CLOs have been a part of the U.S. securitized products market since the late 1980s. At around $1.1 trillion in assets and over $100 billion in annual new issuance in 2024, the CLO market is fast approaching the $1.4 trillion U.S. high-yield market in terms of size.

While most CLOs are sold to large institutional investors such as banks and insurance companies, the asset class has recently become more accessible to retail investors, primarily through ETF products. The proliferation of ETFs providing exposure to CLOs (especially AAA rated CLOs) confirms the growing investor appetite for high-quality, floating-rate fixed income.

To help investors further develop their knowledge of this fast-growing sector, we drew a sample of the five largest publicly listed AAA CLO ETFs that collectively represent the majority of the U.S. AAA CLO ETF market and made a couple of key observations.

Observation #1: All sampled AAA CLO ETFs allow managers to hold less than 100% in AAA CLOs.

Each of the sampled ETFs affords the investment manager the flexibility to invest a minority portion – either up to 10% or up to 20% – of the fund in securities that are not AAA rated. Historically, managers in the sample have used this flexibility sparingly to seek better risk-adjusted returns when market pricing fluctuations have created attractive relative value opportunities.

As shown in Exhibit 1, the spread differential between the AA and AAA rated segments of the CLO index has fluctuated meaningfully over the past few years. As a result, we believe the investment mandates of the sampled ETFs, which allow managers to selectively add a nominal number of non-AAA rated securities, may result in better risk-adjusted returns in the long term.

Exhibit 1: AA CLO credit spread less AAA CLO credit spread (Dec 2021 – Dec 2024)

Variability in relative spreads may create opportunities for active CLO managers.

Source: J.P. Morgan, as of 31 December 2024. Credit spread on J.P. Morgan AA CLO Index and J.P. Morgan AAA CLO Index as represented by discount margin. Past performance does not predict future results.

Observation #2: Alpha opportunities exist within the AAA tranche.

CLO structures may have either a single AAA tranche or a two-tier AAA tranche separated into “junior” AAA securities and “senior” AAA securities. The J.P. Morgan AAA CLO Index is primarily comprised of single-tier and senior AAA securities, but junior AAA structures are not uncommon and currently make up about 3.5% of the AAA index.

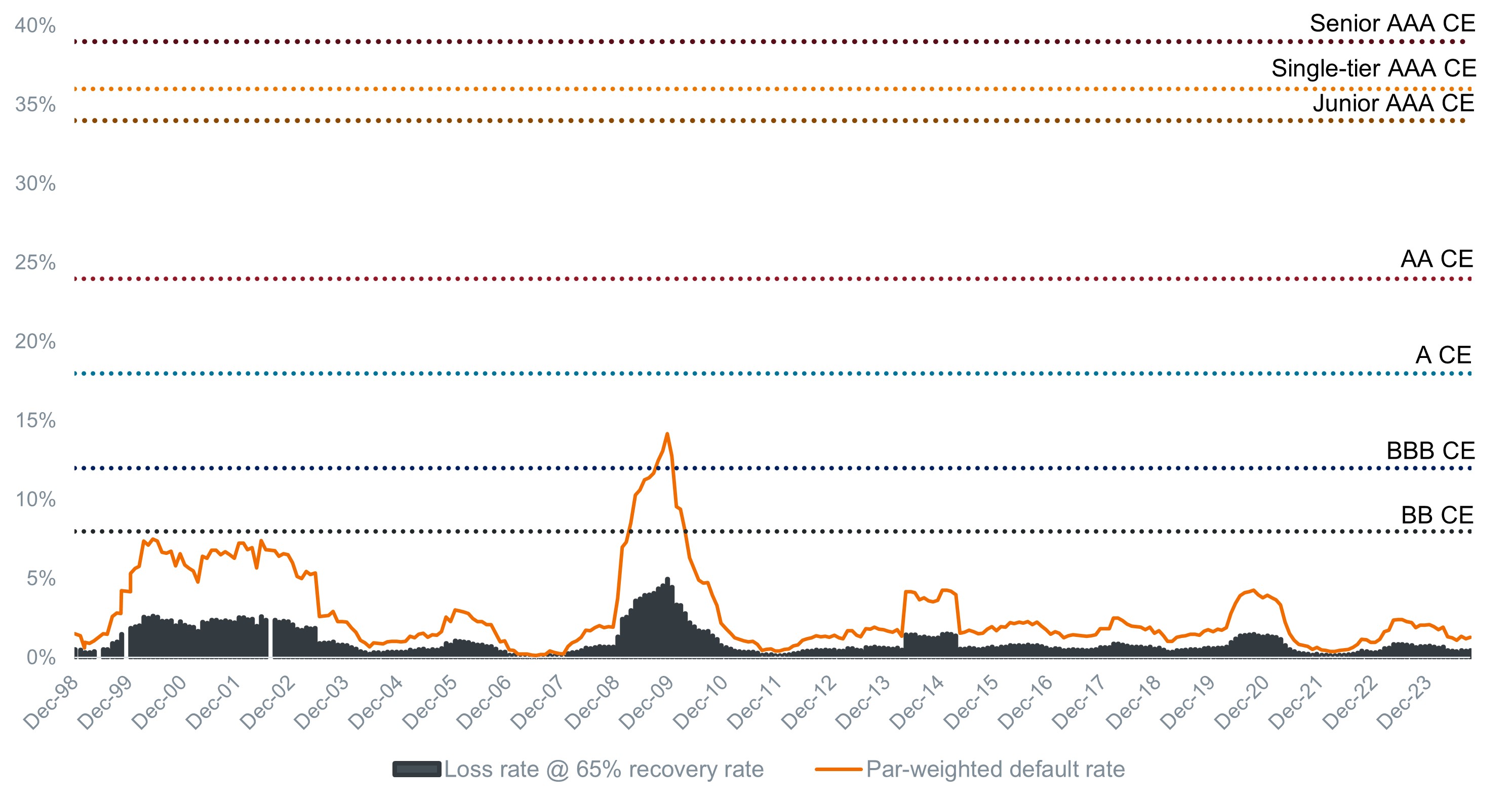

Despite being subordinated to senior AAA tranches, junior AAA securities are still AAA rated and retain seniority over all other tranches. Due to the credit enhancement features1 within CLO structures, there has never been a realized loss in any senior AAA, junior AAA, or AA rated CLO, as shown in Exhibit 2.

Exhibit 2: Loan defaults vs. CLO credit enhancement (CE)

All AAA tranches remain loss remote, with 34%-39% CE.

Source: Janus Henderson Investors, J.P. Morgan, LSTA, as of 31 December 2024. Loan defaults based on S&P/LSTA Leveraged Loan Index data. Loss rate assumes a 65% recovery rate, consistent with historical data. CE represents the level of losses a tranche can withstand. Past performance does not predict future results.

Junior AAA tranches provide another valuable lever for active managers, as they can offer up to 30 basis points (bps) of additional credit spread with marginally lower credit enhancement. Like the AA vs. AAA example above, spreads between senior and junior AAA tranches fluctuate over time, and an active manager may look to selectively exploit relative mispricing of junior AAA securities when markets provide such opportunities.

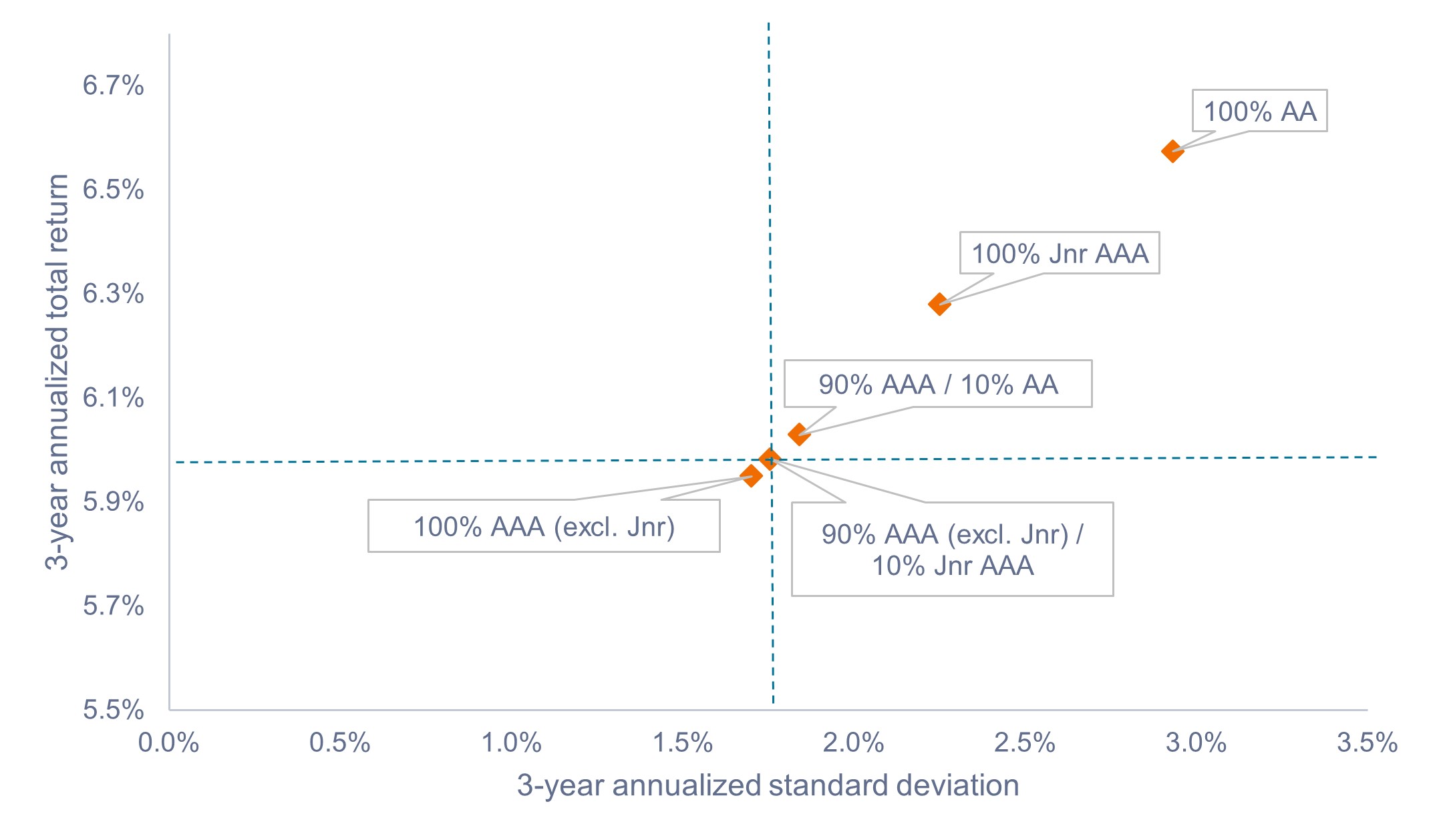

Junior AAA securities have historically exhibited total returns and volatility between that of the senior AAA and AA tranches, as shown in Exhibit 3. Further, a 10% static allocation to either AA or junior AAA securities has resulted in an incremental increase in yield, while maintaining a similar risk profile to a portfolio of senior AAA securities.

We expect the junior AAA segment to continue to gain size and stature, providing an attractive alpha opportunity for active CLO managers.

Exhibit 3: Risk-return scatterplot of various CLO tranches (Mar 2022 – Mar 2025)

Nominal weightings in junior AAA and AA tranches have resulted in incremental increases in total return and volatility.

Source: J.P. Morgan, Janus Henderson Investors, as of 1 March 2025. Past performance does not predict future results.

Conclusion

As investors consider an investment in AAA CLOs, we believe it is important to maintain a focus on the quantitative risk-return characteristics of the sector, while also evaluating the qualitative factors that often affect various ETF products, such as size, liquidity, track record, manager tenure, and fund rating.

Aside from the nuances that exist among various ETF products, we expect investor adoption of AAA CLOs to continue to grow due to the sector’s AAA credit rating, inherently low duration, additional yield over cash, and the diversification benefits it may bring to fixed income portfolios.

1Credit enhancement features within CLOs may include overcollateralization, excess spread, cash reserve funds, and subordination and accelerated paydown, and are designed to provide additional protection to investors in higher-rated tranches against losses in instances of defaults to the underlying loans.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Tranches are segments of a pool of securities that are divided up by credit rating, maturity, or other characteristics.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.