Subscribe

Sign up for timely perspectives delivered to your inbox.

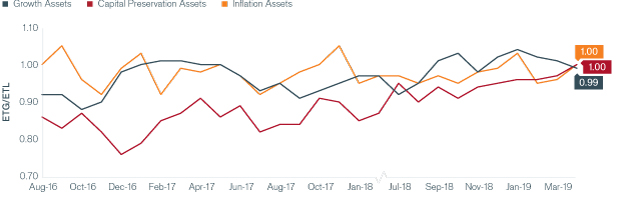

With the 2019 rally in growth assets continuing through March, we now see their level of attractiveness – as measured by our options-market based model – as being roughly in line with their historical average. This is a far cry from late 2018, when a range of potential headwinds were in plain sight. Since then, many would-be challenges have dissipated. Positive developments including the Federal Reserve’s (Fed) dovish about-face, continued progress on U.S.-China trade negotiations and fourth quarter 2018 earnings that were are a far cry from recessionary fears have now been incorporated into the price of growth assets.

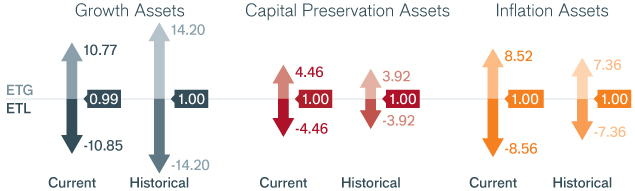

Beginning in August 2016, the “Tail-Based Sharpe Ratios” have been normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories.

*We define ETG and ETL as the 1-in-10 expected best and worst two-month return for an asset class.

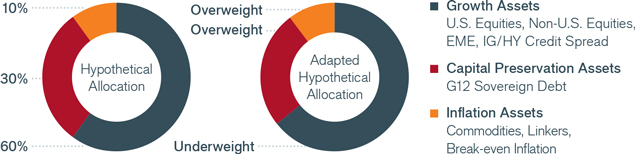

Our Adaptive Multi-Asset Solutions Team arrives at its monthly outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.” These tables summarize the current Tail-Based Sharpe Ratio of three broad asset classes.

On the other hand, we see few signs that possibly negative outcomes are being ignored. As evidenced by recent data – from a rebound in non-farm payrolls to a bump in the manufacturing PMI – U.S. economic output continues to trend in a positive direction. We believe this to be the case despite steady downward revisions in S&P 500® Index consensus earnings estimates; last September, analysts expected 2019 earnings growth to chime in at 10% but they have since dialed that back to under 3%. We readily acknowledge that much of 2019’s positive sentiment toward growth assets was catalyzed by the shift in the Fed’s policy stance. We also recognize that there is little else that developed-market central banks can do to support their economies as they have already fired most of their bullets and have failed to replenish them.

Ultimately, economies will have to stand on their own. Yes, loose monetary policies may trump fundamentals in the early-to-mid-stages of an economic cycle, but eventually economics win. As we reach the later stages of an economic cycle, monetary policy’s ability to provide an incremental boost to economic growth diminishes.

An important factor in underlying economics is inflation, and the risk of it remains on our radar screen. In fact, we consider accelerating prices the biggest threat to the current economic expansion. Backing up this view is our options-based model, which indicates that the attractiveness of inflation-sensitive assets is improving. Furthermore, real yields on long-term Treasuries are well below what we consider to be the normalized level of real GDP growth rate (these should roughly be equal). This implies that money, at least on the longer end of the yield curve, appears cheap – and is likely to remain so due to the Fed’s decision to curtail its balance sheet normalization.

To be sure, inflationary signals are presently not at ring-the-alarm levels, but with the supply of money extremely high, any marginal pickup in money’s velocity or any drop in the excess bank reserves parked at the Fed could awaken inflation from its current dormant state. The kindling is there, and years of low inflation may have lulled investors into a sense of complacency with regard to this pivotal factor in economic outcomes.

In addition to our outlook on broad asset classes, Janus Henderson’s Adaptive Multi-Asset Solutions Team relies on the options market to provide insights into specific equity, fixed income, currency and commodity markets. The following developments have recently caught our attention:

Data was not calculated for all months.