Subscribe

Sign up for timely perspectives delivered to your inbox.

Global Head of Multi-Asset Adam Hetts, CFA, explains why using cash as a longterm investment vehicle can be damaging to an asset allocation. He shares his views on investment opportunities in the second half of 2024 and explains how Janus Henderson’s Direct Advice program can help investors redeploy cash on the sidelines.

For short-term savings or liquidity needs, cash is king. That won’t change – regardless of what happens in markets. Whether as a portfolio manager or an individual investor, it makes sense to have a certain amount of cash available to cover near-term expenses, withdrawals, or emergencies. However, using cash as a long-term investment vehicle can be damaging to an asset allocation.

We understand the current appeal of cash, where relatively attractive yields and negligible risk offer investors a seemingly valid “wait-and-see” option until economic conditions solidify. But investors may be sacrificing more than they realize.

Consider last year: Investors were bracing for the most anticipated recession ever. Moving to cash seemed reasonable, especially after the 2022 market decline, but the hard economic landing never materialized. And while returns on cash vehicles were solid at around 5%, they didn’t match equities, where the S&P 500® Index delivered some of its best performance of the past decade at 26.29%. Investors holding cash over 2023 (and into 2024) have missed out on gains waiting for the “right time” to re-enter the market. That could be a significant setback for one’s long-term investment goals.

First, today’s cash yields are not reliable. When the Federal Reserve (Fed) begins cutting rates, cash yields will drop in unison. While we do not expect the Fed to take rates back to zero, investors sitting in cash have not locked in current higher yields for any meaningful period.

Second, cash rates do not benefit from falling yields like many other risk assets. For example, fixed-rate bonds experience price appreciation when yields fall and, all else equal, the present value of a company’s future earnings increases as rates decline, raising the value of its stock. We have typically seen risk assets outperform cash in the 12 months following the Fed’s final rate hike.

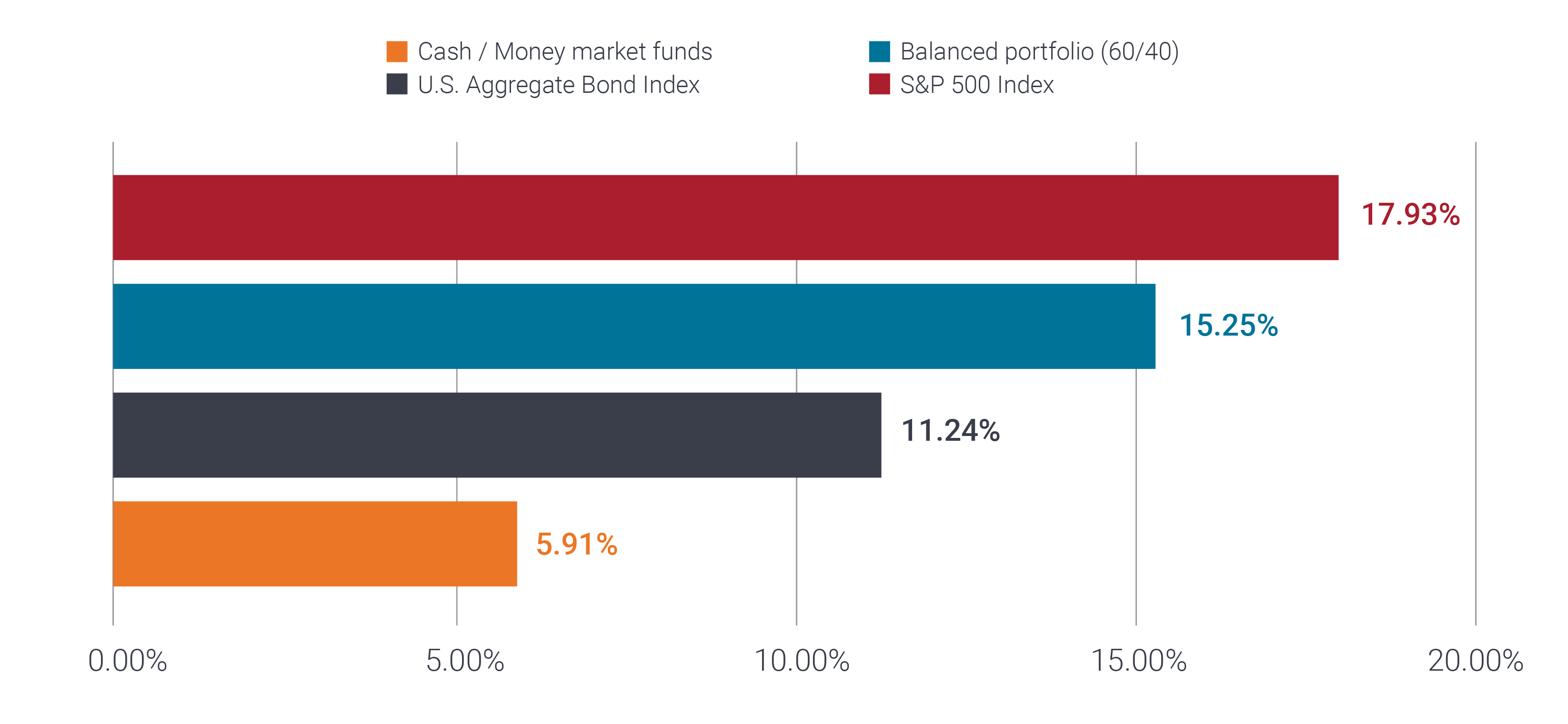

Average 12-month forward returns after the last seven times the Fed stopped hiking

Source: Bloomberg, Janus Henderson Investors, as of 3/15/24. Balanced portfolio comprised of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index and assumes annual rebalancing. Last seven rate hikes at 8/31/84, 2/28/89, 2/28/95, 5/31/00, 6/30/06, 12/31/18, and 7/31/23.

Past performance does not predict future returns.

While the likelihood of a soft landing has increased in most regions, economic resilience and stubborn inflation in the U.S. mean rate cuts here will likely lag the eurozone and China.

As a result, we’re watching for favorable opportunities in global sovereigns as rates start to come down outside of the U.S. Similarly, European investment grade looks attractive given the asset class will likely benefit from cuts by the European Central Bank. We are cautious on U.S. corporate bonds because full valuations suggest limited upside, but corporate balance sheets, in aggregate, are healthy.

Within equities, we believe stocks tied to secular themes like artificial intelligence (AI) still have growth potential, but we see other pockets of opportunity that shouldn’t be overlooked. For one, given the broad rebound in global economic activity, more cyclically oriented stocks (e.g., developed international companies and smaller U.S. companies) could benefit. Further, when rate cuts do arrive, it should bode well for U.S. small- and mid-cap companies, which tend to be more leveraged than their larger-cap peers. However, avoiding the many unprofitable firms in the small-cap benchmark will be key.

Direct Advice programs and their portfolios are designed to benefit from the investment and allocation expertise of our Multi-Asset team, including a strategic, goals-based approach to the role of cash within a broader investment portfolio. The program is intended to give you confidence in your retirement journey by providing straightforward, diversified investment options matched to your risk preferences and investment goals. Depending on your needs, we offer Direct Advice Portfolios and Direct Advice Investments for retirement accounts.

In the Direct Advice Portfolios program, investors are placed in one of six portfolios designed to match their risk tolerance, time horizon, and investment goals by targeting different allocations of equities and fixed income. The portfolio target allocations range from 100% fixed income to 100% equities and can be rebalanced quarterly to maintain consistency with their respective investment strategy and in response to the latest market conditions.

Investors in the Direct Advice Investments program are offered a point-in-time recommendation into one of three Global Allocation Strategies. The three strategies seek to offer broad global diversification in a single investment by utilizing the full spectrum of Janus Henderson investment expertise and solutions. The strategies are not rebalanced quarterly but are activelyallocated to match a specific level of risk and return potential on an ongoing basis.

With both programs, you’ll receive free investment guidance from our team of licensed Investment Consultants at no additional cost beyond the underlying fund expenses.