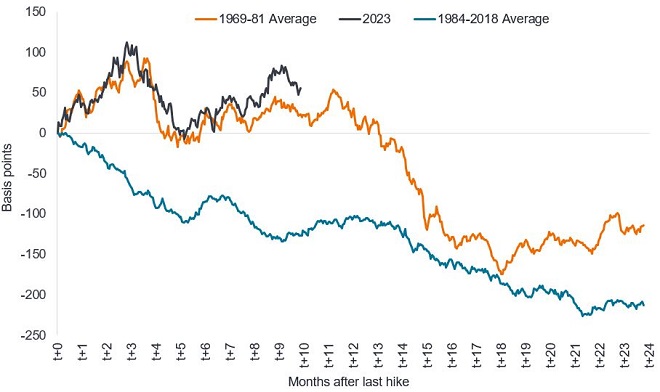

Readers of our insights in recent months will be familiar with Figure 1 below. This plots the change in US 10-year Treasury yield in the months after the US Federal Reserve (Fed) stops hiking interest rates. We observed that yields eventually fell in every case study since the 1960s, regardless of whether the environment was characterised by high inflation (1969-81 period) or low inflation (1984-2018 period). Crucially though, the path to lower yields varied considerably.

Figure 1: Change in US 10-year Treasury yield after last rate hike

Source: Bloomberg, Janus Henderson calculations, as at 17 May 2024. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

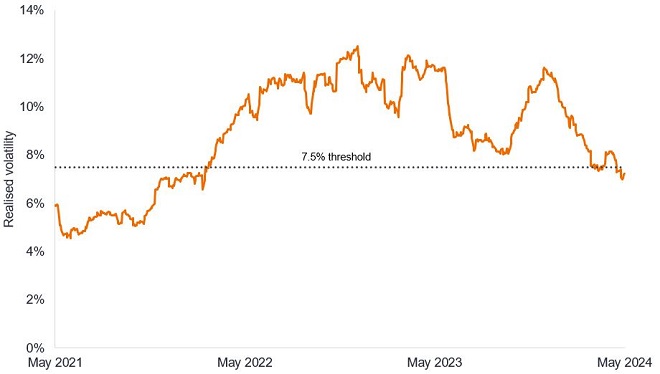

Since the Fed last raised rates in July 2023 the path of the US 10-year Treasury yield has tended to track the average of the 1970s (orange line) in an uncanny manner. Looking closely at the bond market in this period we observed that a necessary condition for a sustained bond market rally was a sustained fall in realised bond market volatility, something which appears to be beginning in the US and has already been achieved on a sustained basis in other markets.

Volatility threshold crossed

Stepping back, a hallmark of the recent three-year bear market in bonds is that it has seen a return to a previous volatility regime whereby higher bond volatility was correlated to rising bond yields, similar to the behaviour of bonds from 1960-2000. In contrast, from 2000 to 2020, higher bond volatility often coincided with a fall in yields (e.g. 2008, March 2020). Volatility regimes tend to persist, either because they are associated with a change in the economic risk or policy backdrop or because of adaptive expectations (where markets tend to form expectations about the future based on what happened in the near past).

Studying the history of the US bond market (1960-2000) in this previous volatility regime, a break back below a given level of volatility was a necessary condition to get a sustainable rally in bonds. That key threshold was a 3-month realised volatility of 7.5% which equates to a daily yield change of 4.7 basis points (bps). We studied realised volatility for the simple reason that implied volatility data for bond markets only stretches back to the late 1980s.

Since early May (coinciding with Fed Chairman Jerome Powell reiterating no more rate hikes, weaker employment data and the first below expectation inflation print this year), the US bond market is beginning to follow the European bond market below this volatility threshold, an encouraging sign. Although this move is nascent and needs to be sustained, it is notable as it suggests that the scars of the recent bond bear market are beginning to heal.

Figure 2: Realised volatility on US 10-year Treasuries

Source: Bloomberg, 3-month realised volatility on US 10-year Treasury, 17 May 2021 to 17 May 2024.

Realised versus implied volatility – the essentials

Volatility measures the movement in price of a security over a specific period. Realised volatility measures actual historical volatility of a security. Mathematically, it compares how far a price deviates from its average value, up or down, in a specified period. The higher the value, the higher the volatility. Implied volatility is calculated from option prices to provide an expectation about future volatility. It is forward-looking and can be thought of as reflecting traders’ best estimates of what future realised volatility will be. Implied volatility rises when markets are more uncertain.

Path of bond yields

So what happens to bond yields when we cross into this lower volatility regime? In Figure 3 we have plotted the average path yields have taken historically once the 7.5% volatility threshold is crossed.

Figure 3: Average historical path of US 10-year Treasury yields after realised volatility crosses below 7.5%

Source: Bloomberg, US 10-year Treasury yield. Average path of seven periods starting in 1970, 1975, 1989, 1990, 1994, 1997 and 2000 where volatility had initially been above 7.5% (and coincident with rising yields) and subsequently moved below 7.5%. Past performance does not predict future returns.

Looking at previous cycles back to the 1960s, there are two key implications for bond yields:

- Yields do not move lower immediately; they typically range trade modestly for the first one to two months. During this time, it is crucial that realised volatility does not pick up again as there was one such false signal (in 1984) where realised volatility and yields began to rise after 24 trading days.

- Thereafter you enter the heart of the bond rally. Three months after the initial cross, yields are 20 basis points (bps) lower on average, six months after yields are lower by 90bps on average, seven months after yields are lower by 120bps on average, and one year out they are 100bps lower.

Individual cases

In five of the seven examples, yields begin to fall within two months of the condition being met. However, in 1997 it took 3.5 months and in 1990 it took 4.5 months and yields went higher by 50bps initially. The 1990 example is somewhat complicated by its unusual backdrop: rate cuts had already begun and hence 10-year Treasury yields were already declining substantially.

Bond market healing

We view the decline in US bond market volatility as an encouraging sign that the market is engaging in a healing process that makes bonds more investable. Lower uncertainty (growing confidence in the end of the tightening cycle) is contributing to lower volatility. As mentioned, other developed markets are further ahead in this process as rate cuts have either started (Switzerland, Sweden) or are expected in the coming months (Eurozone, UK, Canada).

We cannot rule out a surprise in economic data that causes a resurgence of volatility. This could negate current central bank guidance that it is a question of when, not if, it is time to cut interest rates. On balance, however, we believe the monetary and economic landscape is shaping up for a downward move in rates globally, which should encourage investors to lock in yields in fixed income.

Basis point. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%.

Bear market/Bull market: A bear market A bear market is one in which the prices of securities are falling in a prolonged or significant manner. A bull market is one in which the prices of securities are rising, especially over a long time.

Inflation: The rate at which prices of goods and services are rising in the economy.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Option: A financial derivative that give buyers the right, but not the obligation, to buy or sell an underlying asset at an agreed-upon price and date.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the coupon payment divided by the current bond price.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. The investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the U.S. government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Volatility measures risk using the dispersion of returns for a given investment. The rate and extent at which the price of a portfolio, security or index moves up and down.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

There is no guarantee that past trends will continue, or forecasts will be realised.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- When interest rates rise (or fall), the prices of different bonds will be affected differently. In particular, bond prices generally fall when interest rates rise or are expected to rise. This is especially true for bonds with a higher sensitivity to interest rate changes. A material portion of the fund may be invested in such bonds (or bond derivatives), so rising interest rates may have a negative impact on fund returns.