Subscribe

Sign up for timely perspectives delivered to your inbox.

Stein’s Law, a principle from the late Herbert Stein, chairman of the Council of Economic Advisers during the Nixon administration, states “If something cannot go on forever, it will stop.” Mr. Stein’s observation was made during the debate over how to address the widening U.S. current account deficit in the 1980s, and his words were a reminder that knowing if and when to act is never easy.1 The idea seems relevant today in another context, the stock market, which has been booming. After realizing an 18% average annualized total return since the low in early March 2009 (i.e., the bottom of the Global Financial Crisis) through the end of April 2019, investors in the U.S. stock market may ask: Will this last?

Consider the three components of those fabulous returns. First, and admittedly the least exciting source, is dividends. Although the dividend yield for the S&P 500® Index briefly rose above 3% at the height of the crisis, during the bull market, the yield quickly fell into a range of 2% to 2.5%. Today it resides closer to 2% on a forward-looking basis. Given the average payout ratio of 35% in the index, dividends appear well covered and are perhaps the most solid building block of an expected forward-looking rate of return.

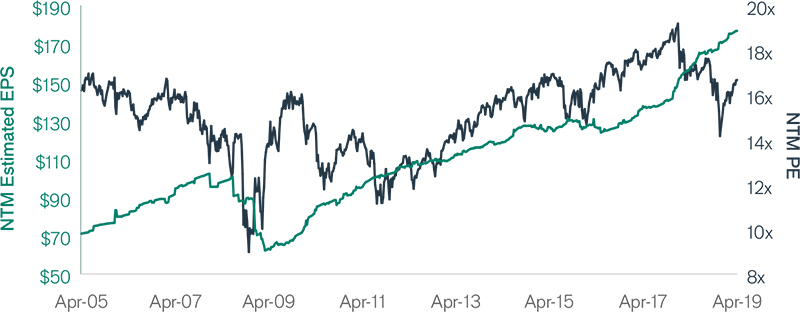

The second component of returns – growth in earnings per share (EPS) – is where the real action has been. The consensus estimate for EPS for the S&P 500 Index over the next 12 months has soared from $68 to $177, a rate of 10% per year (as of April 2019)! Corporate profits have benefited from several tailwinds, including a growing global economy, capital capturing a greater share of income relative to labor, a reduction in corporate taxes and increasing balance sheet leverage that magnifies results. However, looking ahead, it is difficult to see these trends continuing at such high rates, if at all. Real global GDP growth (inflation-adjusted gross domestic product) is expected to be approximately 3.5% over 2019 and 2020, according to the International Monetary Fund’s latest outlook. China’s workforce is shrinking and America’s wages are rising at the fastest rate since the crisis. The benefit of lower taxes to EPS will normalize soon and, while the use of cheap debt-to-fund share repurchases has lowered share counts, leverage ratios are increasingly stretched, leaving weaker credits in a more vulnerable place. All of this is to say that, while corporate profits may well continue to grow, the rate of growth is likely to slow, perhaps significantly.

Source: FactSet, as of April 30, 2019. NTM: next twelve months.PE: price-to-earnings ratio.

But wait, there is more, the third component. It wouldn’t be a proper bull market without significant multiple expansion, and recent experience does not disappoint in that regard. After bottoming at 10x forward estimated EPS during the dark days of the financial crisis, the S&P 500 Index® is currently trading at 16.7x earnings. This change in valuation multiple – call it the Psychological Swing Factor – contributed approximately 5% per year to returns over the past decade! Seasoned investors will know that valuation multiples fluctuate, and while there are good reasons for at least a portion of the increase realized during the bull market (e.g., low interest rates), this component of returns could very well become a headwind in the future should anything go awry. Add it all up – actually multiply 1.025 (2.5% dividends) x 1.10 (10% earnings) x 1.05 (5% valuation) – and you’ve had a wonderful bull market of 18% per year. But that’s in the past and investors always need to look forward: lower starting dividends, mounting EPS headwinds and the possibility of lower valuation multiples suggest a much more modest outlook for returns.

… Investors always need to look forward: lower starting dividends, mounting EPS headwinds, and the possibility of lower valuation multiples suggest a much more modest outlook for returns.

Accepting that the future likely holds the prospect of lower returns than the recent past, what is an investor to do? First, we believe investors should maintain valuation discipline. Consider selling or trimming winners where the valuation has expanded to a level that no longer offers a solid risk-adjusted return potential (this may include technology and other “growth” stocks). Second, avoid excessively levered balance sheets. Remember that leverage magnifies outcomes (both good and bad), and reduces staying power in the event of turbulence. Third, go off-the-beaten-path and maintain high active shares. As the market becomes less attractive, investors should consider being less like the market in their portfolios. Fourth, consider increasing allocations outside the U.S. The MSCI EAFE® Index has lagged the U.S. by 7% per year for the last decade, and some pockets of gloom (Brexit) are excessive, in our view. Finally, diversify. Our team at Perkins is maintaining its discipline around building what we believe are well-balanced portfolios, comprised of attractive reward-to-risk stocks with a wide variety of underlying drivers of earnings and valuations.

Whether the bull market ends with a bang or a whimper, it will eventually end. Tempting as it may be, this isn’t really a question of timing. The only time frame that matters for most savers is the long term. As the balance between potential reward and downside risk becomes less attractive, investors would do well to become more defensive in their portfolios.

Thank you for your co-investment with Perkins Investment Management.

Gregory Kolb