Striking the right note: The Fed opts for policy continuity

Global Head of Fixed Income Jim Cielinski and Portfolio Manager Daniel Siluk believe that effective monetary policy has created conditions in which cautious investors can judiciously add risk by seeking high-quality and attractively yielding assets.

6 minute read

Key takeaways:

- A moderating but still resilient economy has enabled the Federal Reserve (Fed) to hold off on rate cuts, allowing earlier restrictive initiatives to run their course.

- Although Fed Chairman Jerome Powell upgraded 2024 inflation and economic growth projections, his tone was less hawkish than some had anticipated after recent hotter-than-expected consumer price index readings.

- The combination of a soft landing and near-inevitable rate cuts presents an opportunity for investors to increase risk by modestly extending duration and seeking higher-quality issuance.

Compared to the last two Fed meetings – each requiring a generous helping of additional context to explain shifts in the projected policy path – this week’s meeting proved relatively uneventful. Investors should welcome this policy continuity as a sign that a soft landing is the likely endgame. This should go a long way toward giving investors the confidence to modestly increase risk across fixed income portfolios.

By the numbers

As expected, the Fed held its benchmark overnight lending rate steady, at a range of 5.25% to 5.50%. While this outcome was widely expected, the Summary of Economic Projections was highly anticipated, with many wanting to see how the Fed would account for recent inflation and retail sales data. After consumer prices surprised to the upside in January and February, some wondered whether the Fed would stick to their projected three 25 basis point cuts in 2024, and they did.

In acknowledging that the economy remains on sound footing – and perhaps more than expected at this stage – they raised their expectations for 2024 gross domestic product (GDP) growth from 1.4% to 2.1% and core inflation from 2.4% to 2.6%. With those upgrades, Fed officials may have been tempted to lower the number of expected 2024 rate cuts to two. However, growing softness in retail sales and the presumption that hotter-than-expected consumer prices were a function of the seasonality likely held policymakers at three. In a nod to continued economic resilience, however, voting members did reduce their expectations for 2025 rate cuts by one – now expecting the overnight rate to end that year at 3.9%.

Reinforcing the Fed’s expectation of a soft landing, Chairman Jerome Powell commented that demand for labor still exceeds supply. In a service-based economy like the U.S., one would expect labor market and wage pressures to weaken considerably for inflation and economic growth to move materially downward. With the employment backdrop still healthy – the December 2024 unemployment rate projection was revised downward from 4.1% to 4.0% – the Fed still enjoys the latitude of allowing restrictive policy rates to filter through the system. Worth watching are incipient signs that the labor market may be turning the corner. Job openings are 25% off their cycle peak, and voluntary separations (the quits rate) have also fallen back to Earth.

Adding the right kind of risk

We see this report as evidence that the wild ride that characterized global bond markets since the post-pandemic reopening may soon be over. Thanks to effective monetary policy, inflation is declining, and recession risk is low in many markets. In such jurisdictions, this scenario is favorable for riskier assets, including investment-grade corporate credits and equities. While a soft landing is most people’s base-case scenario, we are undeniably late in the policy cycle. At this stage, we believe quality is of paramount importance.

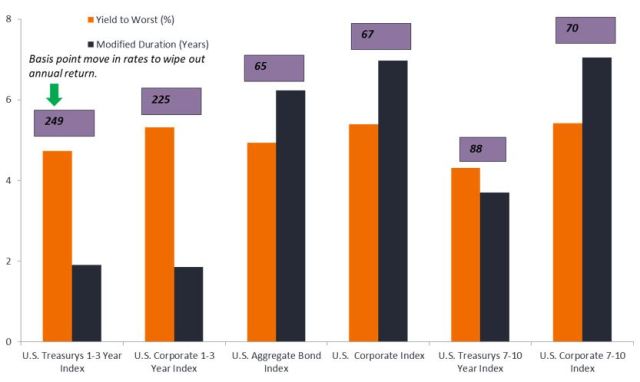

Yield to worst and modified duration of segments of the U.S. fixed income market

In contrast to much of the past decade-plus, the risk-return profile of bonds has reverted to historical norms.

Source: Bloomberg, as of 20 March 2024.

Consistent policy, at least recently, has narrowed the range of outcomes for both the global economy and financial markets. This should incentivize those holding large amounts of cash on the sidelines to consider increasing their allocations to riskier assets. Typically, the first stop in this reallocation is safer pockets of the market, including sovereigns and investment-grade corporates.

Modestly extending interest rate risk (or duration) should also be a consideration. Many investors have little to no duration exposure as they have opted to pile into money market funds, meaning they will have little upside exposure should rates decline. These investors would not have to do much to increase interest rate risk. Focusing on issuance within the one-to-three-year range is a destination worth considering, given the consensus view that the next move in policy rates in the U.S. and most other major markets is down. This could be particularly true for European bonds, as the currency bloc’s central bank may be forced to cut before many of its developed market peers.

In the U.S., the upwardly revised inflation and GDP estimates indicate that a downward move farther out along the yield curve could be more limited. Additional upside growth surprises could even see yields modestly rise. With policy rates at their cycle peak, we expect more stability on the front end of the curve, and though the expected early 2024 cuts have been delayed, their near inevitability means that shorter-dated tenors are positioned for capital appreciation as central banks move away from restrictive stances.

An eye toward the future

The Fed’s battle against inflation has gotten an assist from the supply side of the economy. Workers re-entering the labor force and supply chains sorting out bottlenecks have contributed to price pressures letting off steam. In time, the risk may swing from not enough to excess capacity. That is the point at which we believe dovish policy will be enacted.

However, the era of one-size-fits-all monetary policy is likely behind us. Going forward, countries will have to tailor future policy prescriptions to align with their unique macroeconomic situation.

Other risks remain. Geopolitical tensions remain high, with conflict impacting energy and agricultural flows. Additionally, a series of consequential elections will take place throughout the year. While uncertainty is not an investor’s friend, the resetting of bond yields back to their historical range means that, once again, a mix of sovereign bonds, high-quality corporates, and securitized products can serve as a diversifier to a broader portfolio in the event of a sell-off in riskier assets while at the same time potentially generating attractive levels of income.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg U.S. 1-3 Year Treasury Bond Index measures the performance of the US government bond market and includes public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Corporate 1-3 year Index measures the performance of U.S. investment grade, fixed-rate corporate debt with 1-3 year maturities.

Bloomberg U.S. Corporate 7-10 year Index measures the performance of U.S. investment grade, fixed-rate corporate debt with 7-10 year maturities.

Bloomberg U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

Bloomberg U.S. Treasury 7-10 Year Index measures the performance of US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with remaining years to maturity between 7 and 10 years.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Core inflation/Core Personal Consumption Expenditure Price Index: A measure of prices that people living in the US pay for goods and services, excluding food and energy.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Dovish policy refers to a central bank increasing the supply of money and lowering borrowing costs. Hawkish policy refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Sovereigns/sovereign bonds: Bonds issued by governments to raise money to pay off debt or finance spending. Sovereign debt can also refer to the total of a country’s government debt.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

Yield to worst (YTW) is the lowest yield a bond can achieve provided the issuer does not default and accounts for any applicable call feature (ie, the issuer can call the bond back at a date specified in advance). At a portfolio level, this statistic represents the weighted average YTW for all the underlying issues.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.