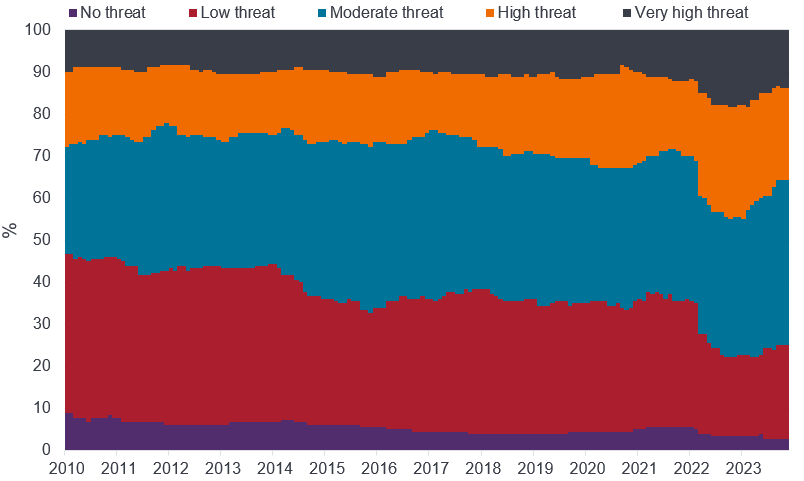

Global politics is becoming more volatile, creating uncertainty but also opportunity for businesses and investors. The Economist Intelligence Unit (EIU) has been tracking political and geopolitical stability for decades. Our dataset shows a clear rise in the threat posed by international tensions to economies over the last 15 years. We assessed in 2010 that around 40% of the geographies we surveyed faced ‘no’ or ‘low’ threat from international tensions; that proportion has now fallen to 25%. Managing geopolitical risk has risen quickly up the agenda for governments and companies.

The economic impact of geopolitical tensions is intensifying

Level of threat posed by international disputes; % of total geographies

Source: The Economist Intelligence Unit, 2023. Based on 180 geography dataset.

Shifts in the global distribution of power

Shifts in the global distribution of power have driven these changes. US primacy is no longer as absolute as it was in the 1990-2009 period, weakening its ability and resolve to act as the “world’s policeman”. Rising powers, such as China, seek greater global influence, while violent non-state actors see opportunity to cause disruption. Geopolitical rivalry has hamstrung the ability of international organisations to mediate security and trade disputes. The widening internationalisation of armed conflicts, as more external parties seek to influence outcomes in a manner favourable for their interests, makes them harder to resolve.

Prepare for more volatility

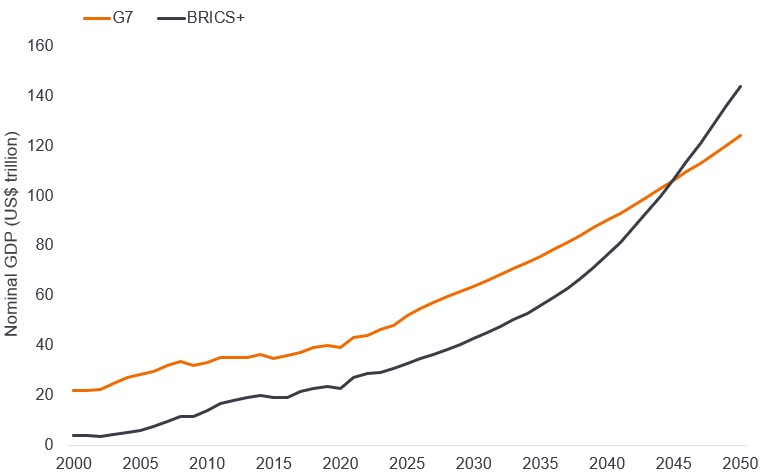

Investors should expect more geopolitical volatility in the coming years. Concerns that we could see the emergence of a global war or even nuclear conflict are overdone: there are few signs of a rival axis emerging to fundamentally challenge the US and its allies (China and Russia relations are not as strong as might be assumed). Nevertheless, our long-term economic outlook points to a further diffusion of global power that will provide emerging economies with greater influence and drive changes to the set of international rules and institutions that have been in place since 1945.

The rising economic weight of emerging economies will strain geopolitics

Source: The Economist Intelligence Unit, 2023.

What does the contest for power mean for investors?

Power contestation and shifts will have a profound impact on investors. Periods of geopolitical change have historically driven important changes in economic outcomes. We see an impact from the current geopolitical environment in several key areas:

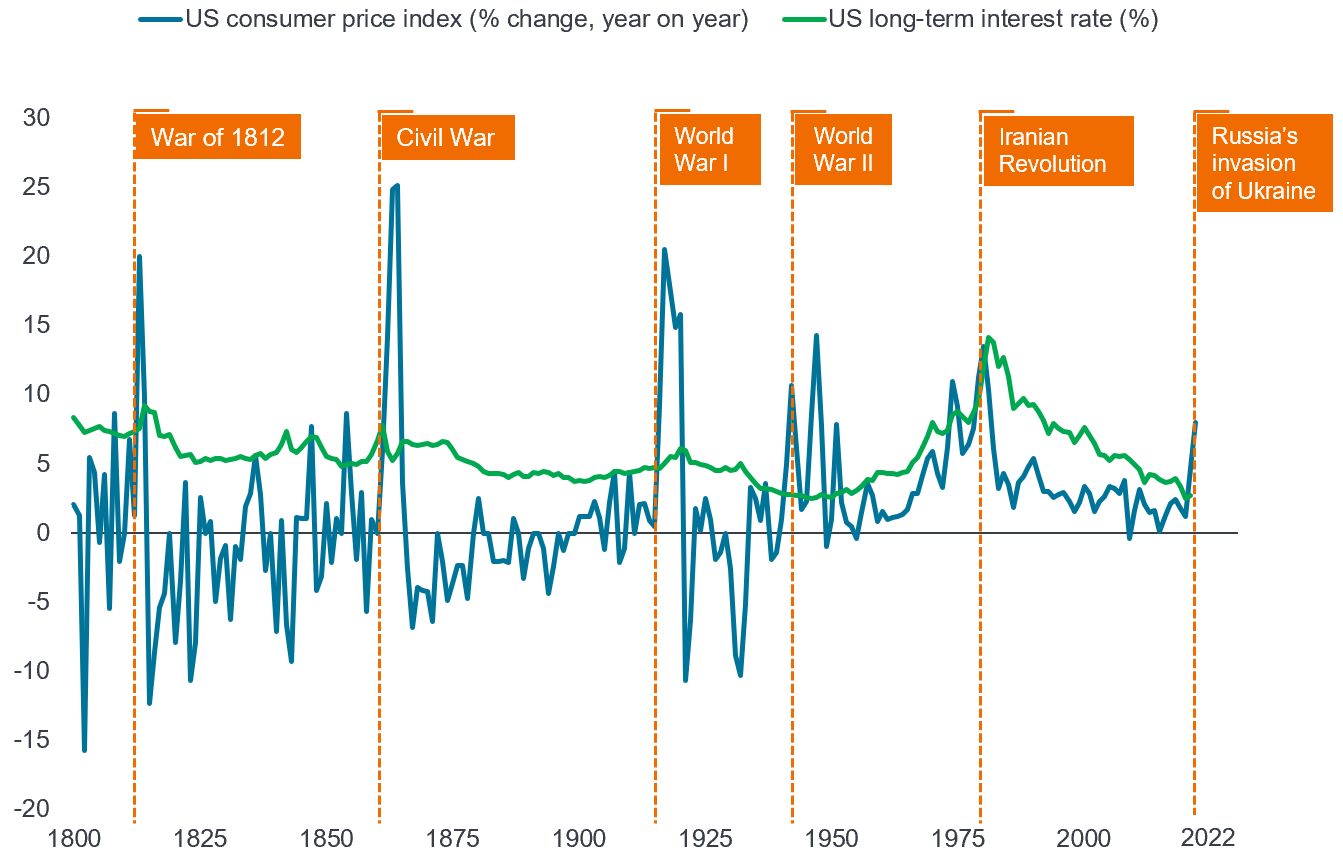

Prices and rates

- Geopolitical competition will be inflationary. A reworking of supply chains, as countries aim to “reshore” or “friendshore” critical areas of production, will lead to higher prices as efficiencies are lost. Restrictive trade policies and the building of strategic commodity reserves will add to these price pressures.

- Outright regional or global conflict would lead to price spikes, owing to demand and supply shocks. War tends to be inflationary because of the demand associated with the war effort and the use of expansive monetary policy tools to fund it.

- Higher trend inflation will keep a floor under interest rates, reinforcing our view they will stay “higher for longer”. Major conflict could reverse this trend, if it led to major monetary intervention.

Geopolitical competition and conflict tends to be inflationary

Source: MeasuringWorth.com; the Economist Intelligence Unit, 2023.

Public and private spending

- Geopolitical competition will encourage governments to prioritise defence and industrial policy needs in their spending: this has already been evident in US and European responses to Russia’s invasion of Ukraine. This will be at the cost of social programmes in areas such as health, education and housing.

- Changing fiscal priorities could lead policymakers to consider greater private-sector provision of key public goods, given strong demand in these areas. In general, however, private investment will be constrained by geopolitical uncertainty and high borrowing costs.

- Fiscal retrenchment is unlikely in the current environment. Besides spending pressures, governments will find it politically difficult to raise taxes. These factors point to persistent budget deficits and relatively high yields. In a conflict scenario, however, yields would be pushed down by demand for global safe-haven assets such as treasury bonds.

Productivity and competition

- Competition between countries has historically been a driver of technological change. The desire to be at the forefront of international innovation will drive public funding in these areas and create opportunities for private players, especially as related to national defence applications.

- Artificial Intelligence (AI) will be a focus of developments in the current environment, given global competition and divisions over the approach to be taken to the sector.

Understanding the implications of the new era

Absent outright conflict, changes in the global distribution of power tend to occur gradually. Nevertheless, recent conflicts in Europe and the Middle East give a sense at the moment that shifts in geopolitics are occurring unusually rapidly. Understanding the implications of this new era of geopolitics will become increasingly fundamental in investing, both to protect against unexpected risk as well as find opportunity.

“As outlined in Navigating change: Three drivers for long-term investment positioning, we share the Economist Intelligence Unit’s view that geopolitics will have meaningful implications for the economy, global trade, and the supply chains that enable it.

For investors, the impact of this shift has multiple layers, and it will be important to assess opportunities though both a macro and a micro lens. Understanding the environment in which companies operate – and whether the geopolitical backdrop is one conducive to that company and industry – is more critical now than ever. Navigating the knock-on effects of cross-border disputes, onshoring, and supply chain adjustments is becoming as important as analyzing the company itself. Our 340+ investment professionals are experts at analysing this kind of change, and we draw on 90 years’ experience of actively positioning investment portfolios on behalf of clients.

Geopolitics will impact all asset classes and we agree with the EIU’s assessment that knock-on effects will include shifts in fiscal spending, a higher cost of capital, elevated yields making bonds attractive, productivity and technological advances, and AI-led developments. Against this shifting backdrop, we seek to provide ongoing differentiated insights to help investors navigate change and think holistically as they position for a brighter investment future.”

Ali Dibadj, Chief Executive Officer

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.