Look around you and so many things are the result of a combination. Where would we be if oxygen and hydrogen weren’t combined to make water? Who wants to return to a world where heavy luggage had no wheels?

In the financial world sometimes putting together different structures can provide investors with an appealing investment. Often this might involve a solution that mixes asset classes to offer a different risk/return profile but sometimes it is also about the structure of the vehicle itself.

Seeking predictability

Many investors crave predictability. It is partly why the bond market exists. In buying a bond an investor essentially lends money for a set period and – providing the bond does not default – receives a specific income over the term of the bond and their principal back when the term ends (the maturity date).

Investors value the predictability of steady income and the return of capital at a defined maturity date that a single bond offers. But this comes with a high degree of concentration risk – what if the bond defaults?

Of course, an investor could turn to a bond fund, which would reduce single issuer risk by diversifying across a portfolio of bonds and comes with the comfort that the portfolio is being managed by professionals. However, these tend to be open-ended so the yield on the fund can vary over time and the capital value when the investor comes to divest is less certain.

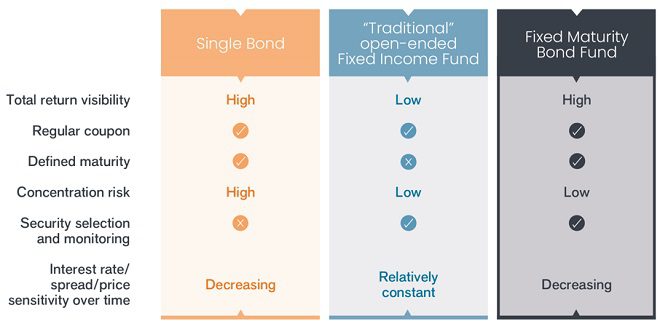

This is where a fixed maturity bond fund comes in. It combines the core features of a single bond (regular predictable coupon and fixed maturity date) with the key benefits offered by a fund (diversification across many bonds, together with security selection and monitoring from investment professionals).

Figure 1: Comparison of features of a single bond, a traditional open ended fund and a fixed maturity bond fund.

Source: Janus Henderson investors, 31 May 2023. For illustrative purposes only.

A fixed maturity bond fund has a finite life (typically in the three to five-year time frame), so investors know when to expect a return of capital. Moreover, with investments mostly made during the initial investment period, this helps to lock in yields, offering protection against potential falls in interest rates. This helps provide visibility around the fund’s potential return and means duration risk (interest rate sensitivity) is low and declines as the fund approaches maturity.

Fixed maturity products are designed to be held to maturity and investors should be prepared to remain invested for the term of the fund. Normally, to help protect remaining investors in the portfolio, there is a fee applied to any investor who redeems before the maturity date.

Key considerations

Ultimately, the most critical elements to assess a fixed maturity bond fund are the level of income generation and the sustainability of the coupon and capital.

Credit risk and reinvestment risk are two of the biggest threats to income on a fixed maturity bond fund. Credit losses could potentially endanger the level of income paid out and the final maturity payment, so it is important to employ a manager with deep credit expertise. Similarly, consideration needs to be given to reinvestment risk as coupons and maturities come due and need to be reinvested later in the fund’s life, potentially at lower yields. To help reduce reinvestment risk, a manager can keep callable bonds to a small proportion of the fund and invest in bonds with maturities that closely align to the term of the fund.

This is where a management team with experience in constructing and managing this type of portfolio is key. A global research footprint can help source the best opportunities, which may mean including some high yield alongside investment grade to exploit price inefficiencies and enhance yield.

A dynamic approach

Within Janus Henderson we advocate a more active investment process than a typical “buy and hold to maturity” approach, which can be termed “buy and actively manage”. It can be thought of as combining two elements:

- Buy component: This refers to establishing the portfolio, setting the base for a strategy and target yield. This is where access to suitable investments and fundamental credit analysis comes into play.

- Active component: This refers to on-going surveillance and risk monitoring to ensure the portfolio is robust and continues to deliver to expectations.

We believe this “buy and active” approach is a potential differentiator to typical fixed maturity bond funds. When managing these funds, we are essentially looking for the most efficient and reliable way to get a consistent yield for our clients over time. Building a robust bond portfolio upfront is hugely important but circumstances change and in our view the ability to be dynamic through our more active approach can be beneficial in avoiding problem credits and defending income.

Taken together, we believe fixed maturity bond funds can offer investors an appealing combination of income, diversification and a known maturity date.

Corporate bonds: A debt security issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue on the maturity date.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Reinvestment risk: The risk that an investor will be unable to reinvest cash flows or proceeds from an investment at a rate comparable to the current rate of return. Callable bonds are seen as especially vulnerable to reinvestment risk because these bonds are typically called (redeemed) by the issuer when interest rates decline.

Yield: The level of income on a security, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the annual coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.