You missed the market rally. Now what?

Portfolio Manager John Lloyd discusses two important considerations for investors who feel like they may have missed the market rally.

6 minute read

Key takeaways:

- Following the 17% rally in the S&P 500® Index since the Federal Reserve’s (Fed) last rate hike, some investors who are parked in cash may now be feeling less comfortable with their positioning.

- In our view, investors who fear they have missed the rally may need to adjust their mindset to embrace the uncertainty of the future.

- While equity markets have rallied on expectations of rate cuts and a soft landing, the U.S. bond market has not yet done so, as yields remain rangebound. This has created opportunities for investors to acquire bonds that we believe will outperform cash assets as the economic cycle unfolds.

Believe it or not, the one-year anniversary of the Federal Reserve’s (Fed) last rate hike is nearly upon us. Unless inflation unexpectedly begins to rise and the central bank is forced to hike again, 27 July 2023 will mark the final hike in this cycle.

Why is this significant?

Because many investors (and segments of the bond market) remain skeptical that we have seen the back of rising rates. In fact, investors’ circumspect approach to fixed income assets suggests that many believe we are still in a hiking cycle.

The equity market, on the other hand, has fully embraced the Fed’s dovish policy pivot and the economic soft landing, as reflected by the 17% rally in the S&P 500 since 31 July 2023.1

Despite the equity market rally, money continues to flow to – and remain parked in – cash instruments and money market funds. The total now stands at over $6.3 trillion, more than at any time in history.

While these trillions of dollars have been earning an easy 5% on the back of higher rates, opportunity cost is real: For dollars that were parked in cash in lieu of being invested in the S&P 500, 17% was foregone to earn that 5%. Similarly, a balanced portfolio of 60% S&P 500 and 40% Bloomberg U.S. Aggregate Bond Index (U.S. Agg) earned nearly 11% over the same period, a noteworthy premium over cash.

While some investors may be content eating this opportunity cost, the shimmer of a 5% cash return has no doubt lost some of its luster for those watching the rally from the sidelines. Investors may, therefore, be asking themselves, “Did I miss the rally? And if so, what do I do now?”

We offer two considerations to help with these questions.

1. Adopt the right mindset

There is an ancient proverb that says: Farmers who wait for perfect weather never plant. If they watch every cloud, they never harvest.

Investing, like farming, is about acting today without knowing what the future holds. Arguably, the greatest illusion investors must overcome is that they can (or need to) predict the future to be successful. The future is inherently unknowable, and even if one could correctly predict what will happen, knowing how or when it will happen remains obscure.

That’s why it is necessary to make peace with the reality that the upcoming year might be a good year, a bad year, or something in between.

Some investors think that parking their funds in cash will be easier on their emotions, allowing for a respite from the rollercoaster of market volatility. However, many find that sitting on the sidelines is even more emotionally taxing than being invested.

Ironically, sitting on the sidelines places investors in a position where they are frustrated by good news, and might even hope for bad news so markets will decline. In this way they are like farmers who have decided not to plant hoping for a severe drought to prove themselves right. This upside-down incentive system can be extremely taxing on an investor’s psyche, as each blip in the market makes one agonize over one’s position.

In our view, investors who have been sitting in cash should adjust their mindset to embrace the uncertainty of the future. Instead of watching every cloud, they can take action by reviewing their financial goals with their financial professional and seeking to rebalance their target asset allocation to align with their long-term goals.

2. Find opportunities in asset classes that have not yet rallied

Investors may be encouraged to hear that not all asset classes have rallied like the S&P 500 has. Notably, core U.S. fixed income has not yet run up, largely because interest rates have remained rangebound.

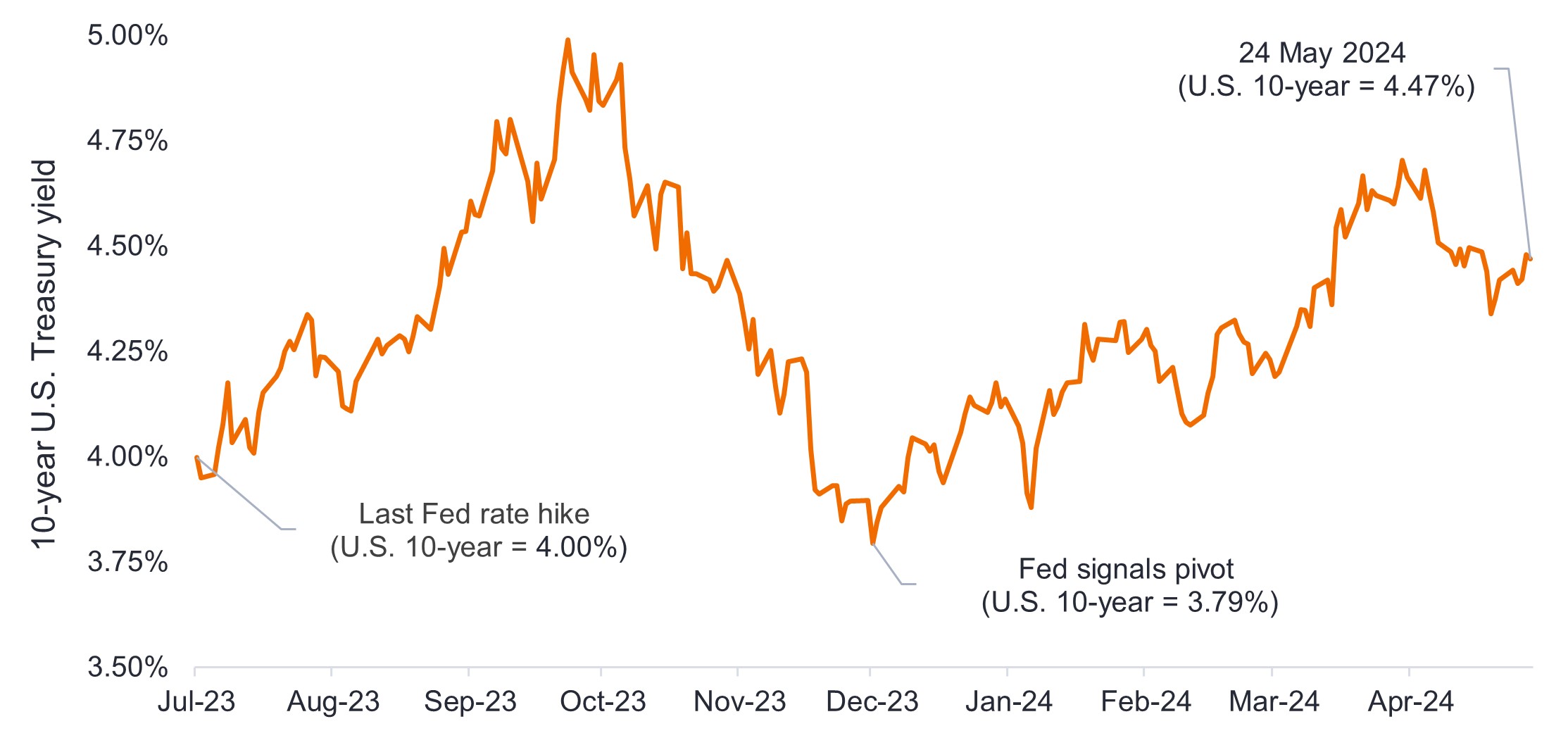

As shown in Exhibit 1, despite the Fed’s dovish policy pivot in December 2023, the yield on the 10-year U.S. Treasury is almost 0.5% higher today than it was when the Fed last hiked. Granted, there are mitigating reasons for this, such as recent stickiness in inflation and a potentially longer wait for rate cuts.

Nonetheless, in our view, the conditions for bonds to outperform are firmly in place and rates have not yet moved to reflect that, creating opportunity for investors.

Exhibit 1: 10-year U.S. Treasury yield since last rate hike (Jul 2023 – May 2024)

Treasury yields are higher today than they were when the Fed stopped hiking rates.

Bloomberg, as of 24 May 2024. Past performance does not predict future returns.

Bloomberg, as of 24 May 2024. Past performance does not predict future returns.

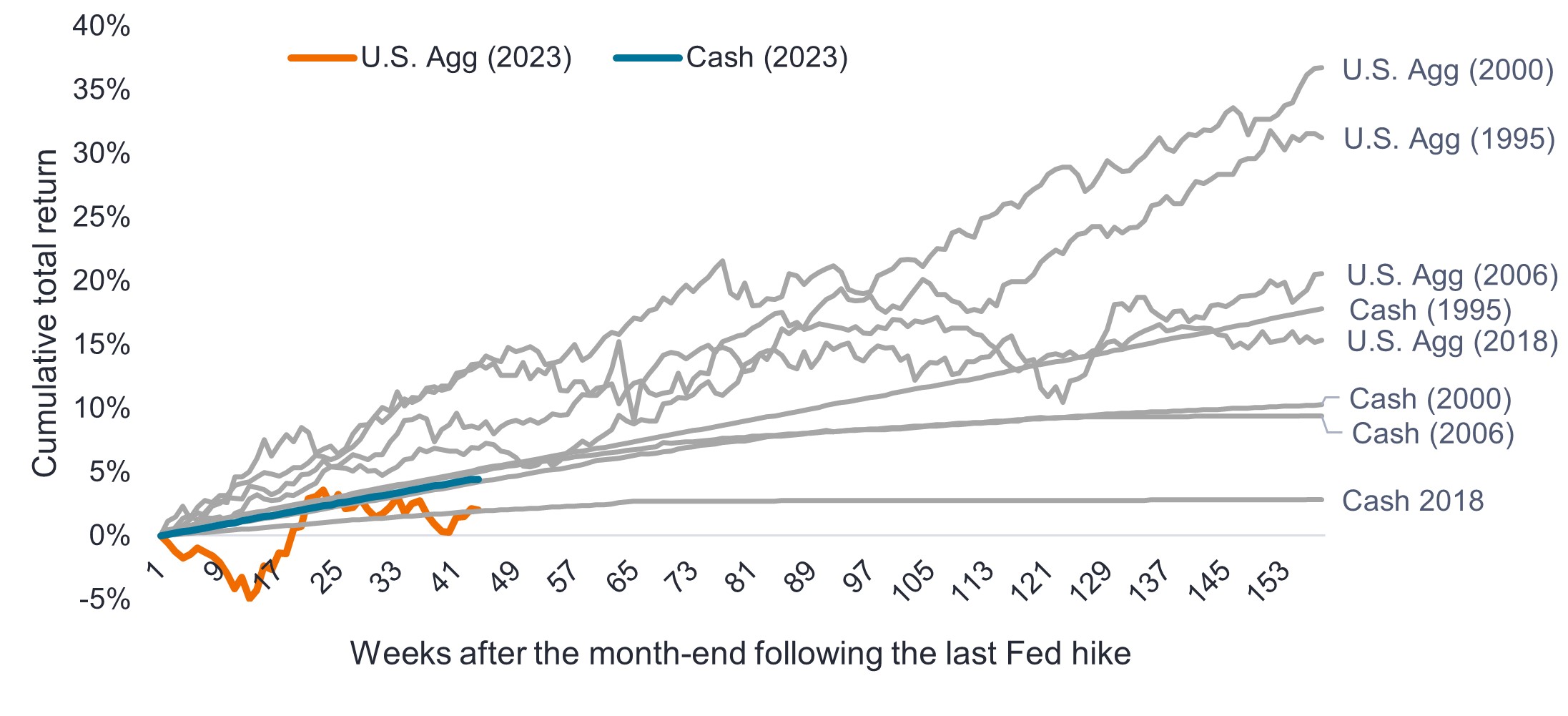

Exhibit 2 shows how core U.S. fixed income has performed versus cash in each of the previous four Fed hiking cycles. In all instances, core bonds meaningfully outperformed cash or money market funds in the three-year period following the final hike. The key driver of this outperformance was falling yields as the Fed began to cut rates. (Falling rates are a tailwind for longer-duration bonds, as their prices rise when rates fall, while their interest coupons remain locked in for longer periods.)

Interestingly, in the current cycle, cash has outperformed core bonds so far – a deviation from prior cycles. We believe this trend is set to reverse once rate cuts appear imminent, resulting in core bonds once again outperforming cash, as they have in previous cycles.

Exhibit 2: U.S. Agg vs. cash returns following Fed hiking cycles (1995 – 2024)

In each of the previous four hiking cycles, core bonds meaningfully outperformed cash in the three-year period following the final rate hike.

Source: Bloomberg, as of 21 May 2024. Cash returns reflected by Bloomberg U.S. Treasury Bills 1-3 Month Index. Past performance does not predict future returns.

Source: Bloomberg, as of 21 May 2024. Cash returns reflected by Bloomberg U.S. Treasury Bills 1-3 Month Index. Past performance does not predict future returns.

In summary

At any given time, the future may look bright and hopeful or dark and ominous. It might even look like all those things at once, just to different people. Regardless of their personal outlook, we believe investors should accept that the future is unknowable, and yet remain committed to their investing journey. Indeed, history has shown that investors who remain invested tend to outperform those who try to time the markets.

Further, investors can always search for opportunities where asset prices might not reflect their potential returns, such as in the U.S. fixed income market, which in our view currently offers attractive investment opportunities for long-term investors.

1 As of 24 May 2024.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.