Subscribe

Sign up for timely perspectives delivered to your inbox.

Given the volatility recently experienced in capital markets, a common refrain among today’s forward-looking investors is:

“How will the next five years be different from the last?”

Considering the historic outperformance of U.S. equity markets since the Global Financial Crisis and the resulting home bias (i.e., over allocation) to U.S. equities, the eventual answer to the above question might have an unusually large impact on investors’ equity allocations.

In this interview, we speak with Greg Kuhl, Portfolio Manager of Global Property Equities, and Adam Hetts, Head of Portfolio Construction and Strategy, to explore the current state of home bias in advisor portfolios and the potential role of global REITs in diversifying and alleviating this bias.

Adam, over the last couple of years, the industry has seen substantial flows into international equities. How has this trend shown up in your conversations with advisors, and how does your team view REITs in the context of global investing

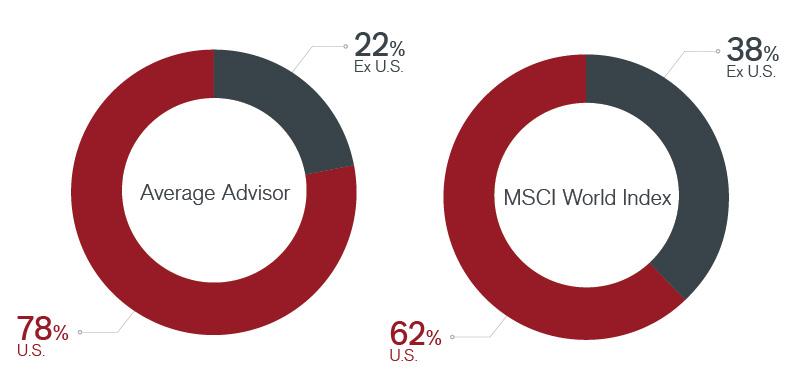

Adam Hetts: This trend has shown up in a lot of different ways. In order to focus on equity globalization and other prominent industry trends, we track average allocations across the thousands of advisor models on which we’ve run analyses. Using these proprietary “Industry Portraits,” we’ve found that even in the face of shifting sentiment and large inflows into international equities, the average advisor’s global developed equity allocation consists of only 22% international equity, while the MSCI World IndexSMis comprised of 38%:

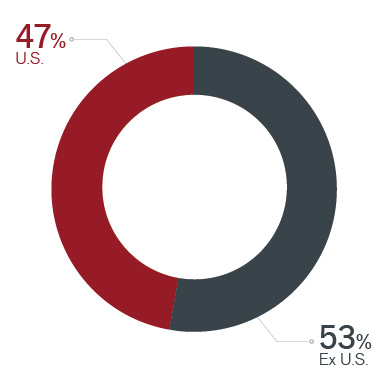

As far as REITs’ role in the global investing conversation, global REITs offer equity risk diversification (see Exhibit 1, next section) as well as regional diversification compared to a U.S.-only approach. By market cap, the FTSE EPRA NAREIT Global Real Estate Index is allocated more than 50% outside North America. Given this footprint, global REITs could play a role for advisors looking to both remove a risk concentration in U.S. equities as well as diversify a portion of the portfolio away from traditional equity risk. This diversification opportunity is meaningful, as 90% of the advisor portfolios in our database are either not allocated to REITs (69%) or have only U.S. REIT exposure (21%):

Greg, as a portfolio manager, how do you think about the diversification benefits of global REITs? Can you talk about the global nature of your fund compared to the benchmark?

Greg Kuhl: While U.S. REITs offer diversification benefits through lower correlations with general equities, international REITs add another layer of diversification benefit:

| Exhibit 1: S&P 500® correlation with… | |

|---|---|

| North American REITs | 0.75 |

| European REITs | 0.69 |

| Asian REITs | 0.63 |

Roughly 50% of our Global Real Estate Fund is invested in North America, 30% in Asia and 20% in Europe. This geographic dispersion helps diversify macro risks, including economic, central bank policy, political and more. As real estate is ultimately a highly localized business with property types, cities and countries operating at varying points in the property cycle, geographic diversity also affords actively managed funds with a larger menu from which to choose attractive investments.

Can you give a couple examples of unique overseas opportunities your team sees, and how these are reflected in your fund’s holdings?

Kuhl: Our Global Real Estate team currently sees very strong supply/demand dynamics in German rental apartments, which is expressed in part through the Fund’s holding in residential landlord Deutsche Wohnen (DWNI GY). Conversely, the team is negative on the medium-term backdrop for U.S. retail real estate and as a result maintains very little exposure to this part of the market.

In addition to diversification by geography and property type, international exposure offers additional diversification opportunities through added opportunities to invest in businesses focused on real estate development for sale as opposed to ownership and leasing. These activities generally represent a larger focus internationally than domestically. While the Fund includes U.S. homebuilders in its investible universe, there are no current holdings here based on our interpretation of near-term fundamentals as relatively lackluster. The Fund does own holdings in builders internationally, including China Resources Land (1109 HK), with residential and commercial developments in mainland China and smaller-cap European residential builders with projects in Germany and London.

Adam, how does your PCS team see global REITs interacting with other popular holdings in advisor portfolios?

Hetts: As far as popular holdings in portfolios, top of mind for many advisors with whom we speak is not just the dominance of U.S. home bias in their equity portfolios but also the corresponding dominance of U.S. growth. Given the structure of the U.S. equity market, this growth concentration often comes hand in hand with broader U.S. equity exposure.

For advisors not only concerned with home bias but also with its corresponding technology overweight, global REITs have the potential to offer diversification – not only at the quantitative level explained earlier (correlations) but in a real-life way that meaningfully improves the investor’s experience if or when there’s a significant event in the technology sector.

With regard to technology risk, how did REITs weather the 2000 dot-com era?

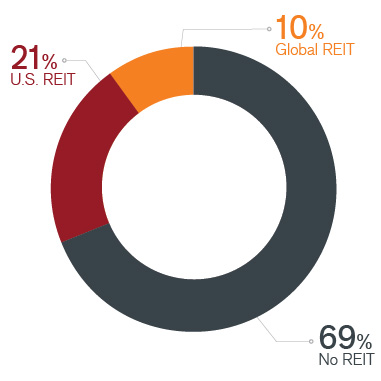

Hetts: The 2000’s dot-com era is an interesting illustration of how global REIT diversification resulted in a smoother ride:

During the 10 years surrounding the March 2000 dot-com peak, the S&P 500® returned about the same as global REITs (11.1% vs. 11.7% annualized, respectively). But in the five years preceding the dot-com peak, the global REIT sector’s annual return of 5.4% made it a relative pariah compared to the S&P’s 24.8%. Then, in the five years following the 2000 peak, global REITs returned an annualized 17.3% against the S&P’s -2.7%.

Altogether, both indices ended up in a similar place, but global REITs experienced a lot less drama along the way. So, while history is not expected to repeat, the dot-com era serves to illustrate potential real-life benefits of diversification: similar or better investment returns with lower risk and therefore less uncertainty along the way.

Greg, how does your team manage sector risk within the Fund, including tech?

Kuhl: Most importantly, it’s generally accepted that today’s tech companies as a group are far superior to those of the 1990s. Today’s REITs are also much improved, with higher-quality properties, less-leveraged balance sheets and stronger management teams. The JH Global Real Estate Fund offers look-through exposure to all facets of the global economy through its investment in companies specializing in myriad types and uses of real estate, ranging from rental apartments to industrial warehouses, office buildings, for-sale residential and data centers.

Also, unlike the broader equity market, the real estate industry has not seen a small handful of companies come to overshadow the rest of the universe. If anything, the real estate universe has become more diverse over time through the addition of new property types like single-family rental and gaming REITs. While the Fund’s investments in data centers and cell towers are exposed to the tech economy, it’s important to note that these assets serve a critical function in facilitating the rapid growth in usage and transmission of electronic data. This trend is expected to continue regardless of which tech companies are in favor at any given time.

Adam talked about the dot-com era as an example of technology risk. How would you compare that with today’s environment, and what does this mean for your outlook on REITs?

Kuhl: Although the current equity market backdrop bears some resemblance to the late 1990s, history should not be expected to repeat itself. However, if it rhymes, REITs may be facing a very favorable intermediate-term backdrop following years of underperformance vs. general equities, attractive current valuations and defensive growth characteristics. The fourth quarter of 2018, which included the worst December since 1931 for U.S. equities, provides a timely example of this phenomenon at work. During 4Q 2018, global REITs fell 4.8% compared to the S&P 500’s drop of 13.5%. While the global REITs’ 8.7% relative outperformance was attractive, the sector’s absolute decline of 4.8% has resulted in these stocks trading at more than a 15% discount to private market asset value – a level not seen since 2011. Coupled with an in-place dividend yield of 4.3% and expected earnings growth of 5%, we believe today’s setup for global REITs is positive.

S&P 500® total return index, FTSE EPRA NAREIT Global Index