Can liquid alternatives strategies ride a pickup in M&A activity in 2024?

With M&A activity showing signs of a potentially significant revival in 2024, David Elms, Head of Diversified Alternatives, and Julius Bird, Client Portfolio Manager, discuss what this could mean for investors allocating to alternatives.

6 minute read

Key takeaways:

- Ongoing geopolitical uncertainty, increased cost of borrowing, a challenging regulatory environment and a sizeable valuation gap have contributed to the bear market for M&A activity over the past couple of years, leading to a decoupling of M&A activity relative to the rise in risk assets.

- However, we are encouraged by a range of positive indicators for M&A activity, in terms of moderating regulatory pressures, steadier deal spreads and the need for Private Equity and Venture Capital funds to deploy capital.

- The potential increase in M&A activity along with the demand for private equity to divest their assets to generate returns for investors, presents a good opportunity for alternatives, across equity price pressure strategies providing liquidity to help facilitate trades and event-driven strategies that capture pricing inefficiencies around corporate deals.

Since the Global Financial Crisis, the world of mergers and acquisitions (M&A) has been dominated by private equity activity. Following a relatively fallow period, however, private equity and venture capital groups are now sitting on huge cash reserves that they need to invest.

M&A activity – a perfect storm of market factors

The past couple of years has seen challenging financing conditions affecting both the availability and cost of credit to fund M&A activity. We saw the initial impact of this in early 2022, reflected in a lower volume of leveraged buyouts, falling back from the peak we saw in the initial post-COVID period. This was reflected in the broader M&A market, where a sizeable valuation gap (the difference in price between what sellers were willing to accept for their assets, and what buyers were willing to pay), higher rates, regulatory pressures and geopolitical uncertainty contributed to fewer deals reaching completion.

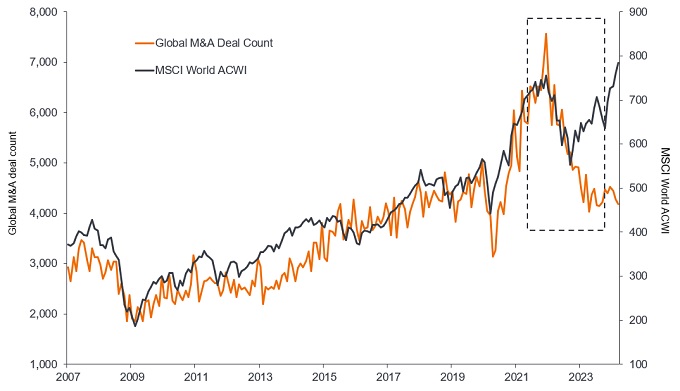

This overall fall in activity persisted throughout 2023 and 2024 and has been reflected in a sizeable decoupling with the rally in public equity markets since 2022 (see Exhibit 1).

Exhibit 1: Global M&A deals versus MSCI AC World Index

Source: Bloomberg Global M&A announced deals, MSCI All Country (AC) World Index, Janus Henderson Investors Analysis, as at 31 March 2024. The MSCI AC World Index captures the share price movements of large and mid-sized companies across a range of markets globally. Past performance does not predict future returns.

What signs are there that the storm has abated?

As we move further into 2024, we are encouraged by a range of positive indicators for M&A activity:

- First, as interest rates plateau across the western world, it should make the financing environment easier to navigate for both those looking for leverage and those providing it. We have seen this reflected in a marked improvement in the total value of transactions in the first quarter of 2024, albeit skewed by a handful of larger deals.

- Second, while regulatory pressure has intensified on perceived ‘anti-competitive’ deals over the past few years, we believe we are at a turning point. This has been a particularly difficult obstacle. For example, in Europe, German regulators blocked the Global Wafers/Siltronic deal, while the Avast/NortonLifeLock deal in the UK was referred to a phase 2 review. However, the US regulator has been most combative (and litigious), with numerous deals blocked in 2022 and 2023. Even in the most benign cases, where a regulator asks for more information, greater uncertainty and the risk of delays can lead to a widening in spreads and a negative mark-to-market.

Encouragingly, the US$69 billion deal between Microsoft and game designer Activision Blizzard, which closed in December 2023[i], could be a landmark decision. The latter agreed to sell its non-streaming rights to French rival Ubisoft Entertainment as a concession to the UK’s Competition and Market Authority (CMA). A US court also decided in favour of Microsoft, thwarting efforts by the Federal Trade Commission (FTC) to block the deal. Following that highly publicised court ruling, we have seen less activity on the regulatory side, which we see as a positive outcome.

- Third, deal spreads have had to adjust to the rising interest rate environment, both to cover expected financing costs, and to compete for investors’ capital from other investment opportunities (such as investment grade or high yield bonds). This has resulted in spreads widening as interest rates rose (Exhibit 2), although this has not been a smooth process. This has increased the size of potential return for investors if a deal completes.

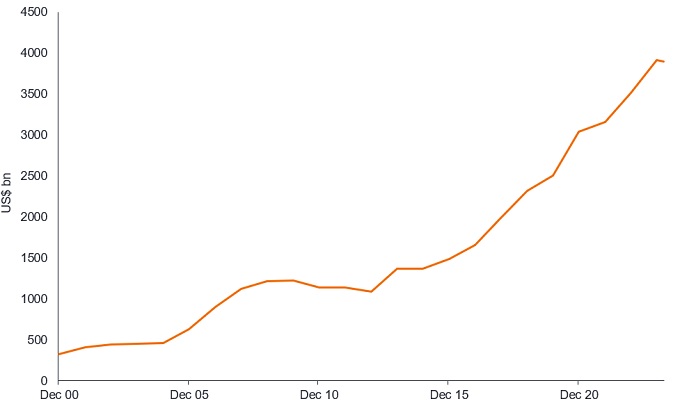

- Finally, private equity and venture capital funds are currently sitting on lots ’dry powder’ that they need to invest (Exhibit 2), which is positive news for M&A activity.

Exhibit 2: Private equity has built up a large cash pile to fund M&A activity

Source: Preqin, Barclays Research, 1 December 2000 to 31 March 2024.

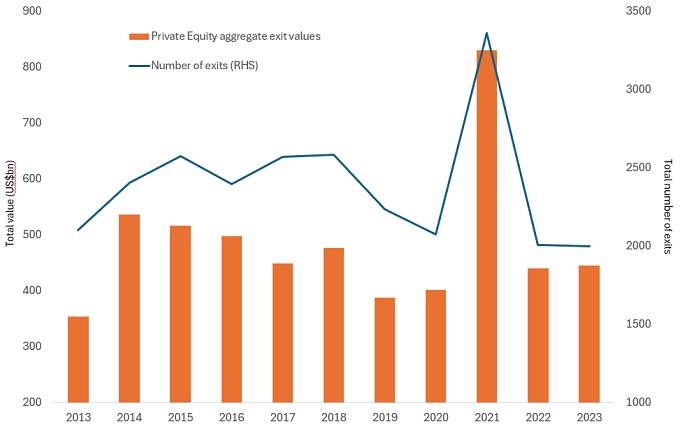

Other contingent beneficiaries of higher M&A activity include equity price pressure strategies that seek to capture pricing inefficiencies around corporate events, such as the downstream divestment process that allows private equity to return money to investors. Private equity funds currently have one of the longest duration profiles on aggregate for their existing holdings, as downward pressure on M&A values has made it more sensible to retain assets, rather than sell them – see Exhibit 3. But private equity firms need to monetise these assets, commonly via public market IPOs or block trades, to realise cash that can be distributed to their investors (and to get paid themselves). A rise in strategic divestments (and industry consolidation) would bode well for activity levels, and attractive deal spreads above the risk-free rate also mean better opportunities to potentially deliver attractive returns.

Exhibit 3: Private equity is sitting on assets it needs to monetise

Source: Preqin, Barclays Research, data as at 31 March 2024. Chart shows the change in both the total value and number of companies being sold by private equity.

—–

Glossary:

Duration: On this occasion, duration is reflective of how long private equity has held its assets without selling.

Risk-free rate: The rate of return of an investment with, theoretically, zero risk. The benchmark for the risk-free rate varies between countries. In the US, for example, the yield on a three-month US Treasury bill (a short-term money market instrument) is often used.

Spread/credit spread: The difference in the yield between two bonds with the same maturity, but different credit quality. It is often used to describe to difference in yield between a corporate bond and an equivalent government bond. Widening spreads generally indicate a deteriorating creditworthiness of corporate borrowers, while narrowing indicate improving.

There is no guarantee that past trends will continue, or forecasts will be realised.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- SPACs are shell companies set up to acquire businesses. They are complex and often lack the transparency of established companies, and therefore present greater risks to investors.