As we have highlighted before, the private commercial real estate market has dominated media headlines and has been slow to adjust reported values as the macroeconomic background changes. This is the opposite for the listed/public market, which is forward looking, being priced daily in stock markets, with valuations very much already reflecting the negative impact of higher rates on underlying property values. This means listed real estate investment trusts (REITs) are trading at wide discounts to private asset values having already “priced in” the impact of higher rates, and today stands to benefit from a reversal in the direction of interest rates.

How do we evidence this? One key indicator is that the private real estate sector is taking advantage of the significant valuation gap between private and listed real estate, to reap the existing value in listed REITs today. Recently, Blackstone, the largest private operator announced it is acquiring listed upscale coastal apartments REIT, Apartment Income (AIR Communities), for approximately US$10 billion. This follows on from an earlier acquisition this year, Canadian REIT Tricon Residential, a portfolio of mainly single-family homes in the US Sunbelt region in January for US$3.5 billion. With both deals struck at more than a 20% premium to the prevailing share prices, we see this as illustrative of the attractive pricing of listed residential REITs (and the wider listed REIT sector).

Still compelling valuations

Looking specifically at US residential REITs (Figure 1), the sector still looks undervalued compared to observed private market pricing from recent transactions. Apartment REITs are currently trading at around 10% discounts to estimated net asset value (NAV), while single family rental REITs illustrate an even wider discount of circa 20%.

Over in Europe, we see German residential landlords trading at discounts of around 40% to appraised values, reflecting higher leverage (debt levels), but also in our view creating an opportunity for investors.

Figure 1: US residential average NAV premium/discount

Source: SNL Real Estate, Janus Henderson Investors. Data from 31 December 2005 to 31 March 2024. NAV or net asset value: value of REIT underlying assets minus liabilities. Premium to NAV: REIT price is higher than its NAV; discount to NAV: REIT price is lower than its NAV. Past performance does not predict future returns.

While we expect peak-to-trough valuation declines for commercial real estate of circa 20% from early 2022 highs, the residential sector may likely see valuations stabilise quicker than many other sectors, being a relative beneficiary from investors’ reduction of exposure to the more challenging segments of commercial real estate, such as office and low-quality shopping centres.

Well placed for growth

Since the 2008 Global Financial Crisis, listed residential REITs have reduced leverage, positioning themselves favourably entering the recent downturn, notably in the US. This lower leverage can allow for superior access to funds at a lower cost compared to private owners. We expect listed REITs to put their cost of and access to capital advantages to good use and acquire “good buildings with bad balance sheets” from private owners. This could increase the potential for the asset class to continue expanding market share, as they have done over the past three decades, as well as contribute to additional earnings growth.

Furthermore, REITs typically have efficient expense structures coupled with an ability to invest in operating platform improvements, which has often resulted in higher occupancy levels, higher achieved rents, and more efficient operating margins compared to their private peers. In early 2024 some US landlords have achieved around 95% occupancy levels, with mid-single-digit uplifts on tenant lease renewals.

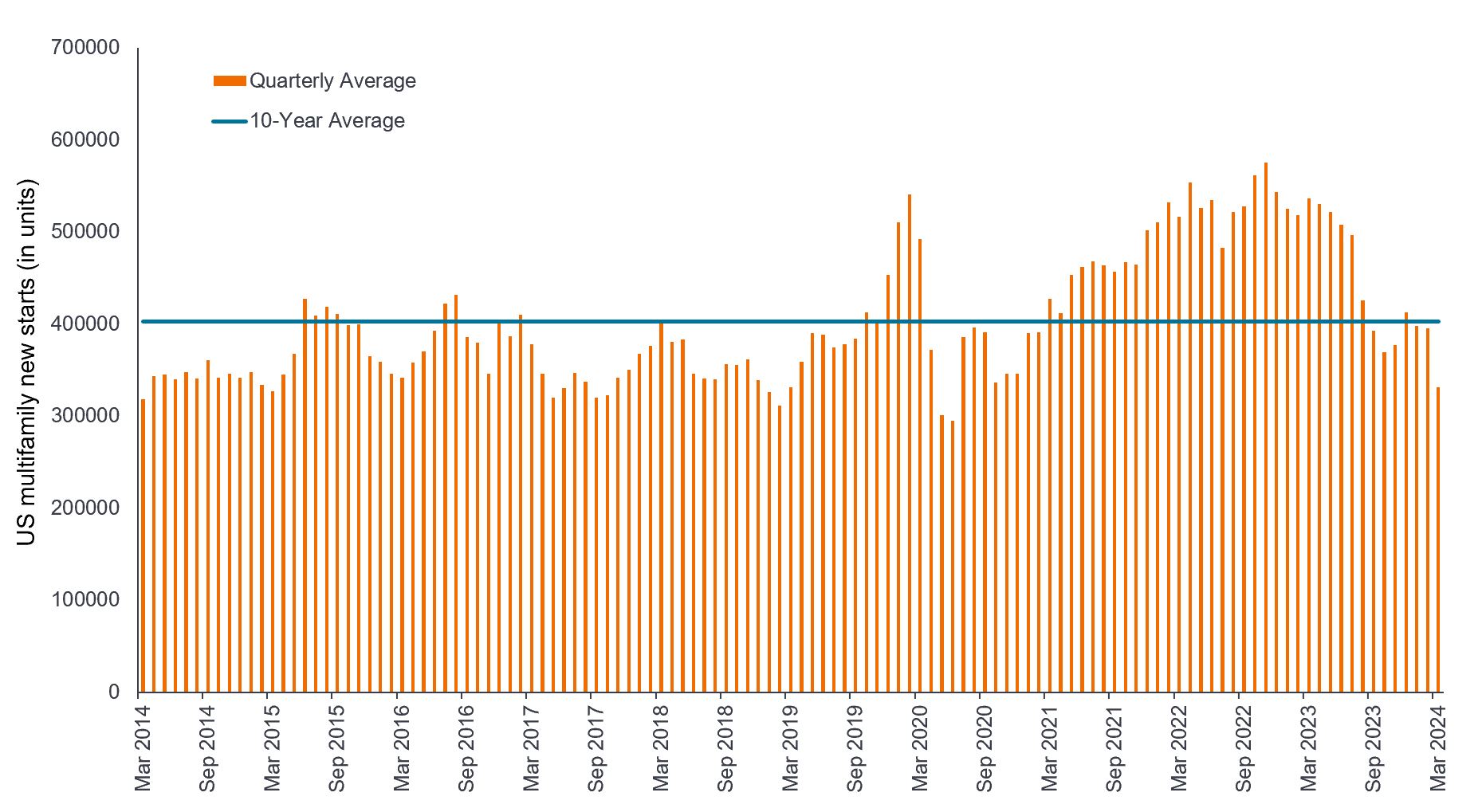

While elevated supply looks to be a short-term headwind for US apartments, construction activity is now slowing dramatically, which should also aid medium-term growth prospects.

Figure 2: New construction starts below 10-year average

US Multifamily new starts (annualised, seasonally-adjusted)

Source: US Census Bureau, Janus Henderson Investors, 31 March 2014 – 31 March 2024.

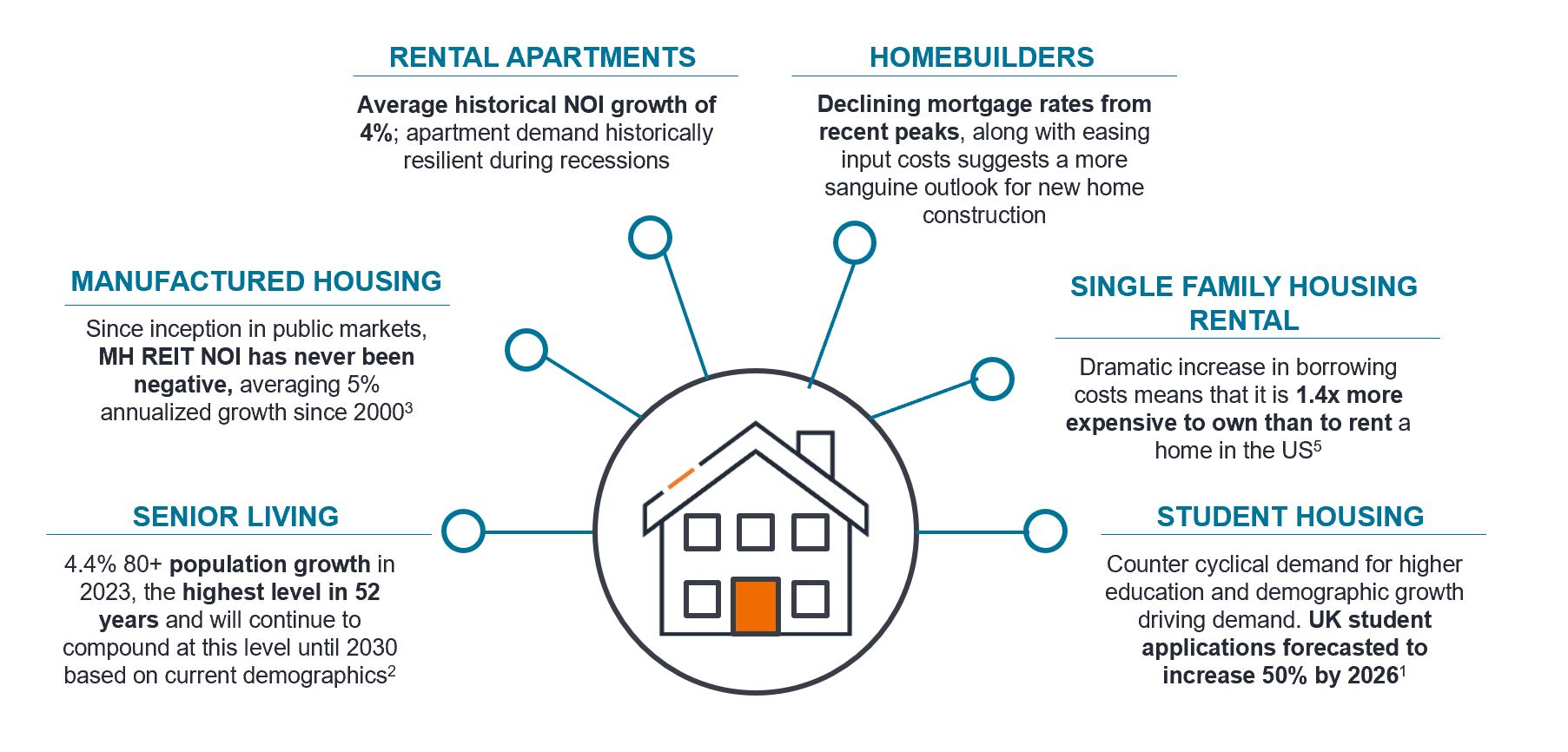

Residential: a diverse sector with defensive characteristics

The listed residential sector has proven it can generate attractive long-term returns and income streams, which have historically tended to keep pace with inflation. The listed market also offers a broader opportunity set. Areas such as student accommodation, single-family housing rentals, retirement communities and senior living, all have benefited from structural demand drivers such as the demographic trend of an ageing population.

Figure 3: The residential opportunity

Structurally undersupplied across different subsectors

Source: 1UCAS, 2OECD, 3,4Green Street Advisors, 5 Jefferies, FRED, NAR, REIS, Redfin, Janus Henderson Investors analysis, as at 31 December 2022. NOI=net operating income, a measure of an income-producing property’s revenues minus operating expenses (financing and tax).

Selectivity is imperative

We reiterate that a selective approach is key when it comes to investing in the property sector, as multiple factors such as tenant demand, market supply, funding cost and availability among others, can differ widely not only between property types but also at the regional and local level.

The single-family rental sector is arguably best positioned within residential, given its sticky customer base and strong demand trends aided by declining mortgage availability and depressing home purchase activity. In North America, the US East Coast’s fundamentals are stronger due to better job growth and supply compared to the West Coast and the Sunbelt markets. In Canada, we are seeing strong market rent growth supported by Canada’s dynamic immigration policy and healthy employment. Meanwhile in Europe, some Swedish and German residential companies assumed large volumes of debt which in a rising rate environment have seen much weaker valuations. However, we think the operational resilience and robust cash flows of companies in the region are underappreciated by the market and importantly, where leverage levels were too high, companies have used dividend cuts, fresh equity injections and asset disposals to help address these concerns.

The bottom line

Residential REIT markets around the world continue to offer compelling opportunities supported by demographic trends, an undersupply of housing in most global markets (that is likely to be accentuated in the years ahead), and a desire for affordable and well-managed rental homes.

We look ahead with greater confidence and conviction that listed REITs may again prove to be a valuable building block within investors’ portfolios, given its potential for attractive and growing dividend streams, diversification against other asset classes, and defensive growth.

Given Blackstone’s recent acquisitions, we would not be surprised to hear of more acquisitions of listed REITs by private operators in the coming months. This should help build a strong positive outlook for listed real estate and provide confidence to investors to take another look at the sector.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time.

Investment grade: a bond/debt issue that has a relatively low risk of defaulting on its principal and interest payments, reflected in the higher rating given by credit ratings agencies.

Net Asset Value (NAV): the total value of an asset minus outstanding debt and fixed capital expenses.

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.