Bond markets are confounding the consensus view that they would exhibit the same aggressive repricing to higher yields seen in 2016 on a Trump election victory.

Figure 1: Change in 10-year government bond yields one week after the US election (Nov 2016 and Nov 2024)

Source: Bloomberg, US 10-year government bond yield. Germany 10-year government bond yield, UK 10-year government bond yield. 8 November 2016 to 15 November 2016, 5 November 2024 to 12 November 2024. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Yields may vary over time and are not guaranteed.

To some extent this assumption seemed to be based on a muscle memory of 2016 and a generalised view that Trump = unbridled fiscal expansion. However, even as it appears likely we see a Republican sweep, the US yield curve has flattened and US bond yields are little changed from pre-election levels.

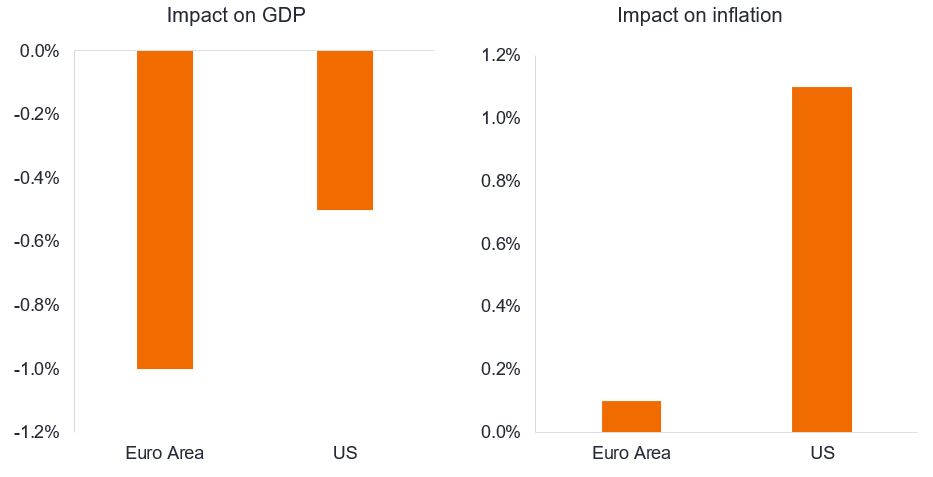

Meanwhile, in other countries, bond yields have fallen as the growth risks of Trump’s tariff plans remain considerable, with arguably little inflationary impact. An interesting case study that we highlighted in October, of the potential effects on inflation and growth, is shown below.

Figure 2: Estimated impact of Trump tariffs on US and Euro Area

Much heavier burden on European growth offers net dovish impulse for the European Central Bank

Source: Goldman Sachs, Jans Hatzuis, “Implications of Higher Tariffs for Euro Area and US Monetary Policy”, at the European Central Bank Forum, 2 July 2024. Assumes 10% tariffs across the board and full retaliation. There is no guarantee that past trends will continue, or forecasts will be realised. The views are subject to change without notice.

The price action in the immediate aftermath of the election results has been logical in our view reflecting:

- Tariff risks discussed above.

- A bond market that is already pricing in only three more interest rate cuts in the US to a level that would likely still be above a neutral rate for the US economy. With US mortgage rates around 7%1 again, this market pricing is not one in which we necessarily expect to see a steepening yield curve.

- An energy policy aiming to increase supply and keep the price of oil capped.

Against this, on the fiscal front the market fully expects a renewal of the Trump 2017 tax cuts, which were due to expire in 2025. However, this is not fiscal stimulus for economic growth per se, it simply prevents unforeseen tax hikes. On the spending side there may well be offsets as the new administration seeks efficiencies, whilst the ability of tariffs to raise government revenue also remains important to consider. The outlook for growth stimulating fiscal spending therefore remains somewhat murky.

In October, we expressed the view that a Trump sweep would not see a replay of the painful bear steepening witnessed eight years ago and that a Trump win could potentially act as a positive catalyst for German bond prices leaving US bonds a relative underperformer.

Germany’s exporting economy is facing multiple headwinds: weakness in China weighing on German exports, competition from China in electric vehicles, and now the threat of tariffs on its exports to the US. This is already affecting domestic politics, with Germany set to hold snap elections in February. With Germany and France in something of a political vacuum, the European Commission will have its work cut out negotiating with the new US administration.

For Trump we are told that ‘personnel is policy’. On that score, we await news of the appointment of the Treasury Secretary as regards fiscal policy, while the possible return of Robert Lighthizer – well known for his protectionist and tough negotiating views – as US Trade representative in the new administration offers further indications of tariff policy. In the meantime, for non-US investors, Lighthizer’s book “No Trade is Free”, published in 2023, gives a precis of the risks to individual countries from a Trump 2.0 trade policy.

1Source: Bloomberg, Bankrate.com US home mortgage 30-year fixed national average, 11 November 2024.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Bear steepening: A situation where yields on longer-term bonds rise more than the rise in yield on shorter-term bonds.

Neutral rate: An interest rate at which the economy operates at full employment and with stable inflation, i.e. a rate that is neither expansionary or contractionary for the economy.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. With an inverted yield curve, yields are higher on shorter-dated bonds than longer-dated bonds. A yield curve can signal market expectations about a country’s economic direction.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- When interest rates rise (or fall), the prices of different bonds will be affected differently. In particular, bond prices generally fall when interest rates rise or are expected to rise. This is especially true for bonds with a higher sensitivity to interest rate changes. A material portion of the fund may be invested in such bonds (or bond derivatives), so rising interest rates may have a negative impact on fund returns.