Global markets in 2024: Chain reactions

Facing a softening global economy, investors have the opportunity to maintain market exposure by focusing on quality securities and constructing diversified portfolios, argues Global Head of Multi-Asset Adam Hetts in his 2024 outlook.

6 minute read

Key takeaways:

- With elevated interest rates likely to weigh further on consumption, employment and economic output, investors should consider prioritizing defensive positioning until greater visibility on the future path of the economy emerges.

- Investors have the opportunity to remain invested by focusing on quality stocks of companies capable of generating earnings across the cycle and positioning fixed income allocations to account for bonds’ higher yields and improved diversification potential.

- By staying invested during near-term economic and geopolitical uncertainty, investors can maintain exposure to the compounding opportunities presented by a series of transformative secular themes.

After a surprisingly robust equities market in 2023, we believe the global economy is entering the new year in a worryingly fragile state, and it is our view that defensive positioning is merited. Alongside this immediate concern is the need to capitalize on opportunities derived from what we see as a paradigm shift driven by three secular forces: Geopolitical realignment, transitioning demographics, and the return of the ‘cost of capital’ thanks to higher interest rates.

Fortunately, current market dynamics create sufficient opportunities to remain defensively positioned while also maintaining exposure to long-term compounding opportunities in the secular themes reshaping the global economy. We see risk in keeping cash on the sidelines as history tells us that 1) even at today’s enticing rates, cash significantly underperforms a balanced portfolio from the start of economic weakness through initial recovery, and 2) increasing interest rate risk after central banks begin easing policy tends to be too late.

A likely series of forthcoming stop-and-go economic readings suggests that quality should be prioritized across multi-asset portfolios and informs our current defensive positioning. For stocks, that means exposure to companies capable of consistently growing earnings across the cycle. Within fixed income, investors can again lean into investment-grade bonds for income generation and diversification against equities. Cross-asset diversification takes on elevated importance under such conditions, with alternative strategies uncorrelated to equities and bonds also playing a role.

Chain reactions

When seeking to explain 2023’s buoyant economy, the long and variable lags of monetary tightening are often referenced. So far in this cycle, these lags are proving to be longer and more variable than ever. An explanation partly lies in the resilience of the U.S. consumer – long a growth engine for the global economy. We fear this won’t last, especially with pandemic-era stimulus exhausted and recent consumption increasingly fueled by debt. We expect 2024 to be a year of chain reactions as higher rates and a weakening consumer converge with changes in inflation, employment, growth, and geopolitics.

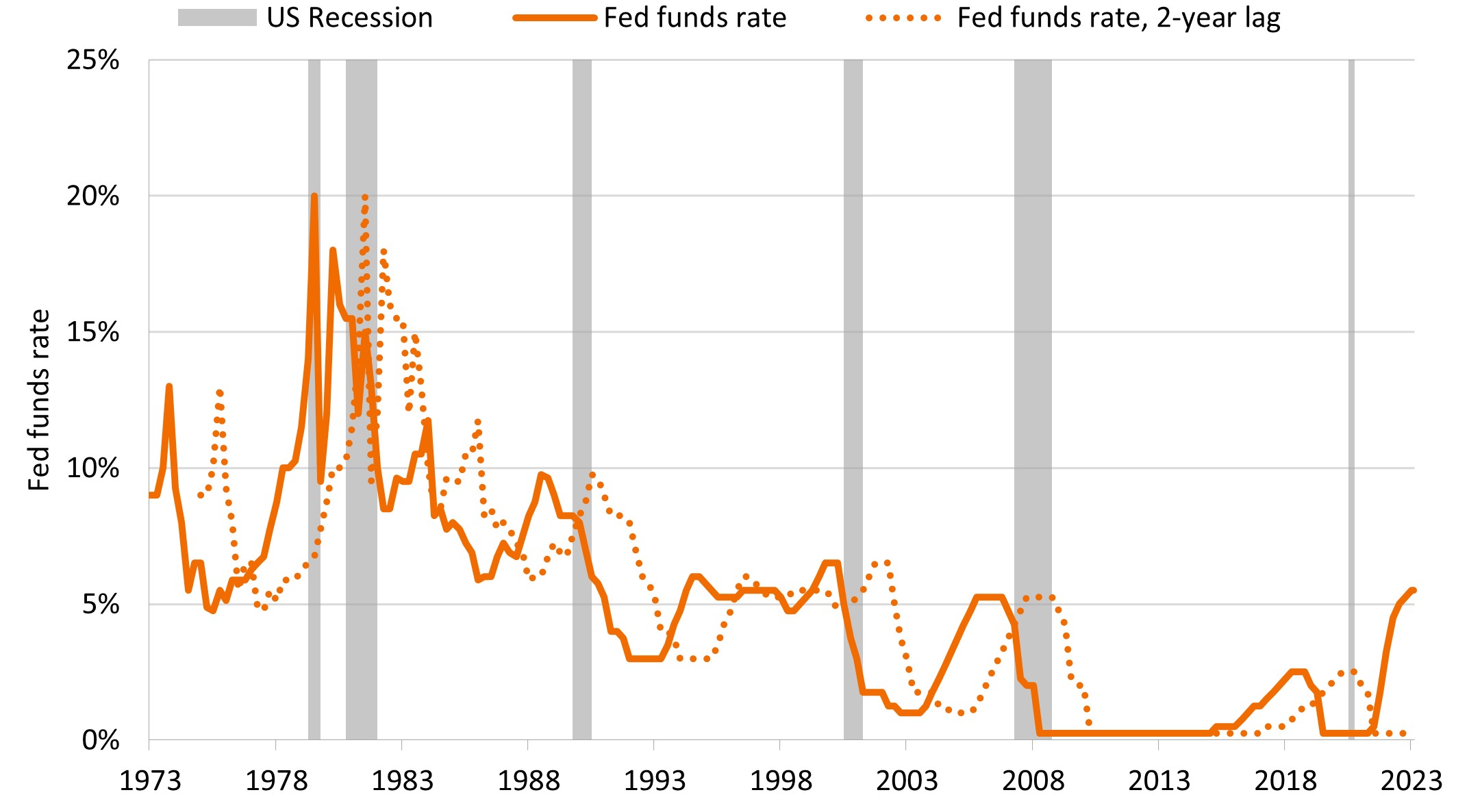

In most cycles around the world, recessions typically lag peak policy rates by a few quarters or even years. Figure 1, for example, demonstrates the link between the fed funds rate and prior recessions. Further clouding the current outlook are the ongoing withdrawal of central bank liquidity, the late-year surge in real interest rates, and a persistently strong U.S. dollar, all of which are augmenting the restrictive effects of rate hikes.

Figure 1: Peak rates approach, but the lagged impact is a big concern

Source: Bloomberg, as of 31 October 2023. In previous cycles a U.S. recession typically followed a peak in the federal funds rate.

Source: Bloomberg, as of 31 October 2023. In previous cycles a U.S. recession typically followed a peak in the federal funds rate.

Equities: Quality companies offer both offense and defense

A unique feature of pandemic-era equity markets is the growth-oriented mega-cap Internet and tech stocks that have led equities higher while simultaneously exhibiting characteristics typically associated with more defensive stocks: steady earnings, stable margins, and strong balance sheets. Exposure to such traits at this stage of the cycle potentially insulates portfolios from earnings downgrades while also positioning them to benefit from the onward march of themes like artificial intelligence (AI) and cloud computing.

Importantly, as the power and efficiencies of innovative technologies are harnessed across sectors, the earnings growth attributable to them will likely become more dispersed throughout the equities universe. Facing a slowing economy in 2024, we anticipate that companies will aggressively adopt these productivity-enhancing innovations in an effort to defend, and in some cases grow, margins.

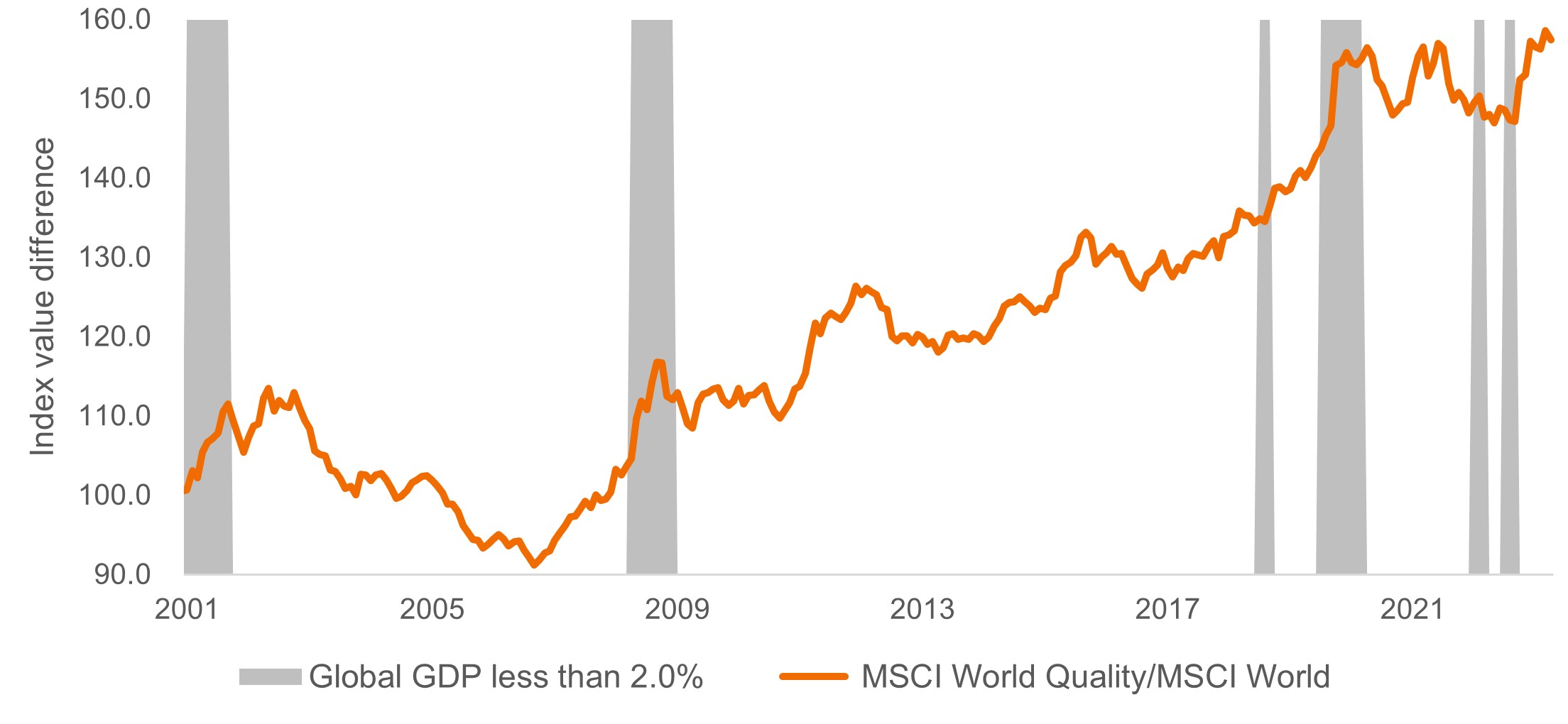

While restrictive monetary policy will undoubtedly continue to weigh on the economy, equities proved resilient in 2023 as companies adapted to defend margins. We expect this to continue. Furthermore, geopolitics, demographics, and a higher-for-longer rate environment create both risks and opportunities for equities. It is not too early for active investors to identify which companies will be on the right side of these trends. As figure 2 shows, ‘quality’ global companies typically outperform the broader market in periods of recession in most countries.

Figure 2: Quality has outperformed the broader global market in recessionary environments

Source: Bloomberg, as of 31 October 2023. Relative performance of the MSCI World Quality Index versus the broader MSCI World Index. Grey bars indicate periods when global GDP growth was less than 2%. Past performance does not predict future returns.

Source: Bloomberg, as of 31 October 2023. Relative performance of the MSCI World Quality Index versus the broader MSCI World Index. Grey bars indicate periods when global GDP growth was less than 2%. Past performance does not predict future returns.

Taking what bonds have to offer

The abrupt ascent of bond yields and commensurate falling prices were far from optimal, but the result is that fixed income can once again serve its traditional role in a balanced portfolio. With policy rates having risen by hundreds of basis points, central banks globally finally have the room to reduce rates should the economy contract.

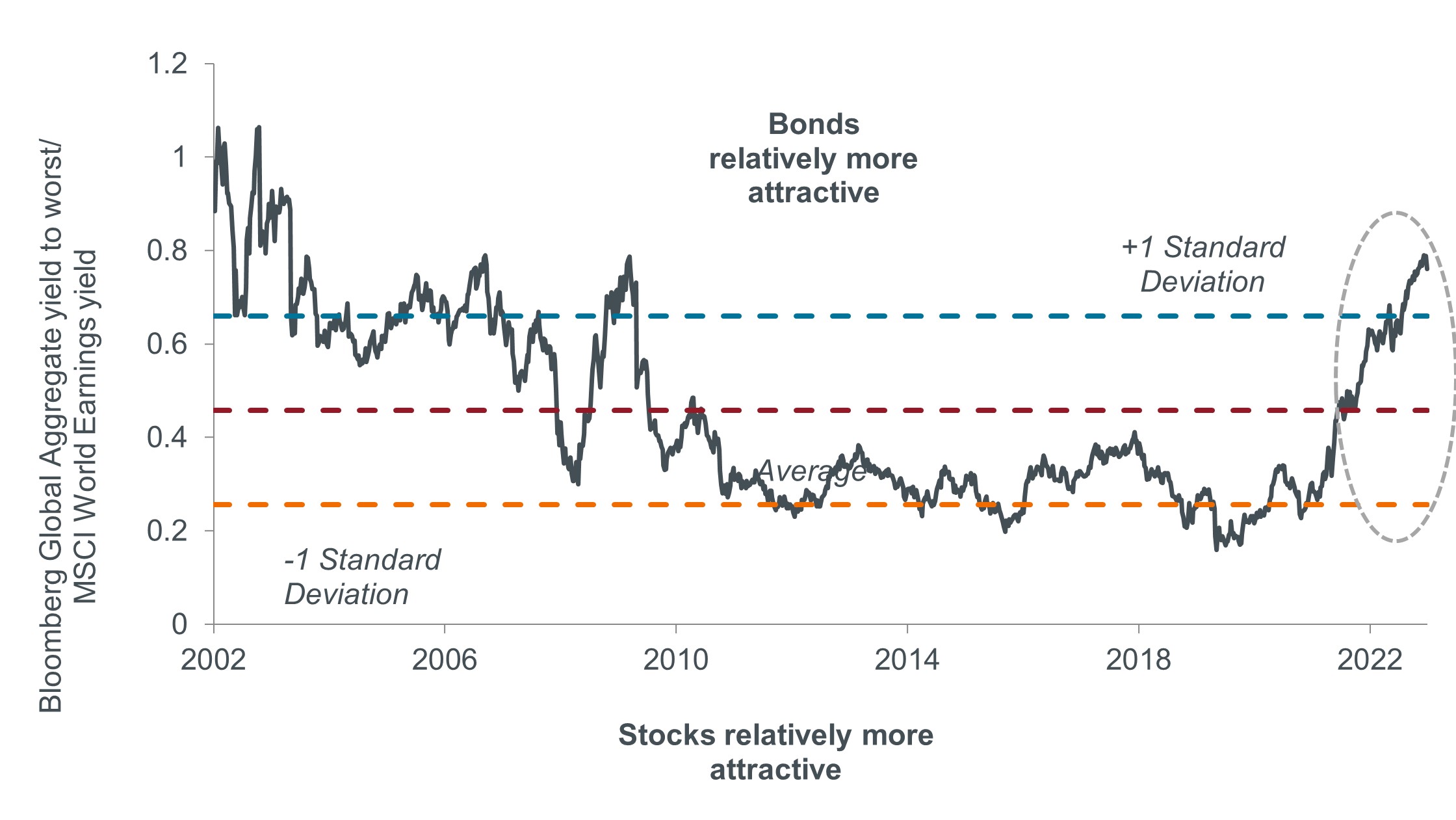

Similarly, with the yield on the 10-year U.S. Treasury well above 4%, bonds could generate capital appreciation to offset a portion of equities’ drawdown in a risk-off scenario (see figure 3). Higher yields in risk-free securities have reduced the incentive to move out of investment-grade sovereign, corporate, and securitized bonds. However, the potential for attractive risk-adjusted returns in less cyclically exposed high-yield segments of the market means that these should also be actively implemented in investors’ portfolios.

Figure 3: Rapidly rising rates have narrowed the gap between bond and equities earnings’ yields

Source: Bloomberg, as of 31 October 2023. Past performance does not predict future returns.

Source: Bloomberg, as of 31 October 2023. Past performance does not predict future returns.

The long game

The cycle matters and should factor into decision making. But we believe the key to investment success is maintaining a five- to ten-year horizon. Through that lens we remain bullish on financial markets. We are finding opportunities across asset classes and believe in the benefits of a diversified portfolio. However, navigating the expected and unexpected chain reactions of 2024 will require deep research capabilities to truly understand their economic impact, identify resulting market dislocations, and help clients move towards a brighter investment future.

Bloomberg Global Aggregate Bond Indexis a broad-based measure of the global investment grade fixed-rate debt markets.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

MSCI World Index℠ reflects the equity market performance of global developed markets.

MSCI World Quality Index℠ is based on MSCI World, its parent index. The index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Tightening policy refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. Easing policy refers to a central bank increasing the supply of money and lowering borrowing costs.

The real interest rate is the rate of interest an investor, saver or lender receives after allowing for inflation.

Basis point (bp): 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

Yield-to-worst: The lowest yield a bond with a special feature (such as a call option) can achieve provided the issuer does not default. When used to describe a portfolio, this statistic represents the weighted average across all the underlying bonds held.

IMPORTANT INFORMATION

Alternative investments include, but are not limited to, commodities, real estate, currencies, hedging strategies, futures, structured products, and other securities intended to be less correlated to the market. They are typically subject to increased risk and are not suitable for all investors.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.