Quick View: Higher for longer… or higher for now

Head of U.S. Securitized Products John Kerschner discusses how the March Core Personal Consumption Expenditures (PCE) reading impacts rate expectations and the overall inflation picture in the U.S.

2 minute read

Key takeaways:

- Stubborn inflationary pressures and a resilient U.S. economy have derailed expectations of aggressive rate cuts in 2024.

- While inflation persistence is continuing, March’s PCE reading confirms that it isn’t accelerating as some had feared.

- Solid U.S. employment, economic strength, and slowing but persistent inflation gives us confidence that the Federal Reserve’s (Fed) patience and continued focus on data is the correct approach.

The start of 2024 has largely been a story of seeing high expectations for overly aggressive rate cuts by the Federal Reserve (Fed) slip away. Fed Chair Powell’s late 2023 dovishness has been met with stubborn inflationary pressures and a more resilient and stable U.S. growth environment. Recent stronger-than-expected inflation prints have made the markets jittery as rates have hit 2024 highs and are exhibiting extreme volatility. The Fed is back to watching the “data” to inform their decision.

Every new inflation print has elevated importance, and the market was in need of an “in-line” release to confirm that the Fed wasn’t starting to lose this battle. The good news is that the U.S. Core Personal Consumption Expenditures (PCE) price index, the Fed’s preferred measure of inflation, confirmed that while inflation persistence is continuing, it is not accelerating as some had feared: The number came in at 2.8%, flat compared to last month’s print. The month-over-month measure also remained stable at 0.3%, similar to last month’s print.

JHI

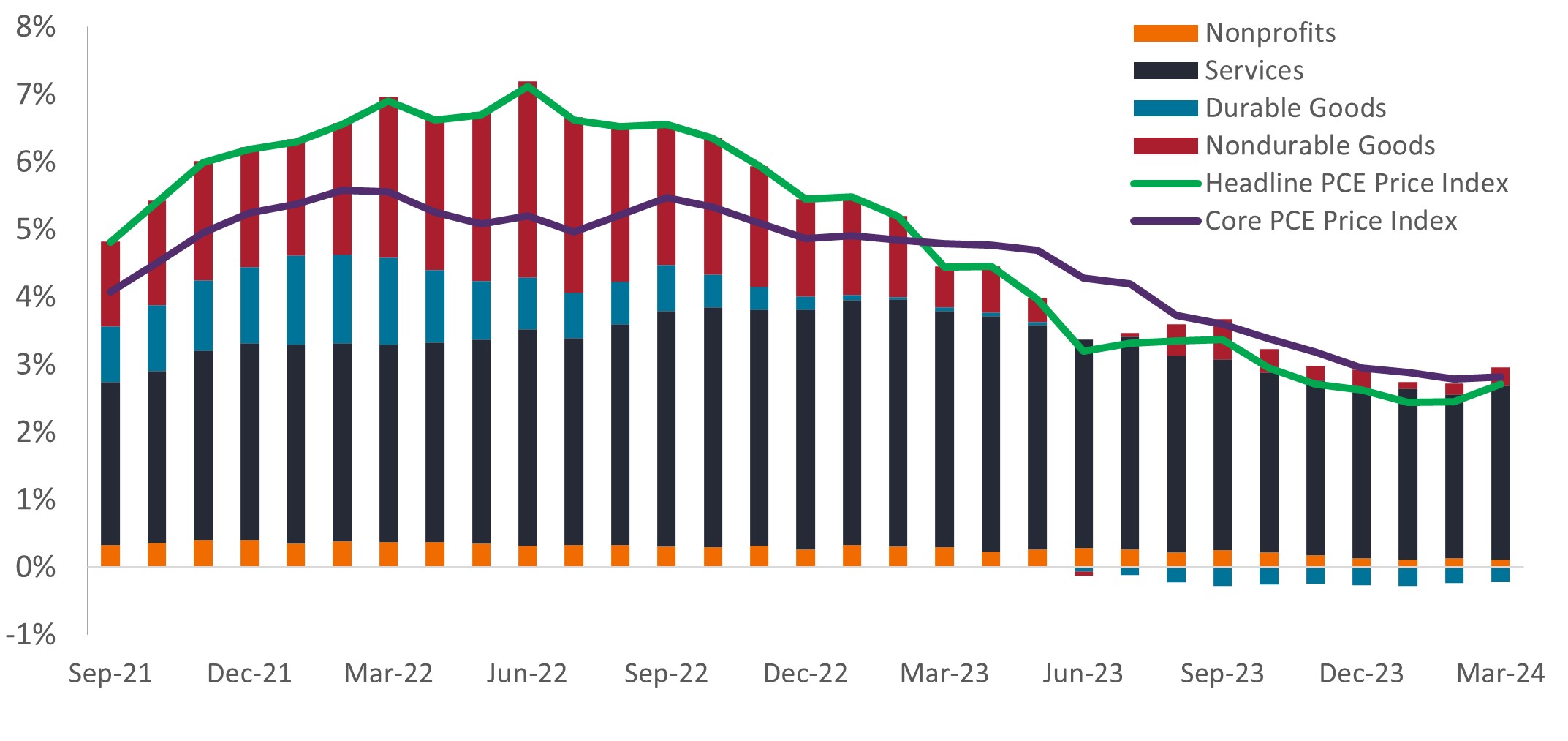

Contributors to PCE Price Index by category

Source: Bloomberg, as of 26 April 2024.

Source: Bloomberg, as of 26 April 2024.

The hard fact is that the Fed needs to see monthly prints averaging in the 0.15%-0.2% range to get to their stated 2% target, which at this point seems a little far off. Although inflation is still too high for the Fed’s comfort, if progress continues, it still may be reasonable to assume one, possibly two cuts in 2024. More specifically, service inflation – excluding the more volatile housing and energy – climbed 0.4% from last month, a slight acceleration from the prior month.

The solid employment picture, current U.S. economic strength, and slowing but persistent inflation gives the team at Janus Henderson confidence that the Fed’s patience is the right approach. One important but lightly followed indicator is the Citi Economic Surprise Index, which measures data surprises relative to market expectations. This indicator has declined steadily over the past few months, potentially indicating that a higher federal funds rate may be indeed slowing the U.S. macro data.

Whether it’s higher for longer or higher for now, we think investors should take advantage of these decade-high yields and, like the Fed, continue to watch the data.

The Citigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts.

A dovish monetary policy is one in which central banks seek to promote economic growth by keeping interest rates low and making credit readily available. This approach is typically used during periods of high unemployment or slow economic growth.

The Personal Consumption Expenditures (PCE) price index measures changes in consumer spending on typical goods and services and is used to calculate inflation (or deflation) in the U.S. economy.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.