As Germany pivots on its fiscal policy, floating rate investments such as CLOs come to the fore, benefiting from higher interest rates, robust credit risk analysis and careful security selection.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Assessing credit markets as they respond to proposals for increased fiscal spending in Germany and a tonal shift at the ECB.

European securitisations are ‘risky’ given concentration and ‘opaque’, which transpires as myths when considering the clear diversity in its biggest sector, CLOs.

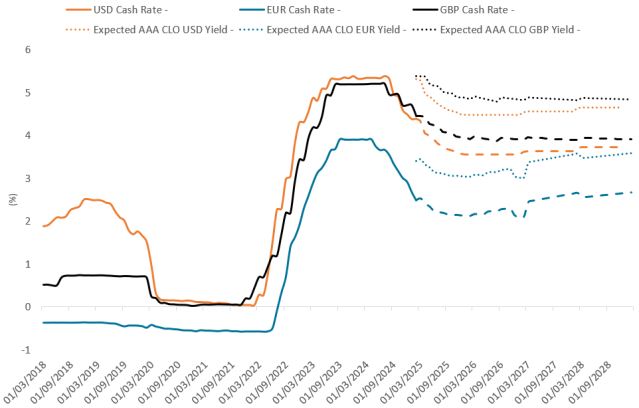

A falling rate environment presents a challenge for income-seeking investors. Where can you go in the hunt for yield as cash rates decline?

Assessing market reactions to the Trump administration’s recently imposed tariffs.

Could plans to loosen Germany's debt rules open the door to more robust growth in Europe's powerhouse economy?

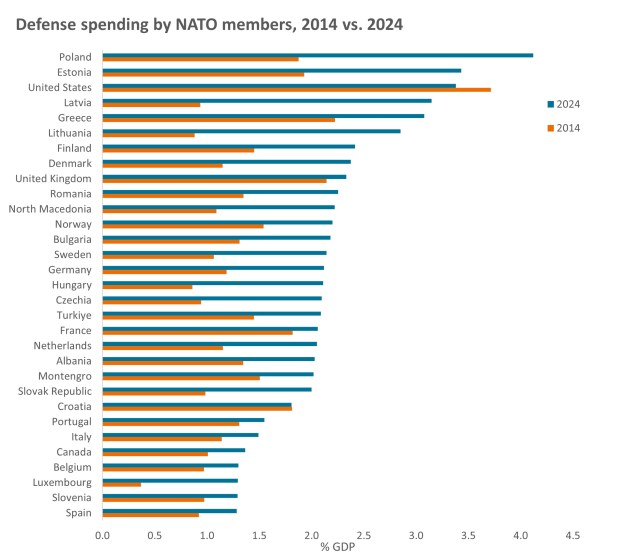

A changing geopolitical landscape is helping revive once slow-growing areas of the market, such as European defense.

Lessons learned from Trump’s first term as post-election euphoria fades and the market enters its next phase of policy impacts and economic realities.

The two West African nations are in the midst of tectonic political and economic shifts. How likely are they to succeed?

Highlights from NVIDIA’s most recent earnings call and the considerations for investors.

From ballots to banks and barracks – could this federal election mark the end of stagnation for Europe’s powerhouse economy?