Subscribe

Sign up for timely perspectives delivered to your inbox.

Emerging market (EM) corporate bonds offer a relatively high yield often for investment grade-style characteristics. Within the JPMorgan Corporate Emerging Markets Bond Index (CEMBI) there are more than 1,400 bonds from 644 issuers in 51 countries across 12 sectors (as of June 30, 2018) so the asset class offers a wide range of alpha opportunities for active managers. Investors are increasingly viewing the asset class as a valuable source of returns and portfolio diversification.

EM credit grew out of the sovereign bond market and has expanded significantly in the past decade. Rapid economic growth and the adoption of more conventional bond structures and reporting methods have seen the asset class flourish. Exhibit 1 demonstrates how the EM corporate bond market has overtaken the developed market high yield market in size within the last few years.

| 2011 | 2013 | 2015 | 2017 | June 2018 | CAGR | |

|---|---|---|---|---|---|---|

| EM external corporates | 860 | 1,378 | 1,692 | 2,075 | 2,140 | 15% |

| DM IG corporates | 3,995 | 4,414 | 5,337 | 5,678 | 6,243 | 7% |

| DM HY corporates | 1,147 | 1,379 | 1,560 | 1,498 | 1,458 | 4% |

Source: JPMorgan CEMBI Monitor, June 2018, DM = developed markets, IG = investment grade, HY= high yield, CAGR = compound annual growth rate between December 31, 2011, and June 30, 2018.

The emerging market corporate bond sector comprises three areas:

In the past, EM credit was associated exclusively with issuers reliant on natural resources, but as economies have grown and industries have developed there is a much wider and deeper issuer base that includes everything from financials and utilities to transport and technology. The types of companies range from systemically important state-owned enterprises to multinationals and domestically focused businesses. In turn, they have varying degrees of reliance on domestic or international markets.

Today, there exist developed market companies with more underlying exposure to emerging markets and EM companies with more exposure to developed markets. Often, EM corporate bonds can represent very solid companies – they are just based in the “wrong” ZIP/postal code. Increasingly, EM companies are assuming a more significant role in corporate consolidation, often acquiring developed market competitors.

The political background of EM is typically more fluid than developed markets. Investors are required to pay close attention to election schedules and outcomes, which can be a catalyst for both challenges and opportunities as fiscal landscapes are reshaped. Environmental, social and governance factors have key roles to play in helping to differentiate between corporate borrowers.

For investors wanting to express a view, EM corporates offer a large, diverse set of issuers with different macro, country, sector, duration (interest rate sensitivity) and credit drivers.

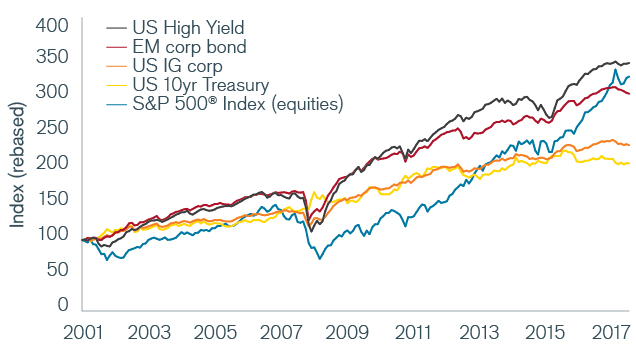

EM corporate bonds have historically offered attractive total returns. Exhibit 2 shows the total return of EM corporate bonds (as represented by the JPMorgan CEMBI Broad Diversified Index) against a number of U.S.-denominated asset classes. Despite being primarily investment grade, EM corporate bonds have generated a performance similar to risk assets such as equities and high yield, but with visibly less volatility.

Income is the leading component of total return in many asset classes over the long term, so the relatively high coupons (income paid out to investors on a periodic basis) on EM corporate bonds have helped to contribute to the strong returns from the asset class. As Exhibit 3 demonstrates, the yield on EM corporate bonds continues to be among the highest available within fixed income markets. What is more, EM corporate bonds typically offer a favorable credit profile. Exhibit 3 shows that EM corporate high yield (HY) on August 31, 2018, was offering a lower duration, higher spread, higher yield, and two notches better credit rating than the U.S. equivalent. Taken in aggregate, EM corporate bonds (represented by the light red column) offer an investment grade credit rating but a yield more akin to high yield bonds.

As EM countries and companies experience fundamental improvements driven by growth and fiscal discipline, ratings agencies have responded with upgrades. The profile of the EM corporate debt market has been improving over time: in mid-2018, some 67% of the emerging market corporate debt stock was investment grade compared with less than 40% at the start of 2000.*

*Source: ICE BofAML EM Corporate Indices, July 31, 2018.

As the EM bond market has grown, bond structures have gradually converged toward those of developed market corporate bonds. Like their developed market counterparts, EM corporate bonds are typically:

Although EM debt is typically synonymous with increased risk, EM companies on aggregate tend to be more financially conservative than their developed market counterparts, with higher cash levels and lower leverage (debt to equity) ratios.

Emerging market economies have grown in strength and now represent more than 59% of global gross domestic product, on a purchasing power basis (IMF World Economic Outlook, April 2018). Moreover, emerging market countries tend to exhibit idiosyncratic features, so while one country’s growth may be slowing, another may be growing rapidly. For example, growth in Thailand slowed sharply in 2013 and 2014, and subsequently recovered, yet the Philippines grew at a consistent 6 to 7% between 2013 and 2018. Exhibit 4 illustrates that emerging markets, in aggregate, continue to outpace developed markets, providing valuable momentum to domestic corporate earnings.

EM credit has the potential to boost the risk-adjusted returns of a diversified portfolio. For example, EM corporate bonds have historically offered relatively high returns but with low correlation to other bond markets, particularly developed market government bonds.

Exhibit 5 illustrates the effect of adding EM corporate bond exposure in 10% increments to a global government bond portfolio. It shows that an increase in exposure initially leads to an increase in return and a decrease in volatility.

It is important to recognize that there are additional risks attached to investing in emerging markets.

By the same token, these risks may translate into higher yields for EM corporate bonds than developed market bonds, providing an opportunity for portfolio managers to capture this additional upside through good asset allocation and security selection.