Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Nick Schommer explores the transformation taking place in energy as utilities invest for the future.

The transformation of energy production, distribution and consumption has begun, with electricity – now increasingly generated by renewable sources – expected to transplant fossil fuels as the world’s primary energy supply within the next two decades. In our view, the resulting impact to companies that make up the energy complex will be broad based and significant, perhaps none more so than utilities.

Traditionally a slow-growing but low-risk corner of the market, utilities stand to play a vital role in the electrification of the global economy. As such, a decades-long investment cycle is now underway that could make utilities more efficient and secure, benefit consumers and eventually drive faster earnings growth for the sector.

Utilities are beginning a capital investment cycle that will be measured in decades, not years, as electricity becomes the world’s primary energy currency. A long runway of capital expenditure should allow utilities to grow their rate bases, a measure of assets that determines potential revenue. The capital investment cycle will focus on both the improvement and extension of electrical grids, including a shift toward more renewable energy generation. Ageing infrastructure is being upgraded for safety and security, and grids are being ‘hardened’ to reduce the impact of storms and natural disasters.

Technology will play an important role in utilities’ operating efficiency as well as the physical buildout. Digital applications should drive down operating and maintenance (O&M) costs by improving energy management and production forecasts, optimising supply chains and workforce productivity and enabling predictive grid maintenance, among other things. Technology can similarly aid in the efficient design and construction of new grids and generation plants. Utilities are also employing security technology to protect their ecosystems from cyberattack. Companies able to leverage technology should stand to benefit from cost savings and improved reliability and quality of their networks.

The added benefit of capital investment is that it is expected to be a win-win for both utility companies and consumers. As technology creates efficiencies, utilities’ O&M costs should decline, while devices like smart thermostats and energy-efficient appliances help limit consumer costs. In the US, recent tax reform should further benefit consumers’ wallets, as utilities have been mandated to pass any tax savings along to customers. The result should be that utilities enjoy rate base and earnings growth while US consumers see their monthly electric bills grow at a rate below inflation. In the case of regulated utilities, this affordability is a key factor, as regulators cap the rate of return that utilities can earn and, thus, limit the costs that can be passed on to consumers.

Utilities have long served their purpose as defensive, dividend-paying investments in portfolios. The companies benefit from consistent demand, and they tend to be less economically sensitive than other sectors of the economy. Considering new capital investment going forward, which can lead to rate base increases, we think utilities should be able to generate solid earnings growth along with consistent dividend yield to produce an attractive total return. In addition, a sustained low interest-rate environment has been a tailwind as it reduces utilities’ cost of capital. Taken together, we believe these factors make the sector better positioned than many consumer staples companies, which suffer from high margins and brand value erosion, or even healthcare, which is caught in the crosshairs of political and regulatory risk.

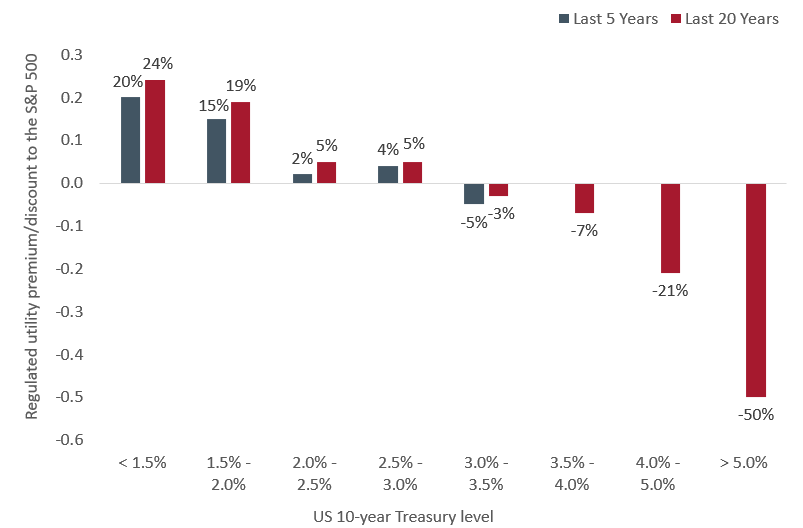

Source: Chart shows the Utility price to earnings (PE) valuation premium/discount to the S&P 500 in different US Treasury 10-year yield environments. Goldman Sachs Global Investment Research, as at 18 October 2019. Price-to-Earnings (PE) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio. Past performance is not a guide to future performance.

While we think the investment environment will remain supportive for the sector, it is also important to look at the fundamentals of individual companies that may benefit. Utilities have had a strong run in recent years, profiting from low capital costs and increased investor demand in a low-rate environment. On both a relative and absolute valuation basis, utilities are trading at elevated levels relative to historical averages. However, if the current low-rate environment persists or rates move lower, valuations will look more attractive.

As seen in the chart above, utilities’ valuations, based on price to earnings, have traded at a premium to the broader equity market in low-rate environments. Conversely, as interest rates rise, utilities tend to trade at a multiple discount to the market. We also believe that some of the rerating in the sector is a result of higher expected growth going forward.

Clearly, it will be imperative to focus on appropriate valuations when considering investments within the space. Management execution will be crucial for growth initiatives and to keep O&M costs down to pass through rate base increases to consumers. Management teams will also have to navigate the complex regulatory framework that many utilities face. Thus, we believe an active approach to investing in the sector with a focus on management execution, valuation and the ability to generate free cash flow, is essential.

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.