Doing good, feeling good: How investors can benefit from the resources sector’s key role in decarbonisation

Portfolio Manager Tal Lomnitzer discusses why investors may want to adopt a ‘blended approach’ that mixes investments in responsible resources with other low-carbon equity investments.

7 minute read

Key takeaways:

- Annual demand for critical minerals to support decarbonisation initiatives is set to nearly quadruple by 2040, according to the International Energy Agency.

- Mining companies need to materially lift investments in new capacity to meet the anticipated rise in demand for critical minerals.

- Investors can still achieve significant decarbonisation by blending investment in high quality sustainable resources firms with a Paris Agreement-aligned index.

The energy transition needed to address climate change will require significant investment in new resources capacity to ensure the efficient rollout of low-carbon technologies. Investors can benefit by acknowledging the key role that the natural resources sector is set to play over the coming decades.

Creating a lower-carbon world will require a significant overhaul of the global energy system. From replacing internal combustion engines with electric alternatives to generating renewable power from solar and wind energy, the steps countries need to take to meet the United Nations Sustainable Development Scenarios to limit global warming to below 2°C as set out in the 2015 Paris Agreement will touch on nearly every aspect of our daily lives.

The energy transition offers significant opportunities for investors to benefit from decarbonisation over the coming decades. While many have focused on investing in firms with higher Environmental, Social and Governance (ESG) ratings and lower carbon profiles in many cases little thought has been given so far to the vast quantities of critical enabling raw materials required to build the low carbon economy such as copper, lithium, cobalt, nickel and steel and rare earths. The green energy transition relies on sourcing enough of these fundamental building blocks because without these materials, there can be no low-carbon future.

Sustainable resource demand set to surge

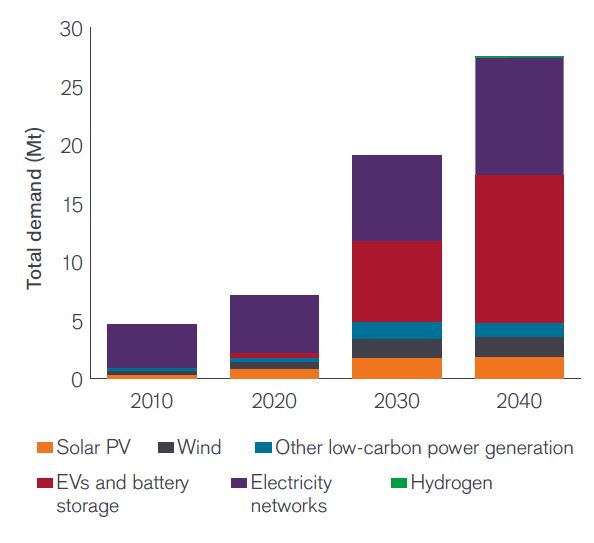

The scale of the upcoming resources challenge was made apparent in a recent report by the International Energy Agency (IEA) on the level of resources needed to support critical decarbonisation initiatives. The global energy body estimated that countries will have to source over three and half times the total demand from the same end markets in 2020, every year by 2040 to keep track with decarbonisation targets.

Figure 1: Transition-linked mineral demand and forecast to meet climate pledges

Source: International Energy Agency, as at May 2021. Note: Includes copper, major battery metals (lithium, nickel, cobalt, manganese and graphite), chromium, molybdenum, platinum group metals, zinc, rare earth elements and others, but does not include steel and aluminium. There is no guarantee that past trends will continue, or forecasts will be realised. The views are subject to change without notice.

The IEA expects the demand linked to electric vehicles (EVs) and battery storage to be the most resource-hungry market. Forecasts show the total yearly demand rising from less than half a million tons in 2020 to over 12.6 million in 2040. This is made up of a wide mix of materials, many of which already face supply constraints. In fact, the forecasted 3.3 million tons of additional yearly nickel demand for this market alone exceeds the current 2.8 million tons of nickel produced annually, underscoring the pressing need for investment in new capacity.

Investment in transition-enabling resources is lagging

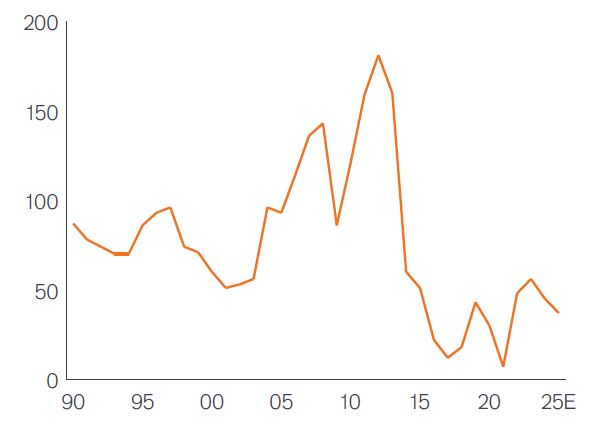

There is a pressing need to ramp up supply to meet the demand associated with decarbonisation. However, global resources firms have yet to materially lift investments in new capacity after a decade of underinvestment that followed the peak spending in 2011 induced by the China-led demand for resources boom. Figure 2 shows that analysts are forecasting near-term real investments in new capacity across the sector to run at about half the pace seen in the 20 years that preceded the peak of China’s hunger for resources.

Figure 2: Real global mining capex (bn USD) per unit of mine production (indexed to 1990)

Source: Jefferies, August 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

Many equity investors ignoring the role or resources in the climate transition

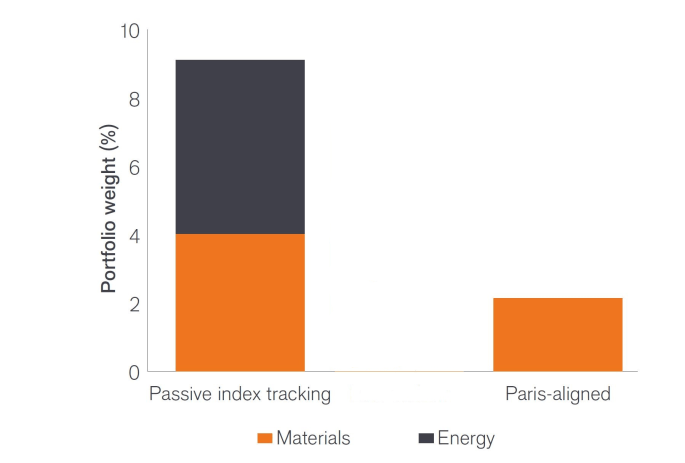

For their part, many equity investors are also unprepared when it comes to investing in resources ahead of the low-carbon transition. The ongoing drive to lower the carbon profile of portfolios – with low carbon-tilted indices or Paris-aligned benchmarks – means many equity portfolios are now underweight the resources sector at a time when the sector’s capital needs are set to surge to meet the demands of the low-carbon economy. Indeed, Figure 3 shows that that a Paris-aligned version of the MSCI World Index has significantly less resources exposure than passive index tracking, with investors following the former strategy committing to having no energy investments and about half the materials exposure.

Figure 3: Resources weight by investment strategy (%)

Source: MSCI, September 2023.

Being underweight the resources sector may have made sense previously given these stocks lagged the wider market during the low-growth decade that followed the Global Financial Crisis. However, this position needs to change if investors want to benefit from this key enabler of the low-carbon transition.

A holistic approach to delivering a climate transition investment portfolio

We think investors may want to consider adopting a more holistic approach to decarbonisation. This can be done by looking at the wider picture of how this can be achieved through the products and services offered by the companies they invest in, rather than purely focusing on the categorisation of ‘low-carbon’. It is essential to acknowledge the critical role materials play in facilitating a low-carbon economy. Currently, the ’scope’ lens applied to gauge the carbon profile of investments puts resources at a disadvantage in the eyes of carbon-conscious investors due to the relatively high carbon intensity of the sector. Measures to acknowledge the role a company’s products and practices play in avoiding emissions (Scope 4 emissions) are starting to gain traction. A greater adoption of these metrics will help highlight the key contribution resources firms play in decarbonisation efforts.

Rethinking resources also doesn’t have to tie investors to firms with poor ESG profiles. The sector overall has made great strides in improving its sustainability characteristics – both in terms of how new resources are mined and produced, and also with firms playing a leading role in the circular economy. There’s no running away from the fact that even sustainable resources companies will have higher carbon intensities than those of low-carbon indices. However, investors can still achieve a significant reduction in the carbon profile of a portfolio relative to the overall market by taking a blended approach that mixes investments in responsible resources with other low-carbon equity investments. For example, a 90% MSCI Paris-aligned portfolio with 10% responsible resources could offer a reduction of more than 70% in carbon emissions compared to the MSCI World Index with the added benefit of potentially more attractive returns and diversification benefits from the allocation to responsible resources.*

Closing thoughts

The unprecedented challenge posed by decarbonisation requires significant investments to enable the roll out of low-carbon solutions required to meet global climate pledges. These investments also need to filter through to supply chain participants to ensure the availability of these technologies at the required scale. The post-COVID economic reopening has shown how even a few bottlenecks can quickly hobble entire industries.

Capital flows need to flow through to the fundamental building blocks that will make the energy transition a reality. Finding a way to properly account for the role companies play in enabling low-carbon technologies should put the resources sector in a better light.

In the meantime, investors should look beyond the near-term carbon profile of their investments and consider whether those investments are ‘doing good’ by enabling a low-carbon future. Acceptance of a slightly higher carbon profile with the potential for better returns could be a better outcome for investors than simply investing in a low-carbon portfolio that makes them feel good today.

Our ESG integration approach: Thoughtful, practical, research-driven and forward-looking

*Source: MSCI, Janus Henderson Investors as at July 2023.

Circular economy: when the value of products, materials and other resources is maintained for as long as possible. This increases efficiency in production and consumption, thereby reducing the environmental impact of their use, minimising waste and the release of hazardous substances at all stages of their life cycle, including ranking waste management options according to what is best for the environment.

Scope 1-3 emissions: Scope 1 covers direct Greenhouse Gas (GHG) emissions from sources owned or controlled by the company, including running its vehicles or boilers. Scope 2 accounts for indirect GHG emissions from the generation of purchased or acquired electricity, steam, heating and cooling used by the reporting company. Scope 3 covers all other indirect emissions that occur in a company’s value chain, including from products bought from suppliers and when customers use its products.

Scope 4 emissions: also known as avoided emissions, are those GHG emission reductions that occur outside of a product’s life-cycle or value chain, but result from the use of that product or service. Usually, they are measured relative to a comparative product or service.

MSCI World Index reflects the equity market performance of global developed markets.

The MSCI World Climate Paris Aligned Index includes large and midcap securities across developed markets. The index is designed to support investors seeking to reduce their exposure to transition and physical climate risks and who wish to pursue opportunities arising from the transition to a lower carbon economy while aligning with the Paris Agreement requirements.

IMPORTANT INFORMATION

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a responsible investment approach, which may cause it to be underweight in certain sectors (due to the avoidance criteria employed) and thus perform differently than funds that have a similar financial objective but which do not apply any avoidance criteria when selecting investments.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.