “The Default Investment Decision: Weighing Cost and Personalization,” Morningstar suggested that managed account users have outperformed target-date funds, even after accounting for higher fees. Further, the research also indicated that managed account users save more than target-date fund users after controlling for certain demographic variables and plan features. Finally, given the personalized recommendation and guidance offered by managed accounts, it is possible to increase levels of participant engagement. Morningstar found that approximately 10% of participants engage the managed account provider shortly after enrollment and 20% engage within two years. While engagement does not appear necessary for participants to benefit from the managed account solution, the benefits are found to be significantly higher when participants do become engaged.

Morningstar posits that in some cases, the higher fee associated with managed accounts may be justified, particularly for older participants with significant balances. A hybrid or dynamic solution is suggested whereby younger participants are defaulted into the plan’s target-date fund but later defaults participants into the managed account solution upon reaching a specified age. Choosing an appropriate age would depend upon each plan’s unique participant characteristics. The paper notes that few DC providers currently offer the ability to facilitate a dynamic QDIA approach; however, the marketplace will likely evolve to meet future plan sponsor demand.

4. Incorporate an After-Tax Savings Option in Your Plan Design

Another forward-thinking trend is to offer employees the opportunity to contribute on a voluntary, after-tax basis. Some plans already allow these contributions, which are in addition to the customary 402(g) limits of $18,500 ($24,500 if age 50 or older). Clarification from the IRS in recent years allows these contributions and earnings attributable to these contributions to be transferred to a Roth account or rolled directly into a Roth IRA with no income limitations. The marketplace has called this strategy the Mega Roth. If the transfer or rollover occurs soon after the after-tax contribution is made, the pre-tax earnings should be minimal. Therefore, the employee is able to fund a Roth without incurring a significant tax liability.

There are some caveats to this strategy. Plans that permit voluntary, after-tax contributions must separately account for these contributions and associated earnings. The pro-rata rule does not apply with these Roth transfers and plans may allow employees to pick which sub-accounts or buckets they wish to transfer to the plan’s Roth option, which in this case would be the voluntary after-tax account. Also, 401(k) plans are subject to nondiscrimination tests to ensure the plan provides benefits to rank-and-file employees in addition to those the IRS deems “highly compensated” employees. After-tax contributions are also subject to ACP testing, even for safe-harbor plans. Depending on the company and the demographics of its workforce, the ACP test might be too high a hurdle and, therefore, companies may opt to pass on allowing voluntary after-tax contributions. Other companies may have to cap these contributions at a predetermined limit (in all likelihood, that limit will be greater than the $5,500 Roth IRA limit).

If this strategy sounds complex, it is. Investment committees should be sure to explore this plan design carefully with their advisor, consultant and service providers.

5. Reward Student Debt Reduction with Company Match

As student debt in America reaches $1.5 trillion in 2018, one employer has found a way to incentivize employees to pay off debt while still saving for retirement. We highlight this development in our last suggestion concerning a recently issued IRS private letter ruling (PLR 201833012) regarding an employer’s proposal to amend its retirement plan to include a student loan benefit. Before the amendment, the company’s 401(k) provided a regular matching contribution equal to 5% of the employee’s compensation for each pay period that the employee made an elective deferral of 2%. The proposed amendment would provide a 5% nonelective employer contribution for all employees who make a student loan repayment equal to 2% of their compensation. Employer contributions would be made after the end of the plan year and only to participants still employed at the end of the year.

Enrolled employees would be allowed to opt out at any time. Further, if employees did not make loan repayments but did contribute at least 2% of their compensation to the plan, they would still be eligible for a 5% true-up matching contribution at the end of the plan year. The same vesting schedule would apply for the nonelective contributions and true-up match contributions as regular matching contributions.

Of concern, and the catalyst for the private letter ruling request, was the “contingent benefit rule,” which prohibits an employer from conditioning other benefits on an employee making 401(k) contributions. In the letter ruling, the IRS found that the proposed amendment would not violate the contingent benefit prohibition based on three important factors:

- The nonelective contribution under the program is not itself conditioned on the employee making or not making elective contributions to the plan

- Because an employee may make elective contributions in addition to student loan repayments, the nonelective contribution is not contingent on the employee electing to make or not make elective contributions in lieu of receiving cash

- The plan sponsor will not extend any student loans to employees who will be eligible for the program

Please remember that the only party that can rely on a private letter is the party that made the request, but these developments should be closely monitored as they provide insight into how other plan sponsors and regulators are thinking.

Final Thoughts

It has been over 10 years since auto-enrollment, autoescalation and qualified default investment alternatives arrived on the scene. While they have been positively received by most plan sponsors, we suggest that the time may have arrived to revisit these features and explore others to determine if a more appropriate course of action is necessary. Using a Roth account as part of auto-enrollment, customizing annual increases in participant deferrals and implementing a dynamic QDIA are three possible ways to enhance existing plan features. Also consider incorporating additional after-tax savings options and implementing tactics to encourage employees to reduce student debt and further help them meet their retirement goals.

Plan sponsors are encouraged to revisit their auto-escalation rates and consider a more customized approach based on preretirement income replacement ratios.

Learn more about retirement strategies and solutions through our Defined Contribution in Review.

Download PDF-

PSCA: Voice of the Plan Sponsor, 2018