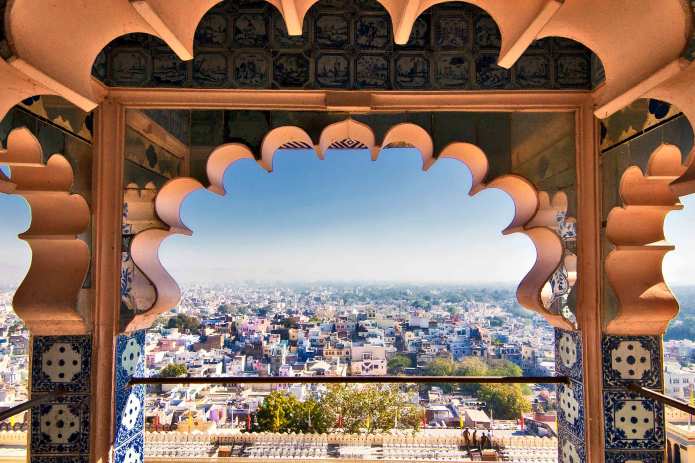

In an era where globalization appears to be on the wane, the landscape for investing in emerging markets (EM) is shifting. A dispersion of economic prospects should result in both winners and losers. Consequently, investors seeking to access the powerful secular growth themes embedded in emerging regions will have to be more discerning. We believe a sweet spot going forward will be EM countries that possess both a reformist government and an innovative private sector. India is one such country.

This nexus, along with India’s favorable demographics, aligns with the country, company, and governance approach that, in our view, serves as an effective framework for EM investors.

Within the EM asset class – especially during a period of economic and policy transition – investors may understandably place considerable emphasis on the macro. We have written extensively on the country aspect with respect to India’s reformist government and will provide a sufficient summary in this note, but our focus will be on the company level – namely the sectors in which well-positioned and innovative businesses thrive. Over the long term, one of the main determinants of equity returns is earnings growth. A favorable macro backdrop and robust corporate governance matter insofar as these factors set the stage for companies to invest, innovate, and grow.

Read more

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Foreign securities are subject to currency fluctuations, political and economic uncertainty, increased volatility and lower liquidity, all of which are magnified in emerging markets. Fixed income securities are subject to interest rate, inflation, credit and default risk. As interest rates rise, bond prices usually fall, and vice versa.

Volatility measures risk using the dispersion of returns for a given investment.