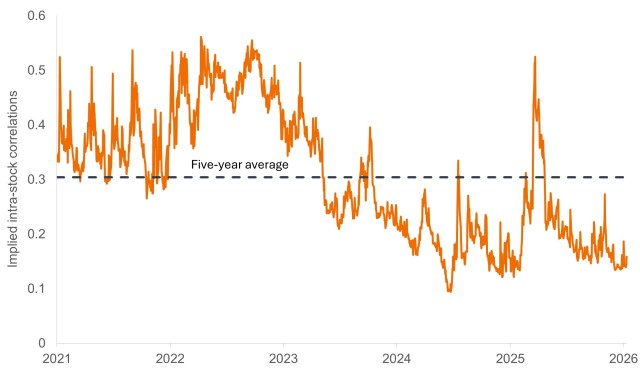

We view the lack of systemic risk priced into the market as the culprit for correlations among U.S. equities being near historic lows.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Can fiscal stimulus continue to drive markets in 2026? The Market GPS Multi-Asset Quarterly highlights some of today's key market factors.

As the Trump administration enters its second year with a focus on affordability, investors must consider what the president’s latest policies will mean for markets.

While options markets indicate a relatively sanguine 2026 for equities, investors should take note of a potentially worrisome absence of systemic risk.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

A discussion on equity and fixed income positioning during a period of AI-driven economic growth and Fed policy uncertainty.

At JHI's recent Madrid Investment Summit, Ali spoke with Jeremiah Buckley and Luke Newman about where they are finding the most compelling opportunities within equities.

What do current market dynamics mean for asset allocation? The Market GPS Multi-Asset Quarterly highlights key drivers and positioning.

How balanced strategies can help investors stay true to their long-term objectives.