ABOUT THIS FUND

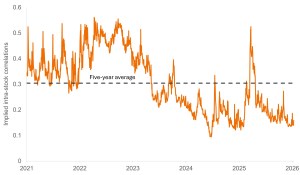

U.S. large-cap equity portfolio that seeks to deliver more attractive returns with lower absolute volatility than the Index over a market cycle. Our systematic investment process utilizes forward-looking signals from options markets designed to identify individual stocks with less downside volatility that appear poised for greater growth or upside volatility.

WHY INVEST IN THIS FUND

- Attractive: This diversified, U.S. large-cap portfolio targets more attractive returns with lower absolute volatility over a market cycle.

- Objective: Our systematic investment process uses forward-looking signals from highly liquid options markets designed to identify individual stocks with less downside volatility that appear poised for greater growth or upside volatility.

- Adaptive: Changes in the market-implied forecasts of good risk versus bad risk will trigger rebalancing while maintaining diversification in an effort to provide more consistent returns over time.

Knowledge Shared

At Janus Henderson, we believe in the sharing of expert insight for better investment and business decisions. We call this ethos Knowledge Shared.