Demographics has long been a driver of investment and consumer trends, in particular when it comes to technology. Generally, the assumption is that younger generations more readily adopt technology as they are more familiar with it. They also tend to be more sustainability focused. But is this definitely the case and where are the nuances within the preferences of each generation?

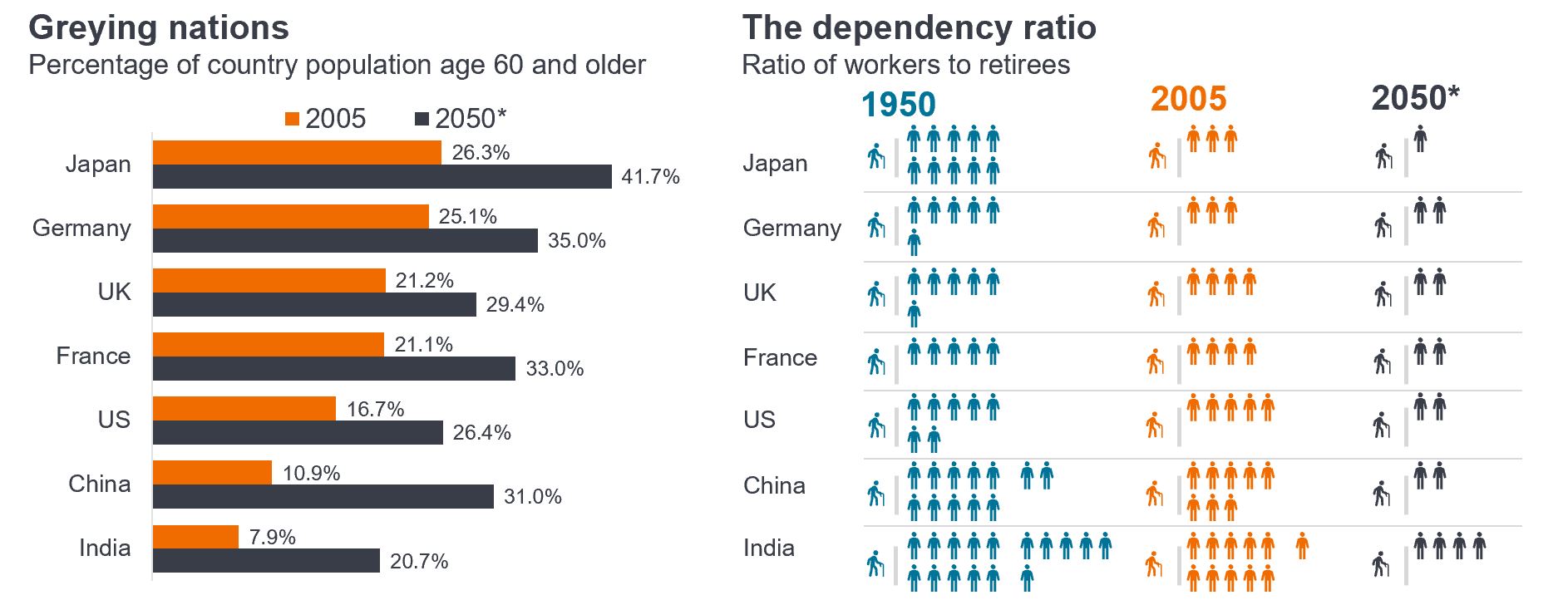

This question is key as the world is facing a major challenge – a rapidly ageing population (see Figure 1). According to the United Nations, the global population aged 65 and above is anticipated to rise from 10% in 2022 to 16% in 20501. While France took more than a 100 years for its population aged over 60 years to grow from 10% to 20%, emerging markets like China and Brazil are forecasted to take less than two decades. The implications are huge, with the dependency ratio (number of workers to retirees) expected to fall even more drastically by 2050.

The upshot of these factors is that productivity and efficiency gains are needed more than ever, with the need to facilitate healthy living and working in later life becoming essential.

Figure 1: Why Artificial Intelligence (AI) matters – the demographic timebomb

The need to achieve productivity gains

Source: (LHS) United Nations, (RHS) OECD data, 2023 (rounded to the nearest whole person). *Projection. There is no guarantee that past trends will continue, or forecasts will be realised.

As long-term investors in the technology sector, we believe a clear understanding of long-term trends and consumer preferences, alongside attitudes toward environmental sustainability, technology adoption, and how these are evolving is imperative. This led us to conduct a survey in partnership with Dr. Paul Redmond from the University of Liverpool, one of the UK’s leading experts on generational change and the future of work. The survey focused on the technology aspect of broader research from Dr. Redmond, as outlined in Demographic shifts: Trends and implications for business and investors.

About the survey

This new and original research provided insights into the environmental sustainability attitudes of the four current working generations or cohorts:

- Generation Z (aged 14-25);

- Millennials (aged 26-41);

- Generation X (aged 42-56);

- Baby Boomers (aged 57-79)

The comprehensive survey of 500 participants based in the UK provided a detailed analysis of each generation’s perspectives on sustainability, financial decision-making, purchasing behaviour, investment preferences, and their interactions with emerging technologies like AI.

Main learnings from the study

1 Each generation is ‘its own people’, with distinct preferences

Attitudes and views differ for individual cohorts. Baby Boomers are environmentally conscious, while Millennials are very tech savvy, with a strong inclination towards sustainability. Being ‘digital natives’ they are the first group to grow up with technology and an awareness of climate change.

These observations are also closely correlated with the level of education and level of income. For example, higher earners with more savings tend to be more climate conscious. Women are also more inclined to be influenced by environmental decisions in their financial planning.

2 Sustainability and purchasing behaviour

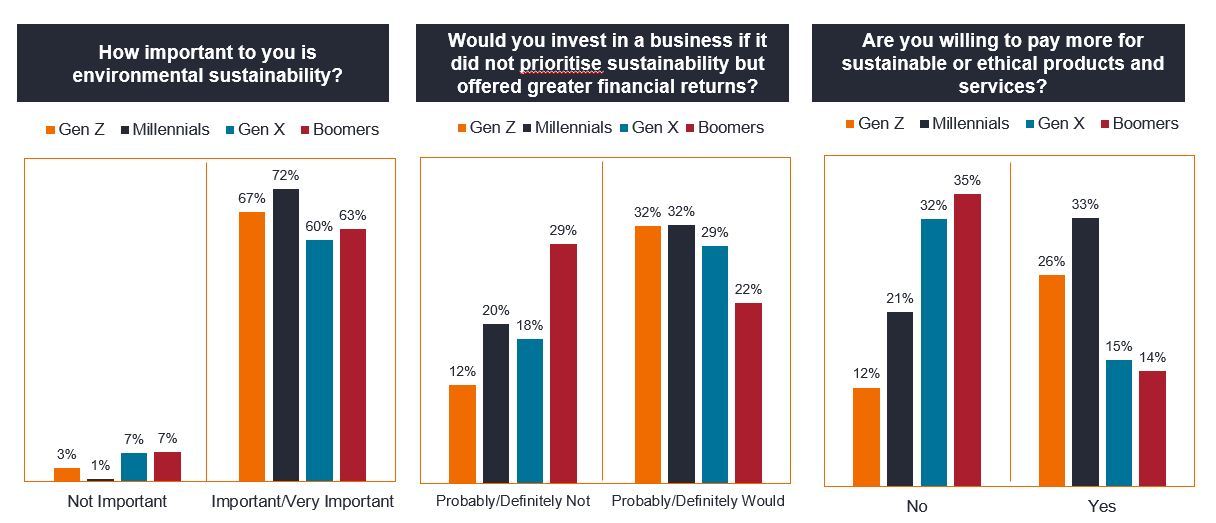

Millennials are the most concerned about sustainability and the environment, therefore are more likely to buy sustainable or ethical products and willing to pay more for sustainable brands and products. For example, they are more likely to buy an electric vehicle; Gen Z has similar preferences. Across all four generations there is an acknowledgement that paying more for sustainable products depends on the product or service in question, although Baby Boomers and Gen X state an unwillingness to pay more, regardless.

It’s noteworthy that while Baby Boomers (retirees) are more environmentally conscious than Gen X, they are less likely to buy sustainable products (Figure 2). This paints a complex picture – it is too simplistic to assume similar preferences for younger versus older cohorts. Our study provided empirical evidence that the young versus old divide does not always ring true. Each generation has its own distinct characteristics and views and can’t just be lumped into one group.

Figure 2: Sustainability – purchases and investments

Source: Demographic Preferences Survey Summary Report, November 2023.

3 Sustainable investing

Environmentally-conscious investment choices are prevalent across all groups; however, the degree varies. Millennials said that they would be “more,” or “definitely” more likely to have their personal finances affected by environmental considerations. Almost the same proportion of responses were generated by Generation Z (66.2%).

Surprisingly, the survey also revealed that financial returns could still sway all demographics (ie. they would consider investing in a business that did not prioritise sustainability but offered greater financial returns – Figure 2). This response might appear to contradict with earlier data, which found a strong commitment among Millennials and Generation Z to environmental and sustainable causes.

4 Attitudes toward AI

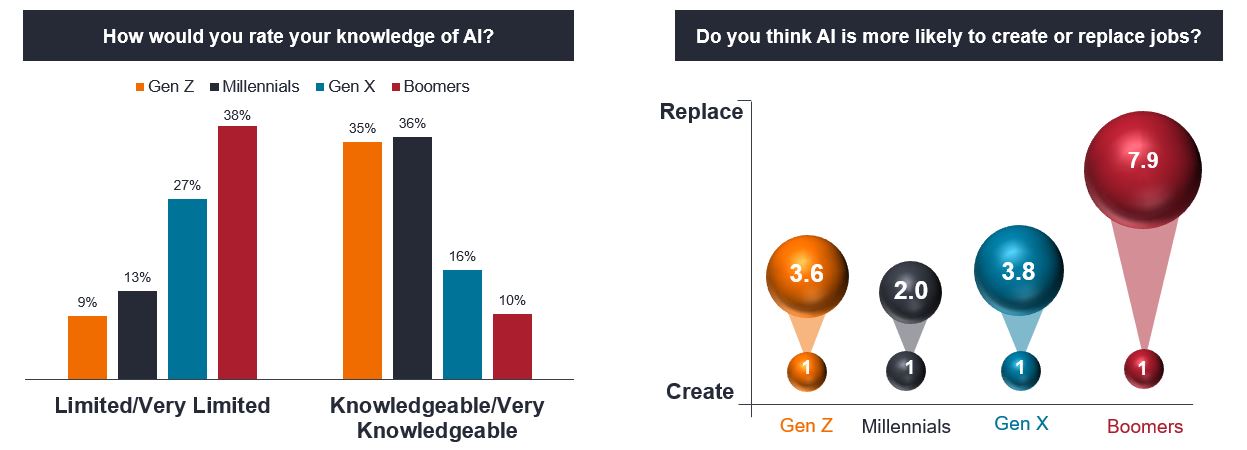

AI is driving not only a “digital’ divide, but also a “generational” divide. There are widespread, multi-generational concerns about increased use of AI, particularly among older generations. (Figure 3). Younger generations demonstrate more trust in AI technology, with Millennials and Gen Z showing a readiness to adopt new advancements such as robotaxis. They are also more optimistic, viewing AI as a possible source of future employment.

Study responses reveal that a lack of understanding about AI may lead to uncertainty among older generations on AI’s influence on sustainable consumer choices. More than half Boomer and Generation X respondents do not know whether AI will play a role in promoting environmental considerations. This goes against Millennials and Generation Z, who are generally more positive about its capacity to drive greater levels of environmentalism.

Figure 3: AI – Younger generations know more, worry less

Source: Demographic Preferences Survey Summary Report, November 2023.

Younger generations think more about transport (eg. robotaxis, electrification, safety) and healthcare (eg. diagnosis, drug discovery, robotic surgery) as areas being disrupted by AI; this bodes well as transport and healthcare are seeing increasing demand particularly from seniors. Older generations tend to look at the areas that have already been disrupted, ie. ecommerce and education, yet also see manufacturing as an area that will be disrupted (which, given long and sometimes complex supply chains, could take decades).

Figure 4: AI can defuse the demographic timebomb

Upskilling and re-skilling will be key

5 Digital communications

Contrary to popular belief, our study found that email, not social media or post, reigns supreme across generations. We are all becoming digital natives, with each demographic now married to their inbox despite differing digital exposure backgrounds.

What does this mean for investors?

The transition to digital paradigms is impacting attitudes towards AI and sustainability, and investing, with a clear inclination towards ethical and sustainable products, particularly among Millennials and Gen Z. However, differences in gender, education and income levels also influence preferences and decisions.

The following table summarises the characteristics of each generational group as indicated by the survey and categorisations from a technology perspective:

Figure 5: Generational groups and their characteristics relating to technology

| Cohort | Characteristics |

| Generation Z | The first true digital natives, comfortable with technology from a very young age, value individual expression, and diversity. Can be thought of as ‘tech pioneers’ reflecting their pioneering role in the digital age and their inclination towards technological innovation. |

| Millennials | Embrace technology during its rapid evolution, grew up with the internet, are socially conscious. Reflects their tech-savvy nature and their commitment to social and environmental causes. Can be thought of as ‘digital environmentalists’. |

| Generation X | Experienced the transition from analogue to digital, independent and self-reliant, sceptical of institutions, and pragmatic. ‘Pragmatic nomads’ reflects their adaptability, scepticism, and a sense of independence shaped by the changing world around them. |

| Baby Boomers | Witnessed significant historical events, value hard work and loyalty, tend to be more traditional, and often served as stewards of established systems. These ‘traditional stewards’ uphold traditional values and institutions during times of social change. |

Source: Demographic Preferences Survey Summary Report, November 2023.

Summary

It is far too simplistic to assume younger generations are more likely to embrace technological change and sustainability, while older ones are more hesitant and resistant. Millennials are emerging as pivotal economic drivers, signalling a shift toward investments that reflect their technologically- integrated lives and their heightened awareness of climate change’s impact. Baby Boomers, Gen X and Gen Z all have their own unique characteristics and leanings.

As proponents of tech equities investing over the long term, we believe that, rather than accepting assumptions, a clear understanding and consideration of generational preferences is key. In a follow-up article, we will discuss how this guides our thinking and portfolio decisions as technological innovation via AI-enabled productivity gains help to solve the global challenges of an ageing population and rising dependency ratio.

1United Nations, World Population Prospects 2022, July 2022. https://www.un.org/development/desa/pd/sites/www.un.org.development.desa.pd/files/undesa_pd_2022_wpp_key-messages.pdf

Source of all survey information is Janus Henderson Demographic Preferences Survey, November 2023.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.