Subscribe

Sign up for timely perspectives delivered to your inbox.

Interest rate risk has been the dominant topic of fixed income investing for nearly a decade. Ever since the Federal Reserve’s extreme easing in the financial crisis, investors have hotly debated the if, when, how, and how fast of interest rate changes. In the frenzy of avoiding potential bond price losses that could accompany rising rates, many investors have become fixated on the direction of rates as a primary predictor of success in bond investments. Given all this attention and uncertainty, it’s no wonder this is a seemingly constant topic in our advisor consultations.

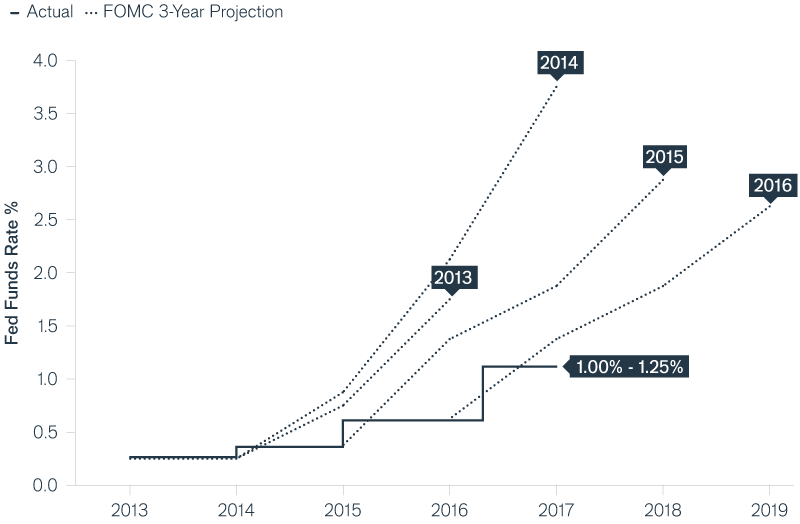

Despite all of the time and energy spent discussing and trying to predict the future path of interest rates, it’s proven that even professional forecasters have had little success in these projections.

U.S. Federal Funds Rate Projections vs. Reality

Source: Federal Reserve Monetary Policy Reports 2013-2016

It is important for investors to understand the impact of a changing interest rate environment and its investment implications; however, we believe client goals should be driving the investment process, not predictions for unpredictable rate movements.

In all of today’s rate discussions, an important point may be lost: short-term moves in interest rates should not make or break an investor’s medium- to long-term financial plan.

In the medium- to long-run, prolonged rising rate periods usually accompany broad-based economic health which should boost the equity portion of most portfolios. Further, client portfolios may be better positioned for rate uncertainty by understanding how different types of fixed income might react to different rate scenarios and diversifying accordingly.

Although the better part of this decade has left investors assaulted with headlines and other alarms about the danger of rising rates, the actual impacts of rate changes on bonds can be understood with simple math. To illustrate this point, let’s take a closer look at how bond returns could play out under rising and falling rate scenarios.

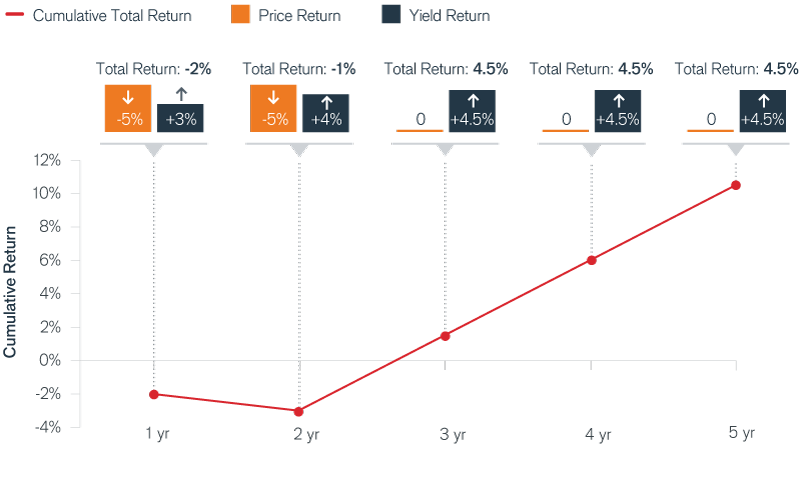

Let’s start with a hypothetical “intermediate bond” fund with a five-year duration, and assume that today’s yield on the fund is 2.5%. Let’s also assume in this scenario that rates increase 2% in parallel over the course of two years, a relatively aggressive path, and all other factors are constant.

On the one hand, this simple scenario confirms bond market fears by creating negative total returns for two years. On the other hand, returns turn positive by year three. In fact, now benefiting from 4.5% market rates, cumulative total returns reach 6% by year four and over 10% by year five.

Higher income buffers initial price declines and results in higher total return over time

5-year fund duration | Rates increase 2% over two years | Instant fund turnover

When rates rise, bond prices drop, but new bonds pay a higher coupon, increasing the income the fund receives as it turns over. Despite the potential for short-term discomfort, over time, rising rates can generally be good for long-term investors.

Recent history shows that, regardless of a historically low interest rate regime, there is always a possibility for rates to stay flat or decrease. While most interest rate discussions focus on rising rate scenarios, falling or flat rate scenarios offer their own unique risk: that of underperforming relative to your benchmark if you have significantly shortened your portfolio duration.

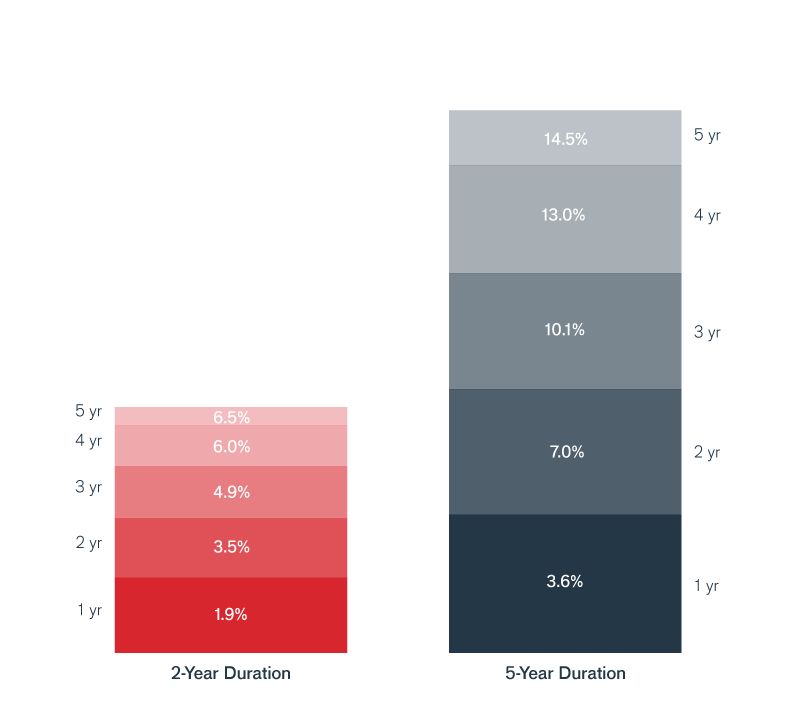

One way to understand this risk is to look at the same hypothetical five-year duration fund and compare it to a hypothetical two-year duration fund with a starting yield of 1.5% in an environment where rates fall 1% over the course of two years and all other factors remain the same. In this case, total return was positive for each year in both funds but the “risk” of lowering duration is highlighted.

5-year cumulative returns: The intermediate duration fund outperforms the short duration fund as rates fall

5-year vs 2-year fund duration | Rates fall 1% over two years | Instant fund turnover

Instead of facing losses, the bigger risk is of relative underperformance – not capturing the bond price gains from falling rates. For instance, if you had positioned a client in short-duration bonds with the expectation that rates were rising, their short-term portfolio would trail intermediate-term bonds by 8% in year 5, according to this scenario.

Modeling out what might actually happen under different interest rate scenarios is telling: potential losses in rising rate scenarios may not be as extreme as some fear, and shortening duration does not mitigate risk in all scenarios.

Meanwhile, core fixed income’s role is as essential as ever: clients rely on their core bond allocations for reliable capital preservation during a crisis. This is why it is more important to put aside rate predictions and refocus on a client’s individual goals, timeline, and key risks and use those points to guide their allocations.

This investor is preparing for retirement in 10 to 15 years. She relies on fixed income to buffer a still-substantial equity portfolio, and her biggest concern is major market drawdowns that could cause her to miss her wealth goals.

This family plans to buy a vacation home in three years and will require a down payment. They need short-term liquidity and capital preservation, and their biggest concern is losing any of their down payment capital.

In a perfect world, every client would only have one need or goal. In reality, clients will usually have a mix of goals – for example, long-term retirement needs but also a shorter term home purchase. To apply this framework, picture a spectrum of risk-based models with each model representing a bucket of clients with a similar mix of these needs. A 70/30 stock/bond risk-based model, for example, might consist of clients with 20% of their core fixed income needs represented by Scenario A (intermediate duration) with the remaining 10% by Scenario B (short duration). Or, a more conservative 40/60 risk-based model, which might consist of 30% represented by Scenario A and 30% by Scenario B.

Interest rates do matter, however this market cycle has shown that projecting interest rate changes is a fickle business. More importantly, the projected losses in most rising rate scenarios may not be as alarming as some assume. Relative to other asset classes with a history of large double-digit drawdowns, most potential losses in core fixed income pale in comparison.

We believe clients are much better served with a goal-based approach. Be careful not to let rate discussions and predictions sideline your focus on your clients’ needs and key risks, which should be the main inputs to making a suitable asset allocation.

We offer a powerful framework to help organize the huge universe of fixed income managers and, more importantly, convey a clear, forward-looking approach to fixed income for clients.