With the world at a juncture on so many important issues, navigating the risks and opportunities from an investment perspective can be challenging. Which companies will provide the solutions, how do you avoid the hype, when does a good idea translate into a sound investment?

Thematic investing, which aims to identify long-term global themes and the companies that stand to benefit from them, allows investors to participate in the drivers of change. It can be approached in different ways but, at Janus Henderson, we believe there are three factors that are important to consider.

1. Acceleration: A decade of faster change

Rewind ten years and the thought of a global pandemic and lockdowns, a land war in Continental Europe, Britain leaving the European Union, or double-digit inflation would have been firmly in the realms of the unthinkable. In a similar vein, the idea we could develop vaccines in months not years to tackle COVID, that working from home would become mainstream, or that after so many winters of discontent electric vehicles and artificial intelligence (AI) would finally reach maturity would also have seemed fanciful.

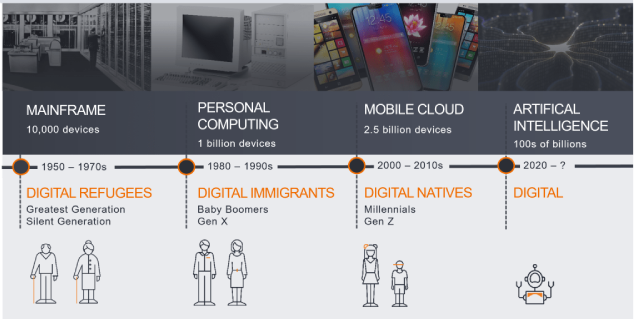

Yet one constant thread is that the world around us is changing and that rate of change is accelerating. Figure 1 shows quite how quickly with the uptake of digital devices growing exponentially through the decades. While we might not agree on or even be able to predict with much accuracy what the next decade holds, we can probably agree that the pace of change is not going to slow down.

Figure 1: Digital transformation driving disruption

Source: Janus Henderson Investors, Citi Research, as at 31 December 2016

As those born in the age of smartphones and apps, known as ‘digital natives’, become the majority of the workforce and in time the owners of the majority of wealth, we believe change is only likely to accelerate further. Their greater willingness to embrace new technologies, a focus on sustainability, demographic trends of growing and ageing populations, resource constraints, climate change, deglobalisation, and rapidly evolving working patterns including hybrid working mean the scene is set for a decade of accelerated change.

2. Innovation: The impact of AI

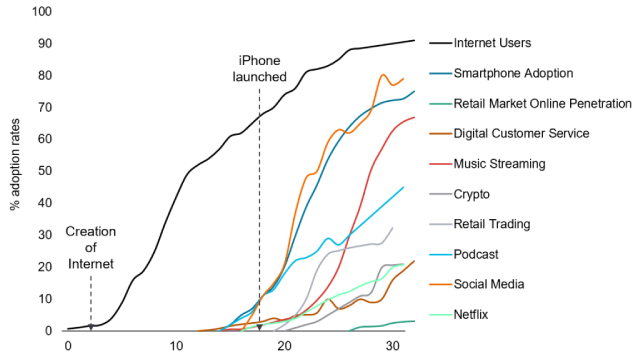

The exponential power of innovation is no better illustrated than by the viral launch of ChatGPT in late 2022. The advent of generative AI is a likely forbearer of a decade of even more rapid change as many industries and jobs are reimagined. The launch of the iPhone in 2007 was a precursor to a wave of innovation that has transformed our daily lives. Downloading music, video streaming, ride hailing, mobile gaming, online dating, posting photos on Instagram, or creating viral short videos were all enabled and blossomed as a result of that technological breakthrough. Figure 2 shows the speed of adoption and development of new digital services that a few years prior to their launch it would have been difficult for people or investors to have imagined. The concept of an app developer or an influencer as a career could not have been imagined. We are generally a lot better at predicting jobs that will be replaced by technology but far less proficient at imaging new career paths that will be created.

Figure 2: Speed of adoption and development of digital services

Source: Morgan Stanley, Tech Diffusion: 10 Lessons from 100 Years, June 2023

We are only just beginning to understand the ramifications of ChatGPT and generative AI, which will not just be confined to the technology sector. AI can be harnessed in the drug discovery process or in DNA sequencing and genome editing, paving the way for an exciting decade of accelerating healthcare innovation. AI will also have a crucial role in driving the efficiency, productivity gains and new solutions to address our sustainability challenges. It, along with sustainability considerations, will also continue to change our work and home living preferences. Hybrid working trends will evolve further and drive change in the property sector with smarter cities, more datacentres, and working patterns reimagined. AI is also an enabler and foundational building block of future technologies such as autonomous vehicles and the metaverse. As such AI will be at the forefront of the accelerating change we see this decade having major ramifications across sectors and the broader stock market.

3. Differentiation: Different times, different winners

In a world of accelerating change it goes without saying that incumbency will be challenged. Over the past decade ecommerce disrupted the retail industry, social media was kryptonite to newspapers and radio, while streaming and gaming has radically changed the entertainment industry. This has major implications for the stocks one wanted to own. Incumbents that have been successful for decades in some cases were pushed into bankruptcy while new companies were able to grasp the opportunities provided by these seismic shifts to become the best performing stocks. Positioning for these tectonic shifts defined your investment returns over the past decade of accelerating stock market dispersion.

We are now witnessing new major tectonic shifts. After more than a century dominated by internal combustion engine cars we are rapidly transitioning to electric vehicles. Government policy, new regulations and subsidies focused on sustainable objectives will more broadly drive a reimagining of our energy supply and many other industries. The market is already trying to delineate between the AI winners and losers. That assessment will need to be dynamic given its rapid development. New trends will also emerge and present fresh opportunity which will need to be harnessed by investors.

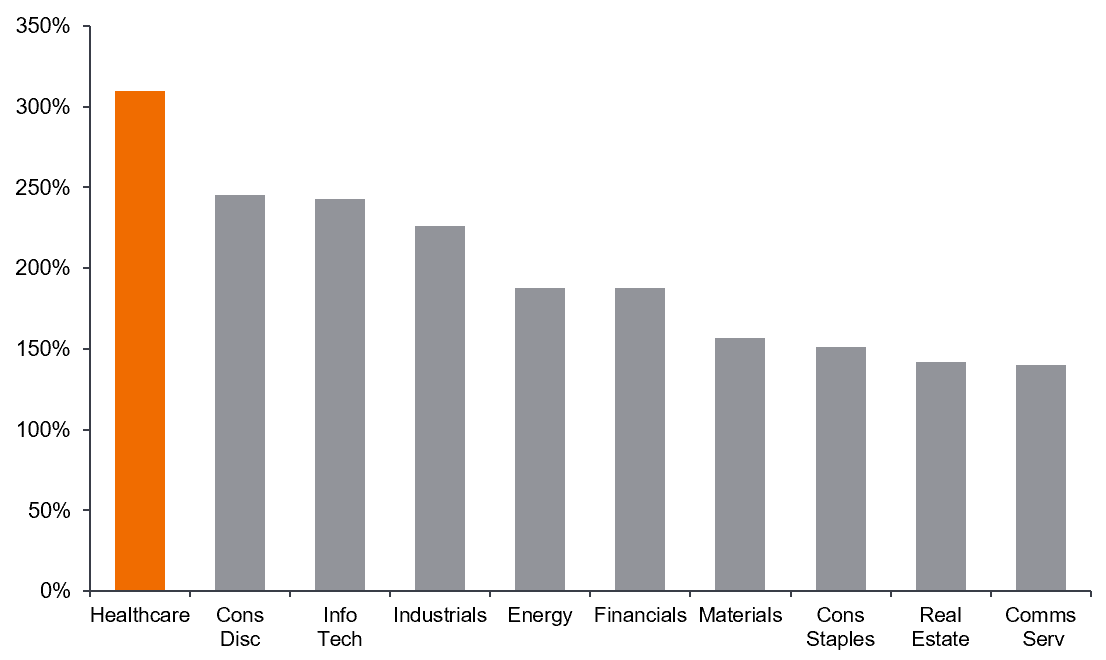

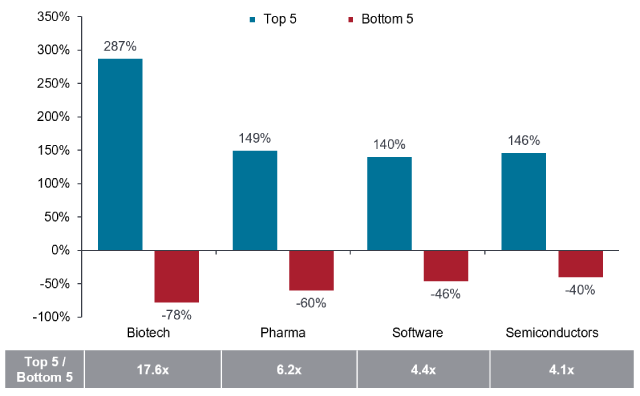

Acceleration and innovation will drive greater stock return dispersion. Differentiating your equity returns requires the ability to identify the beneficiaries of these key themes over time. But while a thematic lens is useful to identify long term growth opportunities, the ability to successfully identify the true winners in those themes requires much more: a deep sector specific understanding of the key trends and technologies at play and the franchises best equipped to take advantage of them. As figure 3 shows, an active approach will be essential to be well-positioned for this increased dispersion.

Figure 3: Thematic investing requires an active approach

Dispersion of returns by sector (over 10 years)

Source: Wilshire 5000 Index as at 31 December 2022. Includes average performance of stocks over $500M in market cap.

10-year average return

Source: Wilshire 5000 Index; 2013-2022. Based on analysis of ten-year period. Past performance does not predict future returns.

Portfolio construction perspective

Matthew Bullock, EMEA Head of Portfolio Construction and Strategy

| “We are now in an environment where the expectations for equity market returns are lower than where they have been in the previous decade. Therefore, to find long-term value, it has become even more important to look deeper into markets to find good growth. Themes by their definition are longer term structural changes that when identified correctly can lead to strong outperformance, however there will be winners and losers. We can see that playing out in the return dispersion Richard shows (figure 3), which we believe fully justifies an active approach.

Themes are very attractive from an investment perspective but equally from a marketing perspective. As such, we see numerous examples of “theme washing” in the market where strategies have been constructed not for the purposes of participating in the long-term theme, but rather for the purposes of marketability. Too often we see thematic portfolios that are either too narrow and take on undue risk, or too broad and dilute participation in the theme itself. As such, it’s imperative when utilising themes in a portfolio, that investors fully understand the breadth of the thematic strategy and the impact on their overall portfolio. We also consider it necessary to blend multiple themes into a broader portfolio. In the same way that timing the market is an impossible exercise, perfectly timing the entry and exit of themes is equally a fools game. When implemented effectively, investors in themes could be holding tomorrow’s winners…but portfolio construction matters.” |

In summary

The winners of today will not necessarily be the winners of tomorrow as themes and franchises remain dynamic. Also, with the resetting of the cost of capital, which makes access to capital more expensive and harder to come by, there is less tolerance for business models that are not self-funding. This is fertile ground for active bottom-up fundamental stock pickers with experience of identifying winners through various economic cycles. For investors, it is therefore essential to assess long term track records and ensure investment teams have the heritage and calibre to manage and create thematic solutions for a world of transformational change.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Dow Jones Wilshire 5000 Index is an index that measures the performance of all U.S. headquartered equity securities with readily available price data. Over 5,000 capitalization-weighted security returns are used and the Dow Jones Wilshire 5000 Index is considered one of the premier measures of the entire U.S. stock market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.