BBB CLOs combine income, structural resilience and diversification benefits, offering an alternative way to reshape credit exposure for a late‑cycle environment of tight credit spreads.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

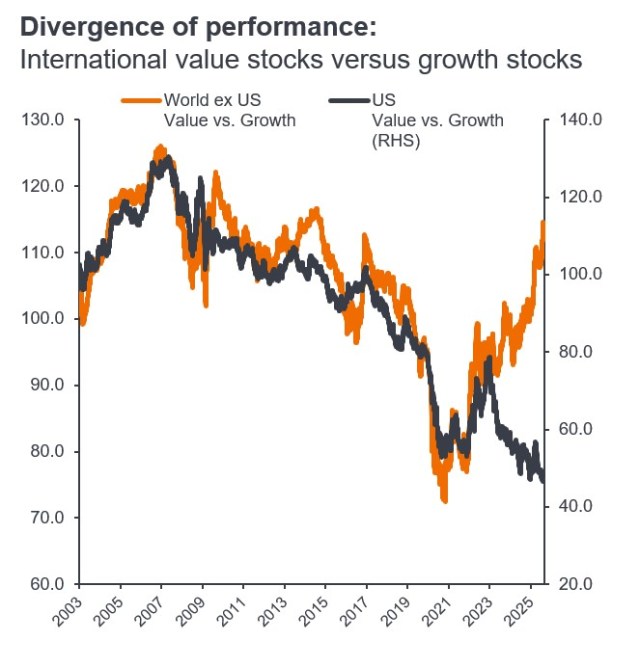

Investors concerned about high concentration in US stocks should look elsewhere to achieve better portfolio diversification.

What are non-agency residential mortgage-backed securities (RMBS), and how might they play a role in investors’ portfolios?

Investors with a narrower focus are missing out on the benefits of diversification.

The first in a three-part video series explores the role securitized assets played in the Global Financial Crisis.

The final installment in a three-part video series considers how non-mortgage related securitized sectors fared through the GFC and what investors can learn from this period in history.

Why bond investors need a new playbook to maximize a fixed income allocation’s potential.

Ranking the best-performing U.S. fixed income sectors of 2024.

How can investors optimise portfolios through this uncertain environment?

What are agency mortgage-backed securities, and how might they play a role in investors’ portfolios?

How rail announcements offer insights into fixed income markets.