Subscribe

Sign up for timely perspectives delivered to your inbox.

Global Head of Multi-Asset Adam Hetts argues that investors should balance the opportunities presented by the extension of the economic cycle with the risks posed by policy uncertainty and elevated valuations when calibrating portfolio allocations in 2025.

This past year was marked by consequential elections across major democracies and the global economy continuing to adjust to a higher interest rate regime than it had experienced for much of the past 15 years. The ramifications of these developments will be felt well into 2025.

Also extending its influence is a resilient economic cycle. While a robust U.S. economy defied expectations as the Fed battled inflation, economic growth must now balance optimism around rate cuts with downside risks if the anticipated cuts don’t fully materialize. To be determined is the degree to which a change in policy by the incoming U.S. administration could impact domestic and global growth. Another potential tailwind for the global economy is more aggressive stimulus in China.

While many of these developments will be welcomed by investors, the global economy remains late cycle, and any incremental risk taking should be approached with caution. Narrowing the tolerance for error is the surge in riskier assets’ valuations in the wake of the U.S. election. As global monetary policy diverges and economic broadening impacts sectors in varying degrees, investors should seek to balance a security’s ability to benefit from the cycle’s extension with its valuation.

The U.S. economy’s streak of outperforming other advanced countries looks set to continue now that the Fed has begun to lower the cost of capital. This is not, however, the full-throated risk-on environment typically associated with the advent of a new cycle. Employment has proven durable, but the trend – notwithstanding the temporary effects of recent storms – has been downward. Rising consumer delinquencies represent another area of concern.

We remain neutral on Europe, despite signs of steadying consumption. The region’s central banks were earlier than the Fed in lowering rates, but that was due to necessity. China, on the other hand, could break out of an extended stupor now that the central government has initiated more action to address structural issues. Furthermore, the country’s equity valuations do not reflect what we view as an improving earnings backdrop.

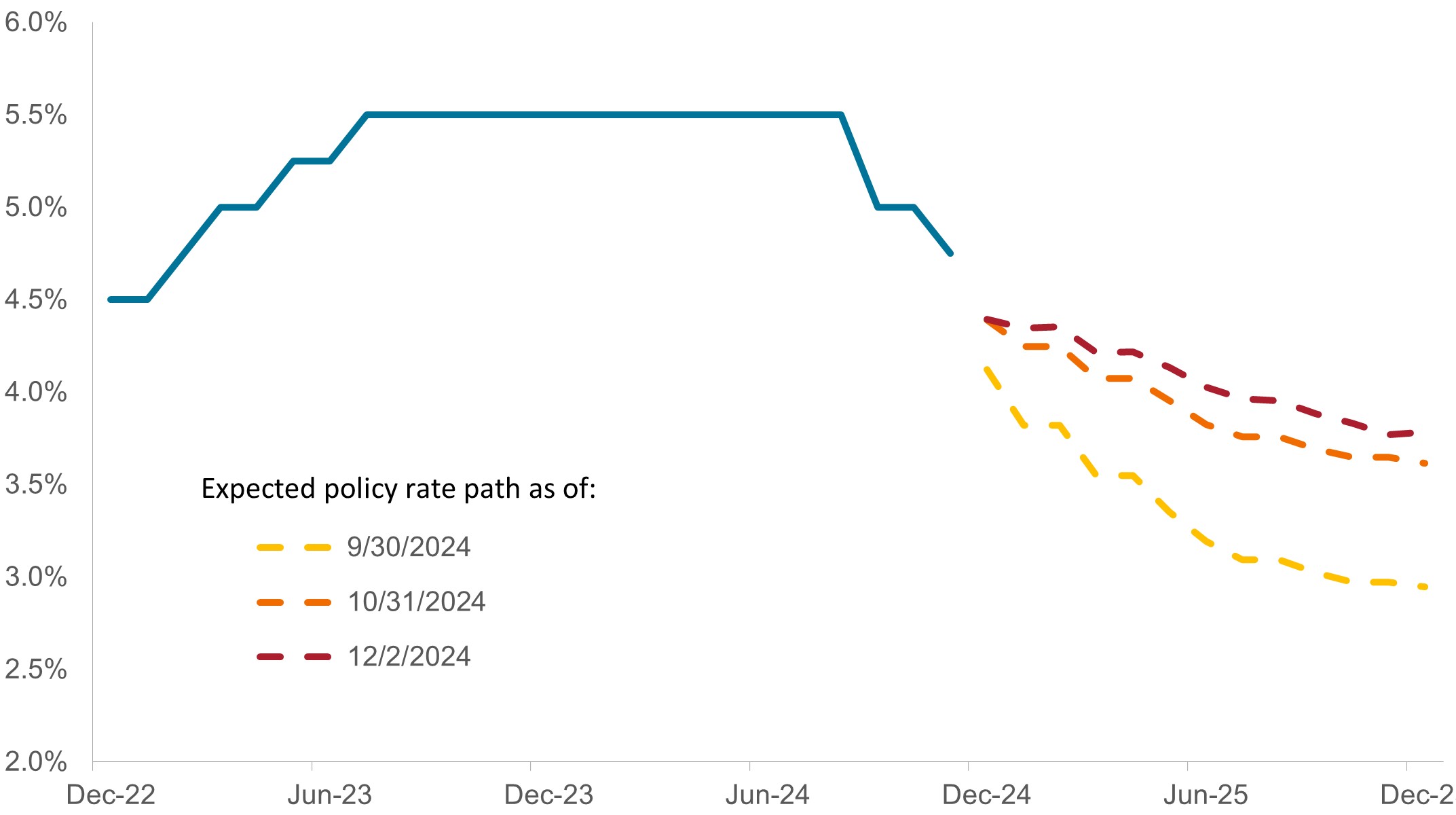

While forward-looking markets’ upwardly revised expectations for the federal funds rate can be viewed as a vote of confidence in the extension of the economic cycle, it also means borrowing costs likely won’t dip to previously anticipated levels.

Source: Bloomberg, Janus Henderson Investors, as at 15 November 2024.

Any shift in U.S. economic policy will undoubtedly reverberate through the corporate sector and financial markets. Deregulatory, corporate tax, and other pro-growth aspects of the incoming administration’s agenda would be favorable for riskier assets. However, tariffs, other policy initiatives or staffing decisions may present risks to growth.

Financials and energy have been highlighted as two sectors that could benefit from more relaxed oversight. The outlook for the tech sector is more nuanced as questions loom over the size and scope of industry behemoths and the protections afforded to social media platforms. Multiple sectors could benefit from a more favorable mergers and acquisitions climate.

Roadblocks to the efficient flow of goods and capital tend to be inflationary, and deterioration of the U.S. fiscal position could spur inflation and put upward pressure on longer-dated interest rates. Pro-growth initiatives would pay off if the rate of economic expansion exceeded the cost of capital but that bar would likely be raised should trade and fiscal policy send interest rates higher.

Although an extension of the cycle should be conducive for riskier assets, we believe that for equities, a modest rotation within the asset class is preferable to increasing overall equities exposure at the expense of core fixed income. Rate cuts stand to benefit small-cap companies that tend to carry more debt. Since they are less dependent on borrowing costs, midcaps don’t necessarily need lower rates to enjoy the tailwinds of economic expansion. The extension of the 2018 tax reform would likely support earnings across the corporate sector.

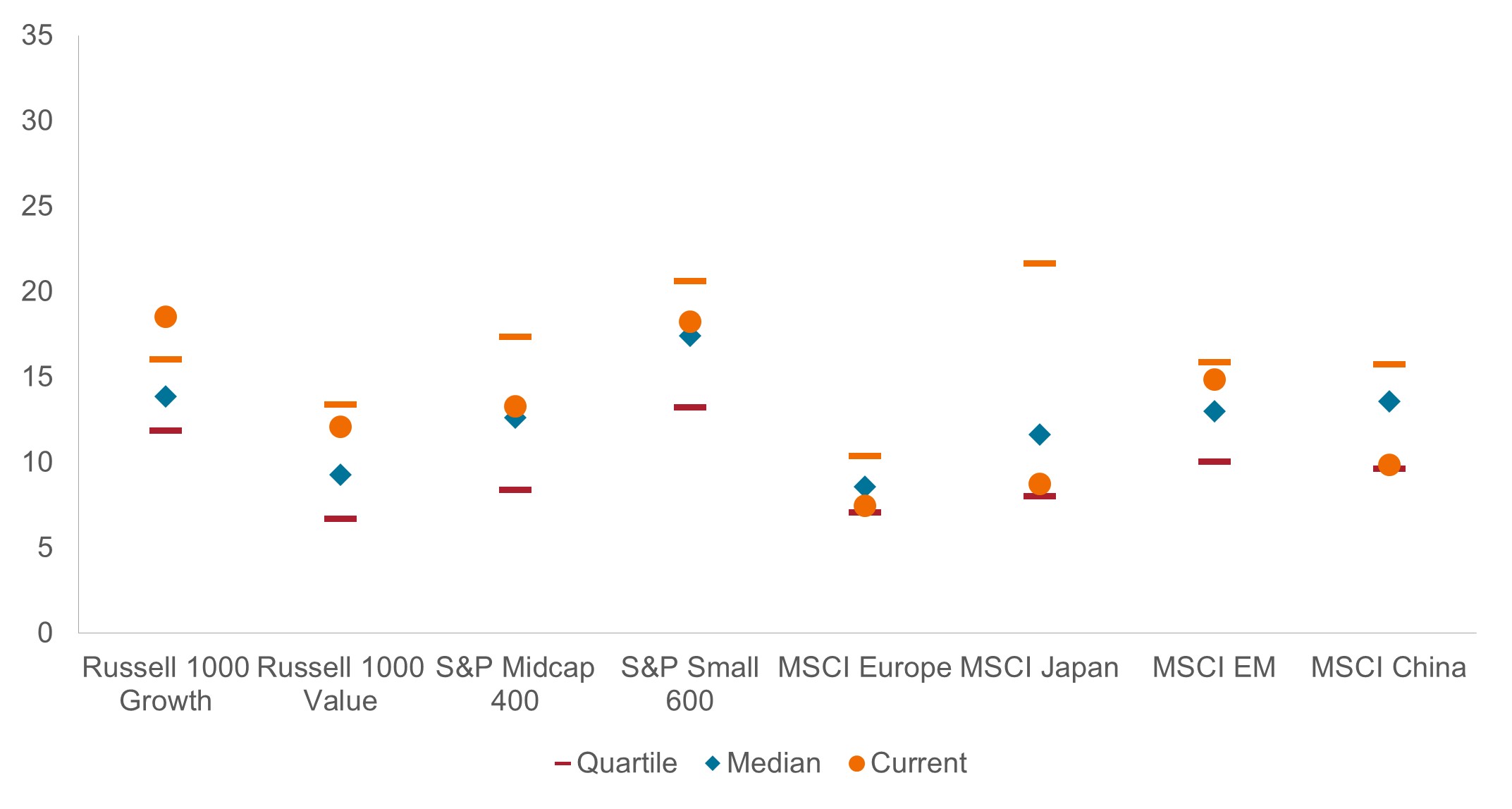

Valuations are elevated, with most equity segments’ price-to-earnings ratios residing in the top quartile of their long-term average. Despite the possibility of broadening economic growth, value stocks are one of the few categories where earnings estimates still have meaningful potential to grow into their valuations. And although broader participation in the equities rally is a welcome development, investors should not lose sight of the Magnificent 7’s continuing ability to beat expectations and justify their persistently high valuations.

Although U.S. earnings estimates are above long-term averages – as are price-to-earnings multiples in most markets – more modest expectations for ex-U.S. stocks indicate that earnings may have potential to grow into their valuations.

Source: Bloomberg, Janus Henderson Investors, as at 15 November 2024.

An already tenuous situation for European stocks could worsen should deglobalization accelerate. Still, consumption within the region indicates green shoots, and Chinese stimulus could cast a lifeline to Europe’s capital goods and luxury products exporters. In Japan, any consumption-related benefit from an appreciating yen could be tempered by headwinds for its sizeable export sector.

The price of fighting inflation was steep for bond investors. But with most of that battle behind us, the new – higher – range of bond yields globally has left the asset class in a better position to deliver steady income, diversification to riskier assets and, in certain jurisdictions, the potential for capital appreciation.

In the U.S., the Treasuries yield curve reset to higher levels and steepened in the wake of November’s election. Should the market’s forecast of notably fewer rate cuts prove correct, shorter-date bonds will have lost a promising tailwind. In only a few weeks, the anticipated terminal rate for this cycle has reset to a materially higher range of 3.5% to 4.0%. Although having already sold off, longer-dated bond yields could face additional pressure if economic growth further surprises to the upside or trade policies and robust wages prove inflationary.

Corporate credits are richly valued, with the difference between their yields and those of their risk-free benchmarks the tightest since 1997. A candidate for incremental allocation in this space would likely be higher-quality, high-yield issuers, as this category provides more carry, a larger yield cushion, and stands to benefit from lower borrowing costs. Corporate defaults trending lower indicates that issuers have withstood the most intense period of restrictive financial conditions. At current spreads, the interest rate sensitivity of investment-grade credits in a still-volatile Treasuries market cannot be ignored. Securitized credits, by contrast, appear more fairly valued and stand to benefit from rising values of their underlying assets.

Fed rate cuts and a resilient corporate sector have left bond valuations elevated, but within the space, high-yield issuance has the potential to provide additional carry and less sensitivity to moves in a still-volatile rates market.

Source: Bloomberg, Janus Henderson Investors, as at 15 November 2024.

Outside the U.S., diverging economic fortunes and monetary policy create opportunities. Europe, for example, likely has little choice but to continue its accommodative course. Higher U.S. rates and the accompanying dollar strength, however, would present a challenge for emerging market issuers dependent upon financing in the U.S. currency.

Carry is the excess income earned from holding a higher yielding security relative to another.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Excess Return indicates the extent to which an investment out- or underperformed an index.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.