Global Investment Grade Credit: an attractive runway into 2024

James Briggs, Portfolio Manager, Fixed Income, sees an upbeat outlook for global investment grade credit in 2024 provided the global economy can maintain growth momentum.

5 minute read

Key takeaways:

- Diminished US recession risk, reasonable valuations, a positive yield environment and a strong debt servicing capacity among investment grade (IG) issuers points to an attractive runway for the asset class in 2024.

- Caution and a tactical approach to implementation is, however, needed with credit risks on the horizon and potential market complacency about longer term credit quality.

- Investors may be well served by focusing on higher quality IG credits, areas offering compelling relative value, and market segments not dependent on a favourable economic outcome to sustain profitability.

We see an attractive runway for global investment grade (IG) credit in 2024 given the diminished likelihood of the US going into recession, reasonable valuations (which are close to long-term averages), largely resilient balance sheets of IG issuers, and an attractive yield environment in light of the trajectory of underlying rates. The US consumer has managed to stay strong so far and real wage gains may be able to protect individual balance sheets and consumer spending as we move forward in 2024. Many large companies – having come into the slowdown in a strong financial position – have termed-out debt profiles and continue to have reasonably good interest cover ratios thanks to strong free cash flow measures.1

With a more positive trajectory for underlying rates in view, we believe global IG total returns will be good in 2024 if the significant growth slowdown we are witnessing does not hit stall speed or a technical recession.

Having said that, we also see genuine credit risks on the horizon and think the market is a bit complacent on the longer view outlook for credit quality. Reasons here include:

Elevated debt levels. The US fiscal position is arguably unsustainable.2 Corporate debt levels are also materially extended. The cost of servicing debt has risen in the wake of higher yields and may remain elevated given the looming maturity wall and the possibility of higher-for-longer policy rates – a message still being reinforced by central banks.

JHI

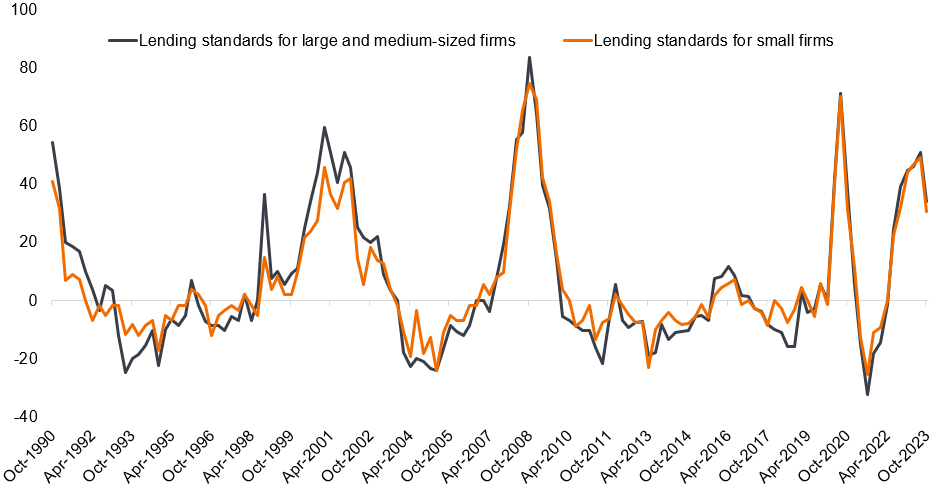

Access to capital – a good forward-looking indicator – has deteriorated. Liquidity withdrawal and rate hikes are feeding through to money supply and bank lending standards. Stronger, larger companies can still access capital, but at a higher price, with each refinancing coming at a premium. As seen in figure 1, lending standards for commercial and industrial loans remain tight, notwithstanding some easing recently.

Figure 1: Bank lending standards remain at elevated levels

Source: Federal Reserve and Macrobond. Chart depicts data, as of 31 October 2023, for the Senior Loan Officer Opinion Survey on Bank Lending Practices. Note: There is no guarantee that past trends will continue, or forecasts will be realised.

Profitability outlook is more challenged. Falling inflation and softer demand (weaker nominal growth), along with wages catching up to revenue growth, and an incremental rise in financing costs, means the outlook for profitability is more challenged. In recent earnings reports, we have seen sales beats declining and cautious outlook statements.

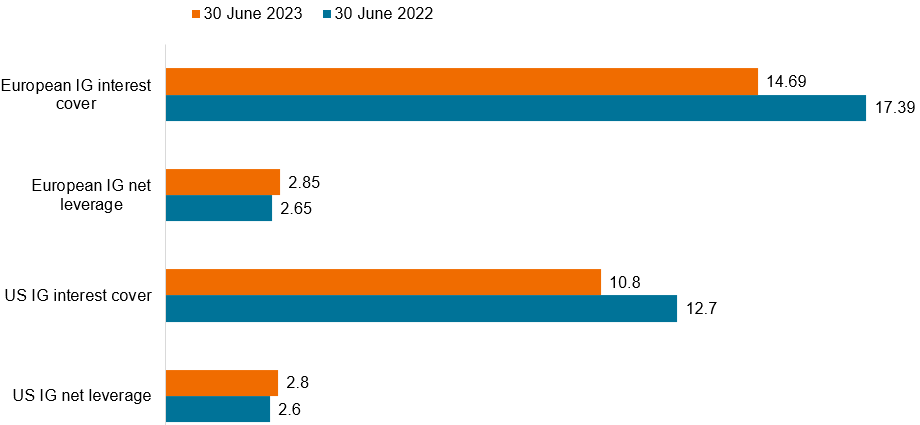

Credit fundamentals gradually moving lower. At the aggregate level, interest coverage has been good, but that is changing as rates have moved higher. As seen in Figure 2, there has been a slight deterioration year-on-year in interest cover for IG issuers. Not alarmingly so, but the direction of travel is worth noting.

Figure 2: IG credit fundamentals in the US and Europe have weakened year-on-year

Source: JP Morgan. Data as at 30 June 2023; the latest available JPM data.

Fat tails. Downside macro risks for the global economy include the lagged impact of monetary policy tightening, uncertainty around the upcoming US presidential election, heightened geopolitical risk, the depletion of COVID-era consumer excess savings combined with the possibility of rate hikes upping savings rates and dampening consumer spending, and the worry that the European Central Bank (ECB) may have overtightened in its fight against inflation. In the US, we view the labour market as normalising, rather than a cyclical cause for concern. Yet, we still have no clarity on an equilibrium level for growth, inflation, employment, and margins.3

Investment implications

Our investment view on the asset class is somewhat cautious, reflected in our preference for the higher quality end of the IG spectrum and an overall neutral to slightly positive credit beta stance. Security selection and nimbleness, in our view, will be crucial to performance in 2024 as we navigate an uncertain, data-dependent environment.

Among the areas that we favour are financials. Admittedly, we do have concerns relating to financials’ commercial real estate exposure, their high beta, cyclical characteristics and, as evidenced by Silicon Valley Bank in 2023, their vulnerability to sudden asset price fluctuations. That said, in this sector, we see compelling relative value in a number of high-quality national champions.

We also favour market segments that can withstand a cyclical slowdown; those not dependent on a favourable economic outcome to bail them out. An example here is companies in the technology sector that are benefiting from secular tailwinds.

Geographically, we see European IG as offering comparatively generous valuations. We also think Europe offers an opportunity to be slightly long duration given cautiously dovish statements from the ECB recently and Europe’s relatively weak growth.

Footnotes

1 Investment grade trailing 12-month default rates, albeit a backward-looking measure, have shown virtually zero movement on a year-on-year basis as at 31 August 2023 according to Moody’s Investor Services. The deterioration in credit fundamentals has mostly been seen among US high-yield issuers.

2 In the third quarter we saw a noticeable increase in term premia as investors became more focused on G7 budget deficits and supply-demand imbalances creeping into fixed income markets.

3 The dispersion of growth and inflation rates within the G7 is still very apparent. We are still seeing strong US growth, driven by strong consumer spending, while Europe keeps slowing down. Indicative of the heightened level of uncertainty, a wide range of possible outcomes are being forecast for the US economy in 2024. Goldman Sachs forecasts year-on-year (yoy) real GDP growth of 2.1%, the IMF has yoy real GDP growth at 1.5%, while consensus forecasts are for 1% growth. Sources: IMF World Economic Outlook (dated 10 October) and Goldman Sachs’ report (forecasts as at 8 October 2023) titled Macro Outlook 2024: The Hard Part Is Over. According to the IMF, the likelihood of a hard landing has receded, but the balance of risks to global growth remains tilted to the downside.

Definitions

Balance sheet. A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Free cash flow. Cash that a company generates after allowing for day-to-day running expenses and capital expenditure. It can then use the cash to make purchases, pay dividends or reduce debt.

Cyclical. Relating to a business or economic cycle.

Beta. Beta measures the volatility of a security or portfolio relative to that of a market index. A beta of less than one means lower volatility than the index; more than one means greater volatility.

IMPORTANT INFORMATION

There is no guarantee that past trends will continue, or forecasts will be realised.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.