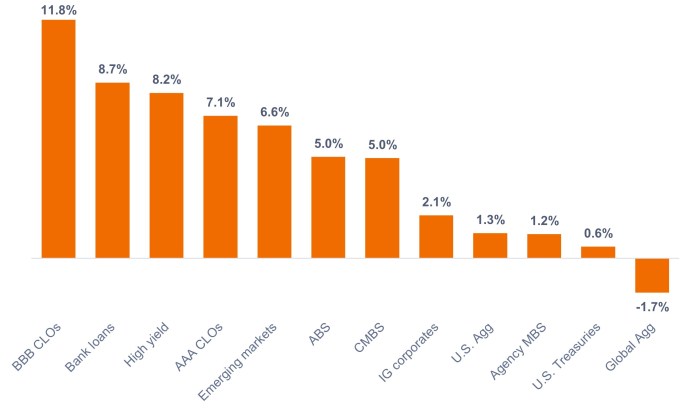

There was significant dispersion in returns among various fixed income sectors in 2024.

Notably, investors who hold portfolios that track the Bloomberg U.S. Aggregate Bond Index (U.S. Agg) or the Bloomberg Global Aggregate Bond Index (Global Agg) may be frustrated by their lagging performance.

In contrast, investors who adopted a multisector approach with exposure to a wide array of securitized, corporate, and sovereign fixed income assets may have generated solid positive returns in 2024, as shown in Exhibit 1.

Exhibit 1: U.S. fixed income sector returns (2024)

Securitized and sub-investment grade sectors led the way.

Source: Bloomberg, as of 31 December 2024. Indices used to represent asset classes as per footnote.1 Past performance does not predict future returns.

What performed well?

- Securitized credit sectors. Securitized credit had been trading cheap relative to corporates for some time, offering opportunities for attractive risk-adjusted returns. Securitized credit spreads tightened in 2024, leading to outperformance, while their inherently shorter duration shielded them from the adverse impact of rising bond yields.

- High yield and bank loans. Despite high-yield credit spreads trading near their historical tight levels and investor concerns around bank loan defaults, the high-yield and bank-loan sectors outperformed. Robust economic data, strong corporate fundamentals, and favorable demand-supply dynamics supported returns in these sectors.

- Dollar-denominated emerging markets (EM) debt. EM debt had also been trading cheap relative to corporates heading into 2024, while many developing economies are ahead of developed-world central banks in their rate-easing cycles. Standout performers included countries with improving fundamentals and ratings potential and countries in the sub-investment grade portion of the EM index.

What lagged?

The Global Agg was the only major index to register a negative calendar year return as its foreign currency exposure suffered amid the late, strong rally in the U.S. dollar. Within the U.S., longer-duration sectors such as agency MBS and Treasuries lagged as the 10-year U.S. Treasury yield rose 69 basis points to 4.57%.

Much of the rise in Treasury yields came in Q4 to account for the risk of higher inflation stemming from the incoming administration’s policies on immigration, trade, and taxes.

Despite lagging credit sectors in 2024, agency MBS outperformed U.S. Treasuries and, in our opinion, is trading cheap relative to Treasuries and investment-grade corporates.

Three takeaways for investors

First, we believe it is important to maximize income per unit of risk and limit drawdowns in the present environment. In our view, investors will be rewarded by clipping relatively high coupons and picking individual bonds with positively skewed risk-return expectations, as opposed to making macro bets.

Second, we think allocating to sectors that are trading at cheaper relative valuations – such as loans over high yield, CLOs and ABS over corporates, and agency MBS over Treasuries – will be key in 2025. Even with the strong performance in 2024, the yields in fixed income remain compelling versus historical yields, inflation expectations, and the S&P 500® Index forward earnings yield.

Finally, the U.S. and Global Aggregate Bond Indexes are not fully representative of the fixed income universe. For example, the U.S. Agg is comprised of 45% Treasuries, 25% agency MBS, 25% investment-grade corporates, with no high yield or loan exposure, and only around 2% in securitized credit sectors.

We believe investors should think beyond static indexes and consider an active, multisector approach that seeks to capitalize on the broad range of opportunities in fixed income.

1 BBB CLOs = JP Morgan BBB CLO Index, AAA CLOs = JP Morgan AAA CLO Index, Bank loans = Morningstar LSTA Leveraged Loan 100 Index, High yield = Bloomberg Corporate High Yield Bond Index, EM debt = Bloomberg Emerging Markets USD Aggregate Index, CMBS = Bloomberg Commercial Mortgage Backed Securities Investment Grade Index, ABS = Bloomberg Aggregate Asset Backed Securities Index, IG corporates = Bloomberg U.S. Corporate Bond Index, U.S. Treasuries = Bloomberg U.S. Treasuries Index, Agency MBS = Bloomberg U.S. Mortgage Backed Securities Index, Global Agg = Bloomberg Global Aggregate Bond Index.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Earnings Yield measures earnings per share for the most recent 12-month period divided by the current market price of those stocks.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.