Biotech sector update: Going for gold

Portfolio Managers Andy Acker and Dan Lyons explain why they think the biotechnology sector could be set up for stronger performance in the quarters to come.

5 minute read

Key takeaways:

- The delay in Federal Reserve rate cuts contributed to the muted performance of biotechnology stock indices during the first half of 2024.

- But with U.S. inflation now trending lower, investor enthusiasm for the sector is beginning to return, as evidenced by strong demand for biotech equity issuance and recent stock performance.

- In our view, interest rate cuts, combined with attractive valuations and accelerating innovation, could help set up the sector for outperformance.

Biotechnology stocks have gotten off to a slow start in 2024, with the S&P Biotechnology Select Industry Index returning just under 4% over the first six months compared to 15% for the S&P 500® Index.1

But like an Olympian who underwhelms in the semifinals — only to seemingly come from nowhere to take home gold — the sector could be poised for much stronger performance in the quarters ahead.

The rate cut tailwind

One point of momentum is rate cuts. In late 2023, biotechnology stocks surged as investors bet the Federal Reserve (Fed) would start to trim rates in early 2024. That enthusiasm waned when higher-than-expected inflation prints in the early months of the year caused the Fed to delay.

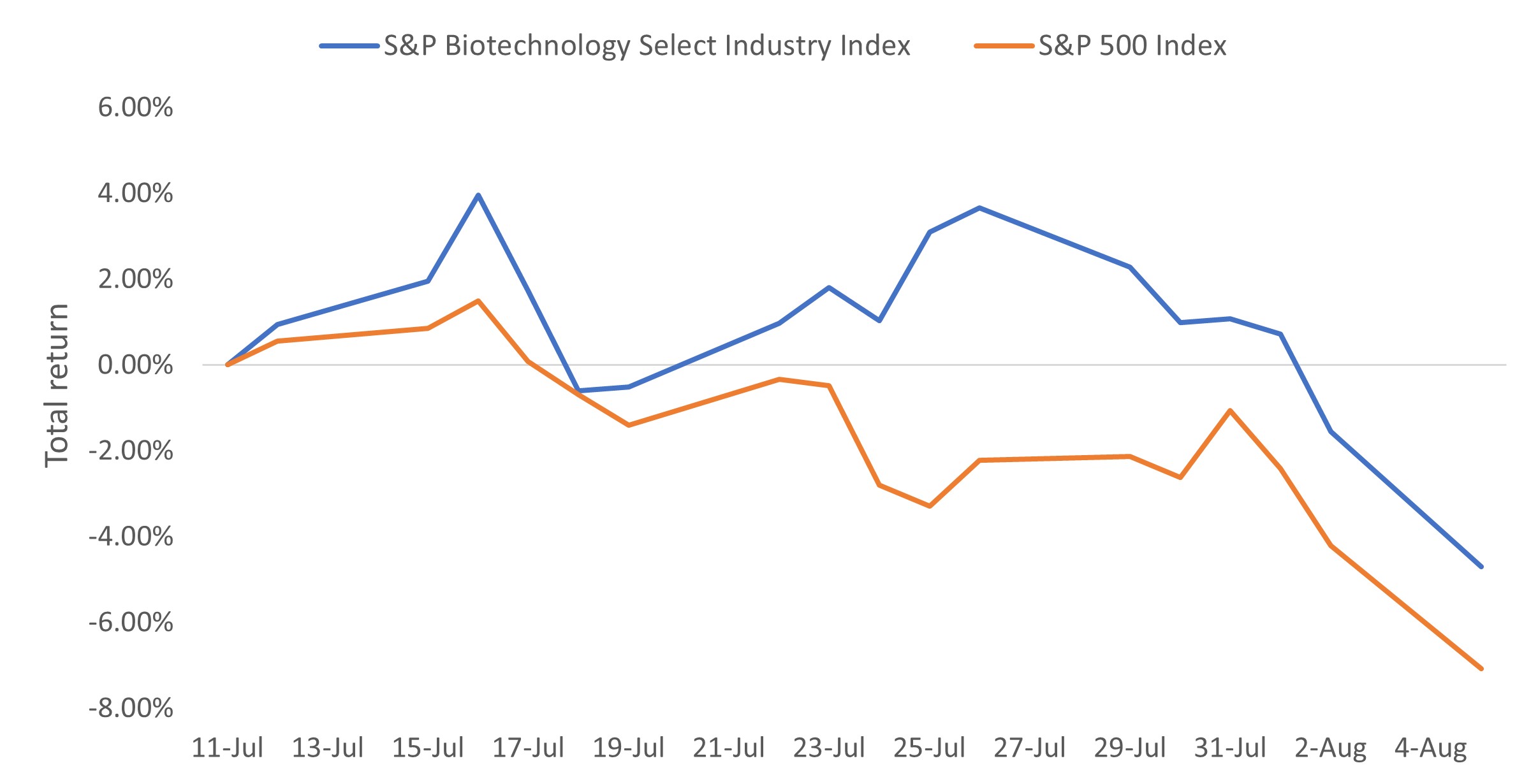

But with inflation now trending consistently lower and the prospect of a Fed rate cut in September growing, optimism could be returning. In fact, since July 11, when the U.S. Consumer Price Index fell to an annual rate of 3% for the first time in a year, the S&P Biotech index has outperformed the broader equity market (Exhibit 1).

Exhibit 1: An improving inflation outlook has helped biotech to outperform

Source: Bloomberg. From 11 July 2024 to 5 August 2024. The S&P Biotechnology Select Industry Index represents the biotechnology sub-industry portion of the S&P Total Market Index. The S&P Total Market Index is designed to track the broad U.S. equity market, including large-, mid-, small-, and micro-cap stocks.

Source: Bloomberg. From 11 July 2024 to 5 August 2024. The S&P Biotechnology Select Industry Index represents the biotechnology sub-industry portion of the S&P Total Market Index. The S&P Total Market Index is designed to track the broad U.S. equity market, including large-, mid-, small-, and micro-cap stocks.

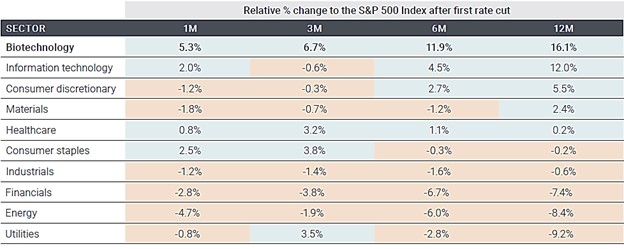

This divergence in returns has precedence. According to analysis done by Redburn Atlantic, in seven of the last eight rate-cutting cycles, the biotech sector has delivered gains both one month and six months after the first rate drop. After 12 months, the sector has outperformed the S&P 500 by an average of 16% (Exhibit 2).

Exhibit 2: Historically, biotech has delivered positive returns during rate-cutting cycles

Source: Redburn Atlantic. Data based on sectors in the S&P 1500® Index. The S&P Composite 1500® combines three leading indices, the S&P 500®, the S&P MidCap 400®, and the S&P SmallCap 600®, to cover approximately 90% of U.S. market capitalization. It is designed for investors seeking to replicate the performance of the U.S. equity market or benchmark against a representative universe of tradable stocks. Data from 1995.

An attractive starting point

Low valuations help support the case for positive returns. Biotechnology valuations have been depressed as a result of a three-year pullback that ended in late 2023. As such, as of mid-July, nearly 130 biotech companies had a negative enterprise value — meaning companies were priced as though any research and development (R&D) would only detract from a firm’s value, not add to it. While that figure is down from a peak of 232 last year, it is still well above pre-downturn levels.2

With a low starting point and investor enthusiasm growing, we think biotech stocks have ample room to run. In the second quarter, the average biotech stock returned 44% following a positive news event, up from 31% during the same quarter the year before. In addition, losses have been more tempered, with the average stock losing only -37% following negative updates.3

Accelerating innovation

We expect no shortage of potential catalysts for biotech companies in the months ahead. In the first half of 2024, the Food and Drug Administration approved more than two dozen new drugs, including Imdelltra, a targeted bispecific T-cell engager (TCE) from Amgen for patients with an advanced form of small cell lung cancer. (TCEs are a new type of immunotherapy showing early promise against solid tumors.) Another 41 drugs are expected to be reviewed by the end of the year, including for cancer, schizophrenia, and liver disease, and some could have blockbuster potential (annual sales of $1 billion or more).4

This innovation — much of it driven by the sector’s small- and mid-cap companies — is helping fuel a wave of mergers and acquisitions (M&A). During the first half of 2024, 21 transactions were announced, outpacing or equaling total deals done in seven of the last nine years.5 While much of the activity has been concentrated in so-called bolt-on acquisitions (deals valued at between $0.5 billion and $2 billion), that could change once the U.S. election and its regulatory impacts become clearer later this year.

In the meantime, companies are finding it easier to raise capital to fund R&D. Indeed, the first half of 2024 was one of the busiest six-month periods on record for equity offerings in biotech, with over $28 billion raised during the period (Exhibit 3).

Exhibit 3: Biotech equity issuance

Source: Leerink, Dealogic. Data from 1 January 2017 to 30 June 2024. PIPE=Private investment in public equity. A PIPE refers to any private placement of securities of an already-public company in which investors commit to purchase a certain number of restricted shares from a company at a specified price.

Source: Leerink, Dealogic. Data from 1 January 2017 to 30 June 2024. PIPE=Private investment in public equity. A PIPE refers to any private placement of securities of an already-public company in which investors commit to purchase a certain number of restricted shares from a company at a specified price.

In our view, these trends indicate demand for biotech’s innovation is alive and well. We also think they suggest it’s only a matter of time — and a few macro factors such as rate cuts and the U.S. election getting sorted out — before biotech could once again come out on top.

1 Bloomberg, from 31 December 2023 to 30 June 2024.

2 CapitalIQ, Stifel. As of 12 July 2024.

3 Jefferies, as of 30 June 2024.

4 Food and Drug Administration, as of 16 July 2024.

5 Oppenheimer, CapitalIQ, and company filings. As of 30 June 2024.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.