Active Fixed Income ETFS

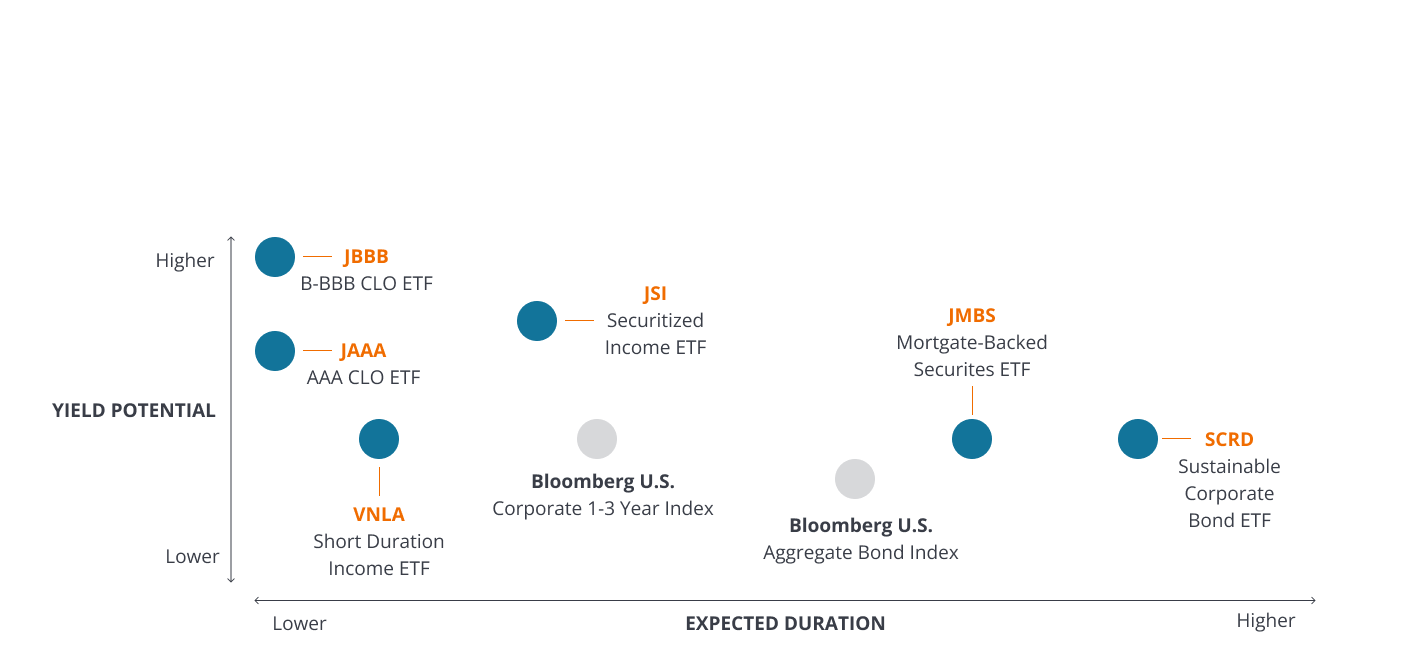

In a market flooded with fixed income exchange-traded Funds (ETFs), we prioritize your needs by providing specialized, actively managed ETFs. You gain access to our extensive investment expertise and our platform is renowned for its remarkable growth and leadership, all designed with your financial success in mind.

Discover how our expertise can propel your success

1st

top growing fixed income ETF provider for taxable bond ETFs

Source: Morningstar

4th

largest active fixed income ETF provider

Source: Bloomberg

11th

overall active ETF provider in the in the U.S.

Source: Bloomberg

as of March 31, 2024

Leverage our ETF specialists

With a deep understanding of exchange-traded funds, our ETF Client Product Specialists can provide strategic guidance on implementation and portfolio construction.

Dan Aronson

Sr. Director, ETP Client Product Specialist

dan.aronson@janushenderson.com

Craig Dehner

Director, ETP Client Product Specialist

craig.dehner@janushenderson.com

Lee Gross

Director, ETP Client Product Specialist

lee.gross@janushenderson.com