Subscribe

Sign up for timely perspectives delivered to your inbox.

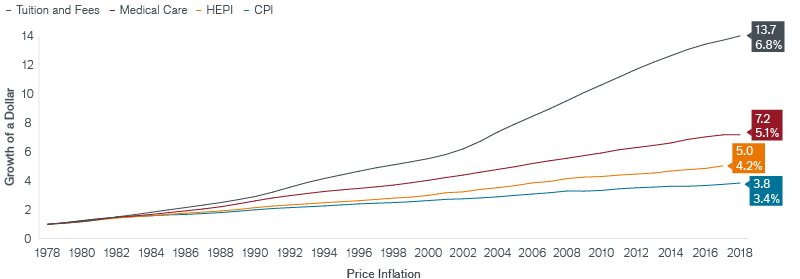

A guaranteed real return of 5.0% represents the holy grail for most investors. It is the holy grail because most investors earnestly seek it but few expect to achieve it year in and year out. The real return of 5.0% is an ideal objective because it preserves purchasing power of corpus while meeting the spending needs of most investors. But, what does real return of 5.0% look like for health care institutions? Due to the different pace of price appreciation of the underlying goods and services, a real return of 5.0% differs from one investor to the next. We illustrate this point in Exhibit 1.

Source: Tuition and Fees: College tuition and fees in U.S. city average, all urban consumers, not seasonally adjusted, https://data.bls.gov/pdq/SurveyOutputServlet. Medical Care: Medical care in U.S. city average, all urban consumers, not seasonally adjusted, https://data.bls.gov/timeseries/CUUR0000SAM?output_view=data. HEPI: Higher Education Price Index. CPI: Consumer Price Index.

Historically, for medical care, a real return of 5.0% has equated to 10.1% in nominal returns because the underlying price index has increased 5.1% per year since 1978; for parents of college-bound kids, it has translated to 11.8% nominal returns because tuition and fees has increased 6.8% per year. As an aside, the foregoing chart explains why college education has increasingly become unaffordable for many American families: tuition and fees grew twice as fast as the broad consumer price index, doubling in price about every 10 years.

In an ideal world with no balance sheet or liquidity constraints, 10.0% nominal return should be the long term threshold for health care investment portfolios to meet the ongoing spending needs and to keep up with medical care price increases.

Based on the above, we pose the following rhetorical questions for health care investors to ponder:

This is how the Yale Endowment summarizes its policy portfolio

The target mix of assets produces an expected real (after inflation) long term growth rate of 6.9% with risk (standard deviation of returns) of 13.9%.”

Clearly, for the Yale Endowment, it is not enough to preserve the purchasing power of corpus, but to grow it over time. For the rest of us – with more modest return objectives – what does the policy portfolio that generates a real return of 5.0% look like?