Subscribe

Sign up for timely perspectives delivered to your inbox.

While we have remarked time and time again that inflation represents a key risk to the economic growth that has persisted in recent years, signs of it remained muted. We have searched our options-based market signals far and wide for indications of building price pressures, to no avail. But finally, this month the options market is starting to register above average inflationary signals, and – importantly – the upward trend of “expected inflation” seen last month continues.

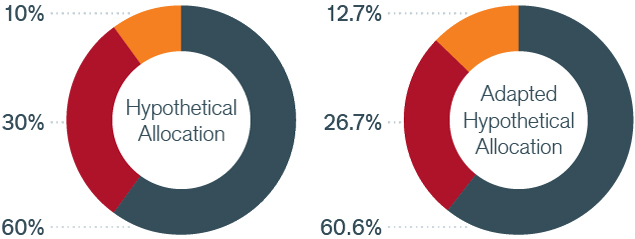

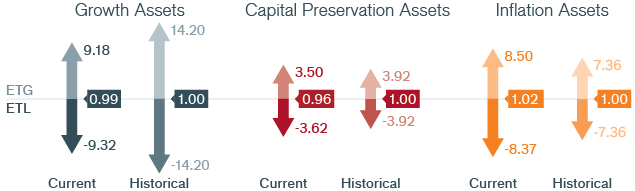

Our Adaptive Multi-Asset Solutions Team arrives at its monthly outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.” These tables summarize the current Tail-Based Sharpe Ratio of three broad asset classes.

This is significant because we remain convinced that inflation poses the most serious risk that can upend the financial markets. While the Federal Reserve (Fed) pivoted to a more accommodative stance late last year to fend off concerns of a slowing economy, we believe the policy shift, in fact, increased the very risk they were aiming to dampen, which is economic slowdown by accelerating inflation risk.

While shorting the “yen” is well known as the “widow-maker” trade, inflation historically has been a “widow-maker” on a grander scale. Every Fed leader in their goal to maintain growth has kept financial conditions and the price of money cheap for too long, ultimately waking up inflation from a dormant state. A hibernating bear is still a dangerous bear, particularly when it just wakes up. Very few of us are pleasant when we are unexpectedly awoken, and the same holds true with inflation. It may appear nonexistent, but when it appears, it arrives rapidly and violently. This has forced each and every Fed leader to react by quickly draining liquidity which, in turn, pushes the price of money too high, followed by higher real rates and ultimately tipped the economy into a recession. Inflation set the chain of events that led ultimately to a recession – the “widow-maker”.

The Fed’s current leadership is risking this reactive destruction by shifting away from what had been an effective, proactive strategy. In recent years, the Fed has taken steps to normalize financial conditions and contain inflation before signs of it emerged. That strategy appears to have ended, with the result likely being a Fed sitting in the passenger seat rather than having its hands on the steering wheel.

The options market is beginning to price in this inflation risk and inflation-sensitive assets are, on a relative basis, currently the most attractive asset class. With excess reserves held at the Fed continuing to fall, wage growth continuing to rise, labor markets strong, commodities on the rise, and an ever-accommodative Fed keeping longer‑term real rates low and, hence the price of money cheap, inflationary risk cannot be underestimated. While our signals are not pointing to imminent breakout inflation, they are forewarning us to pay closer attention to inflation risk and this risk today is just above normal levels.

Given this, it is no surprise that the attractiveness of both bonds and equities have fallen below average levels. Inflation sits on one side of a scale all by itself with every other asset class on the other side – as inflation rises most everything else falls, even real assets as a tightening response will lead to an increase in real rates.

Because of the significance that inflation risk poses, particularly at this stage of the monetary cycle, we will continue to pay special attention to price levels and share any important insights with the readers.

In addition to our outlook on broad asset classes, Janus Henderson’s Adaptive Multi-Asset Solutions team relies on the options market to provide insights into specific equity, fixed income, currency and commodity markets. The following developments have recently caught our attention: