SECURE 2.0’s Roth catch-up mandate is here, and it will change the way many plan participants save for retirement.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Three tax-related provisions of the bill that will affect many advisors’ high-income and high-net-worth clients.

Many students starting college will also reach another milestone: Turning 18. Here are the legal documents families should draft to help children prepare for adulthood.

How upstream gifting may be used to reduce the tax implications of selling a concentrated stock holding.

An overview of House Republicans’ extensive draft provisions to Trump’s tax bill.

How retirees and pre-retirees can take full advantage of the resources available on the Social Security Administration’s website.

A summary of the IRS's annual “Dirty Dozen” list of common tax scams and tips on how to identify and avoid them.

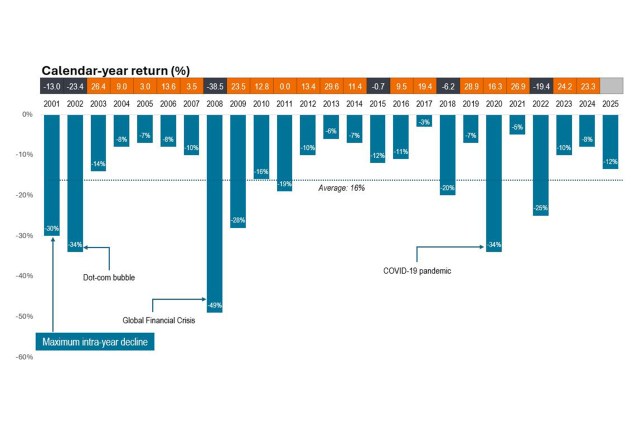

Intra-year stock market declines have historically rarely translated to the market being down for the entire year.

Timeless teachings from Greek Stoic philosopher Epictetus that may help investors navigate market volatility and uncertainty.

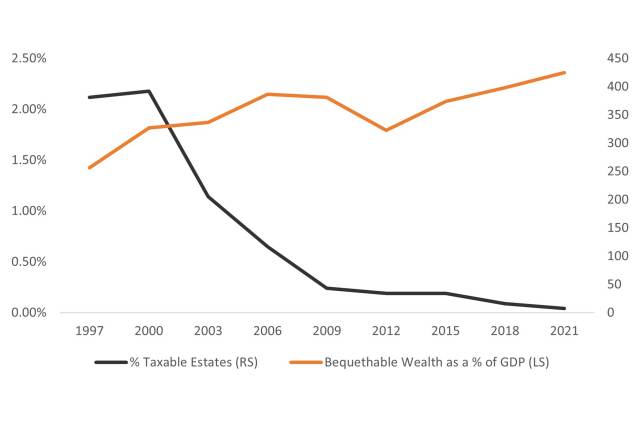

While the wealth that may be passed on to the next generation continues to grow, the number of estates that pay the federal estate tax has plummeted.