| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

Recently we visited Kai Tak in Hong Kong, an area probably more famous as the site of Hong Kong’s original airport famed for its ‘Checkerboard Hill turn’, to line up with runway (a 47-degree maneuver at low altitude to avoid dense urban areas and mountainous terrain), than the mixed-use development it has become today. Kai Tak itself was originally the vision of two men, Ho Kai and Au Tak, who built it from reclaimed land in the 1920s with the plan to deliver a residential development for wealthy immigrants. Unfortunately, when that plan failed, the land was acquired by the government, which then turned it into an airfield.

Kai Tak today

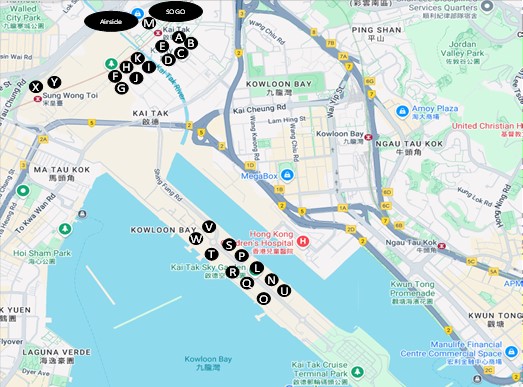

A century later, Kai Tak has finally become what it was originally intended for – a mixed-use development scheme with, at its centrepiece, a new 50,000-seat stadium, known as Kai Tak Sports Park (which will open soon and host a Coldplay concert). Another key component has been the residential developments, which have been built close to the Kai Tak MTR (Mass Transit Railway) station over the last few years, and more recently, the new developments that have been built on the runway itself – these have been more difficult to sell.

Hong Kong residential is struggling

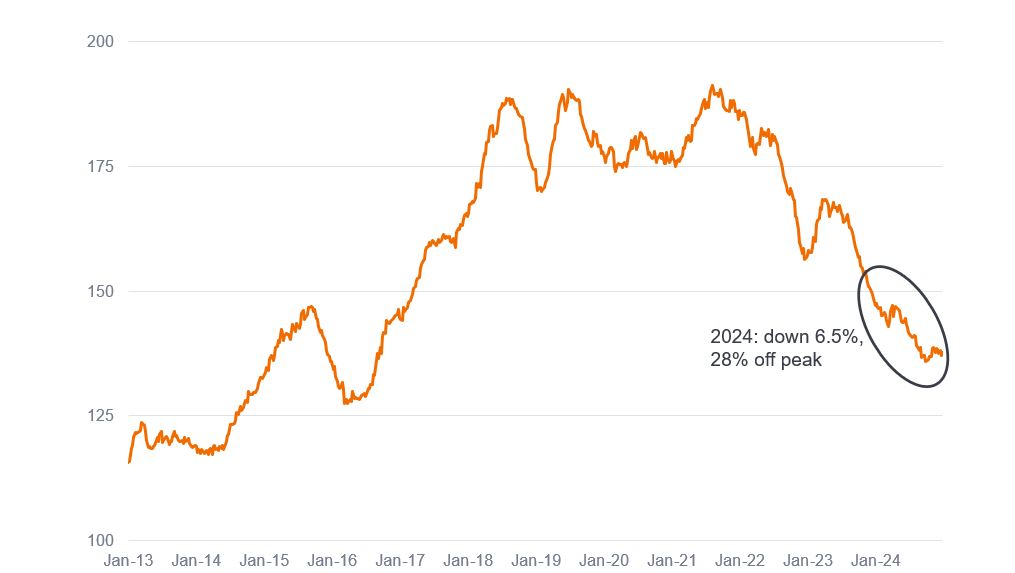

Kai Tak’s situation is not surprising given the state of the Hong Kong residential market, which has been in free fall for the last four years, with values down some 28% since the peak in August 2021.

Figure 1: Residential sector weakness continues

Source: Centaline, BoFA Global Research. Weekly data from 6 January 2013 – 24 December 2024.

The residential malaise can be attributed to several negative factors, such as poor affordability (Hong Kong ranked as the least affordable city in 2023),1 rising interest rates (through the US$/HK$ currency peg), and a changing political environment.

Kai Tak is almost the perfect depiction of Hong Kong’s ‘boom and bust’ residential market over the past decade. The first land sale here in 2013 at HK$5,157 per square foot (psf) climbed steadily to the peak of almost HK$20,000 psf in 2019 in a flurry of land grab deals. It has now gone full circle with a plot on the runway sold in 2023 back at around HK$5,400 psf.

‘The Knightsbridge’ – a seafront view for a mere US$5m

One of the projects we visited on the more ‘glamourous’ west-facing side of the runway with views over Kowloon Bay towards Victoria Harbour was The Knightsbridge. We noted more sales staff than tenants. Buyers are struggling with the high interest rate environment and still high average prices of more than HK$30,000 psf, translating into circa US$5 million for a 1,380 sqft apartment. Still, the view was spectacular!

A luxury ‘The Knightsbridge’ apartment unit

Soft demand is clearly an issue, but that is not the only thing keeping buyers away. Supply levels remain elevated. Hong Kong’s overall unsold residential inventory is running at record highs of more than 50,000 units, with Kai Tak accounting for a quarter of this. 26,000 units have been built in Kai Tak over the last number of years, with almost 60% sitting on the runway, of which only about 2,000 have been sold.

Q – location of The Knightsbridge development, “a luxury urban landmark, a world-class mansion on the waterfront”.

Paradise lost?

But what does this mean for the developers who built these units? Almost all of the major Hong Kong property developers and a few Chinese developers have exposure in the Kai Tak project. With supply this high and demand this low, margins (even at these elevated price levels) are thin, if at all positive.

For some companies with better balance sheets, they may be able to ride this downturn out, however, others may not be so lucky, with cracks already beginning to appear. We have seen a couple of distressed developers offload their undeveloped plots at a significant loss. Many others have also taken steep write-downs on their exposure in the area. Several developers with cash flow issues have chosen to cut prices even if it means a loss, just to move inventory. The potential fallout from any stress, given the large level of unsold inventory, will no doubt have a knock-on impact, potentially even on stronger blue-chip companies.

While Mr Kai and Mr Tak’s goal to build a garden state from reclaimed land here may finally have been realised a hundred years later, whether their vision for it has also been realised, remains unclear.

1 Demographia International Housing Affordability Report.

Balance sheet: a financial statement summarising a company’s assets, liabilities and shareholders’ equity at a particular point in time. Balance sheet strength is an indicator of a company’s financial health and stability.

Blue chip companies: widely known, well-established, and financially stable companies, typically with a long record of reliable and stable growth.

Cash flow issues: occurs when the total amount of money flowing into the business is less than money going out. Often caused by poor cash management, it may impact a company in terms of repaying debt and other expenses, and ultimately could lead to business closure.

Currency peg: a monetary control policy where a government or central bank sets a fixed exchange rate between their domestic currency and a foreign currency.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.