Subscribe

Sign up for timely perspectives delivered to your inbox.

Ali Dibadj, CEO, and Matt Peron, Global Head of Solutions, explain why a higher cost of capital and wave of innovation are likely to create opportunities for selective investors to differentiate between companies that are well positioned for this new regime and those that don’t appreciate the magnitude of this sea change.

The term regime change within investment markets is typically associated with inflation and interest rates returning to pre-Global Financial Crisis (GFC) levels. We, however, believe the term also applies to how one should invest. A higher cost of capital changes how companies and investors alike are seeking returns. Notably, it puts the onus on selectivity and an active approach to investing.

The era of ultra-low interest rates distorted capital allocation processes. As we explored in our 2024 outlook, Navigating change: Three drivers for long-term investment positioning, whether an organization had a good or bad business model was almost irrelevant; inexpensive capital was readily available to support even the most unviable businesses. The return of higher lending rates has dramatically changed the landscape for companies, with funding now much harder to come by and investors more discerning about where they choose to allocate capital.

While we expect interest rates to recede from their current highs, the new normal looks certain to be higher than the unusually low pre-pandemic level. This will force companies to work harder to compete for investor capital and, with the bar raised, some companies will be more successful than others. Indeed, many companies will fail. Consequently, investors must take a more rigorous approach to security selection, increasing the importance of deep industry knowledge.

The era of low rates also coincided with the growth of passive investment strategies designed to follow the market. Funds that closely track benchmarks have a place in meeting certain investment objectives. Yet, in a higher cost of capital environment, we believe an active approach to security selection is better suited to separating the winners from the losers and generating outsized returns.

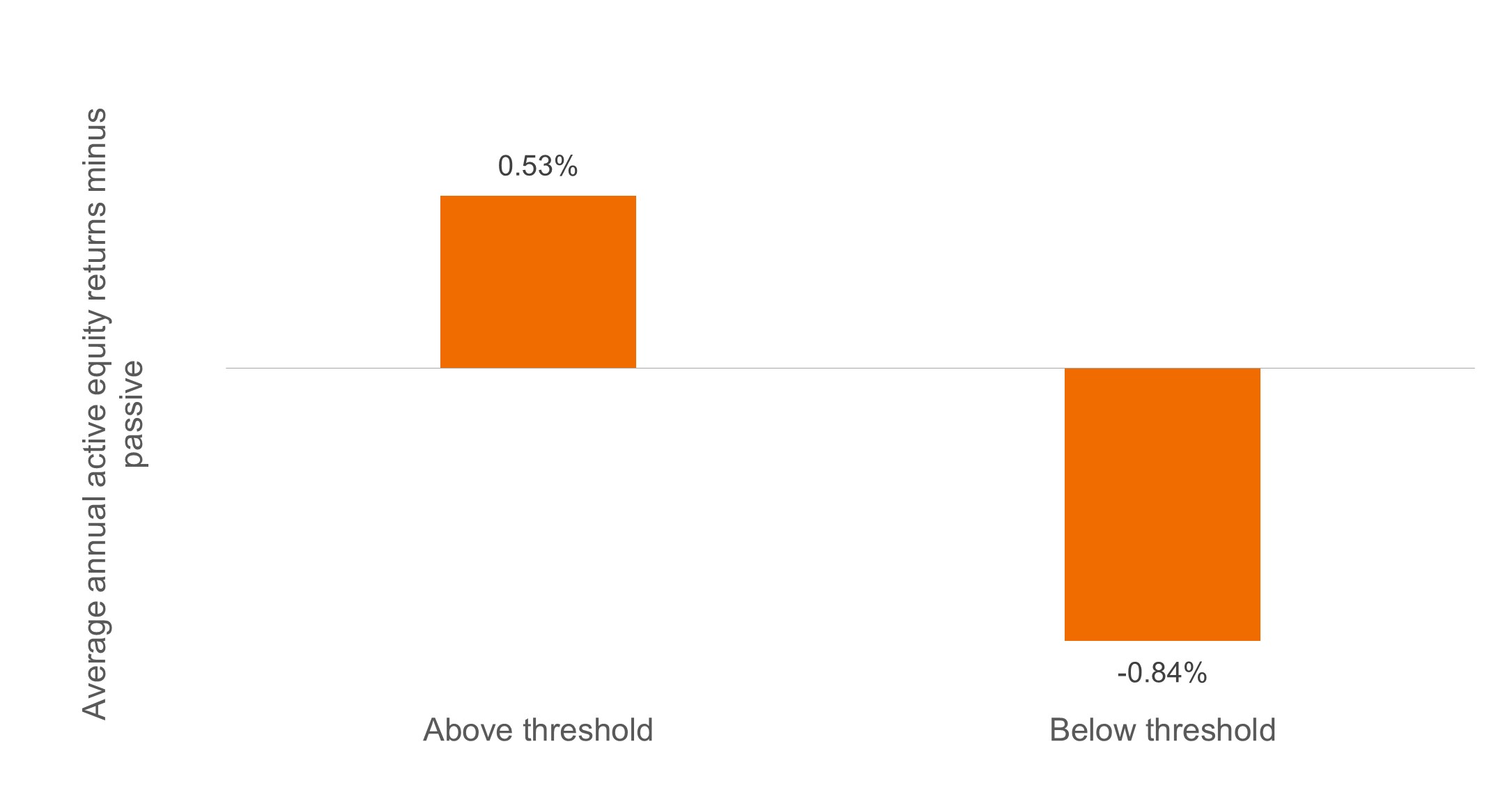

This is borne out when looking at active versus passive returns within U.S. equities through different rate environments. Based on data going back to 1990, the average passive fund outperformed the average active fund when the yield on the 10-year U.S. Treasury Note was 3.50% or lower. However, when yields are higher than 3.50%, as we expect for the foreseeable future, the average active U.S. equities fund has historically been ahead. Of course, this is based on the average active and passive fund, and active managers with proven research capabilities and strong track records would aim to beat the average.

Source: Bloomberg, Morningstar, Janus Henderson Investors, as of April 2024. Data from 31 December 1989, non-market-cap weighted averages.

Source: Bloomberg, Morningstar, Janus Henderson Investors, as of April 2024. Data from 31 December 1989, non-market-cap weighted averages.

It is not just a higher cost of capital that causes us to believe investors conducting in-depth research will be rewarded in the years ahead. The breadth of shifts occurring in the economy increases the potential divide between the secular winners and the companies at the highest risk of being disintermediated. For years this rift has been on display in the technology sector as innovative upstarts created entirely new industries or displaced slow-to-react incumbents.

This creative destruction has already spilled into other sectors, and rapid advancements in artificial intelligence (AI) and other novel technologies will likely amplify the divide. It is particularly evident in the healthcare space, where pharmaceutical and biotech companies are creating new classes of novel therapies at an increasing rate.

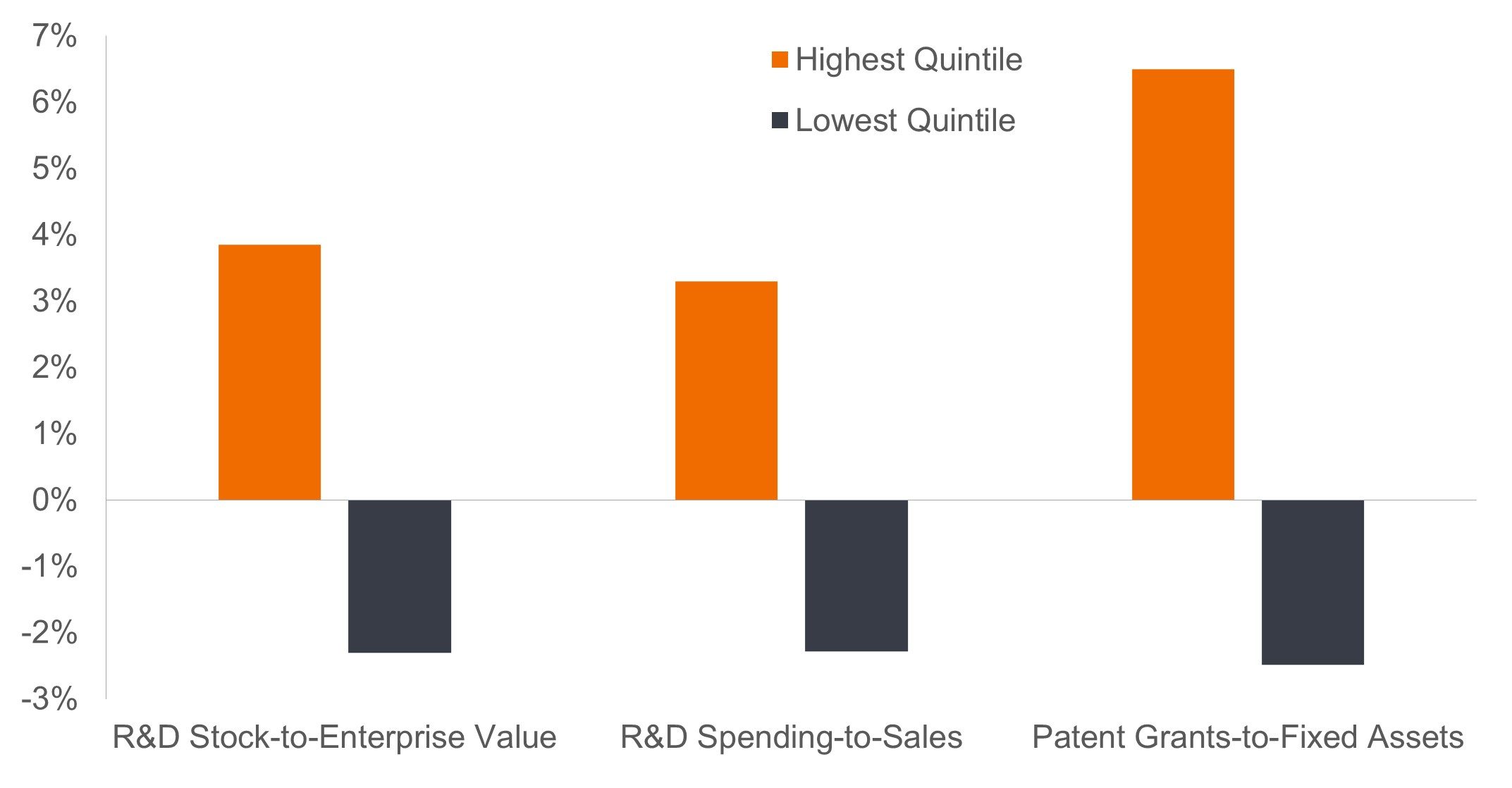

As with other waves of innovation, not all companies will adopt an effective strategy. Those that don’t are at risk of losing market share to peers or will put off investors by their inability to grow earnings as rapidly as evolving competitors. As an example, U.S. large-cap companies that committed research and development (R&D) funding to allow for innovation outperformed those that did not (see chart below). From an investing perspective, we believe a deep understanding of the structural forces at play combined with expert research into company strategy will be essential to navigate change and generate excess returns.

The outperformance of highest quintile R&D to Enterprise Value stocks is the continuation of a decades-long trend, while R&D-to-sales outperformance reflects the more recent massive investment in the digitization of the global economy.

Source: Empirical Research Partners, April 2022. Large capitalization stocks, relative returns to the highest and lowest quintiles of select factors. Equally weighted monthly data compounded to annual periods. Ten years ending mid-April 2022. R&D Stock-to-Enterprise Value is capitalized stock of R&D expenditures, accumulated over trailing periods of three to eight years depending on the sector, relative to enterprise value.

Periods of transition and rapid disruption require investors to stay alert. As the knock-on effects of a higher cost of capital and innovation play out, we expect to see greater dispersion within equity returns. Growth companies will have to “earn” their multiple, meaning that, without the tailwind of a low discount rate supporting valuations, they will have to prove they can grow earnings faster than the market over a sustained period.

Companies that rely upon debt markets for financing recognize that investors now have alternatives. No longer can they count on an eager market as they roll over maturing debt. Instead, they must show that they can generate sufficient cash to cover their obligations and, in cases where debt financing is required, have the discipline to judiciously manage their balance sheet. Those that cannot are best avoided since, without the support of yield-starved investors, their solvency and position in market-cap-weighted benchmarks are at risk.

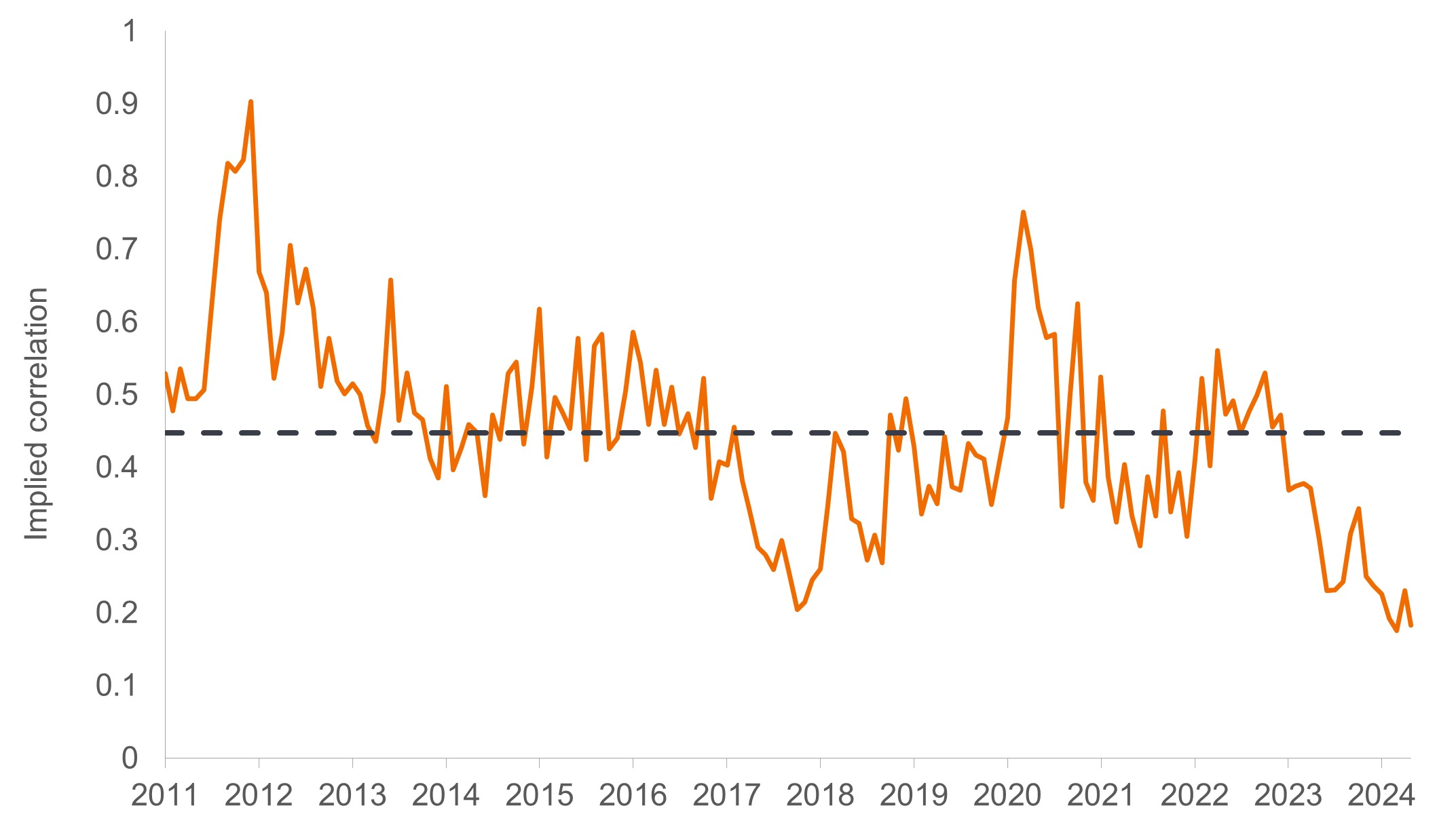

The process of identifying the winners and losers has already begun. After an extended period of financial markets moving in near lock step – often in reaction to macro data – idiosyncratic factors are increasingly guiding the trajectory of individual securities. Within equities, correlations between the S&P 500 Index’s 100 largest stocks are the lowest they’ve been in years – and it is little surprise that the descent was catalyzed by the resetting of rates.

Correlations among the S&P 500’s largest companies have fallen precipitously as investors seek to identify the business models best positioned for an era defined by a higher cost of capital and innovation.

Source: Bloomberg, Janus Henderson Investors, as at May 2024.

Financial markets have survived – and in some cases thrived – during the era of low rates. The downside has been a host of distortions interfering with market pricing that ultimately affected investor behavior. Accommodative policy and the reach for yield resulted in wave after wave of macro developments and style factors influencing the trajectory of entire asset classes. Many investors have grown comfortable with top-down, momentum, and passive strategies. Going forward, we believe such strategies will face challenges, as a higher cost of capital and rapid innovation will likely lead to diverging fortunes between visionary companies and also-rans.

Distinguishing between these two camps by leveraging fundamental research and industry expertise should enable expert investors to resume their historical role of allocating capital to its most productive use. In the process, investors who understand this imperative and successfully navigate this regime change should be rewarded.

Janus Henderson can rely upon 90 years of experience when seeking to actively allocate to the companies most capable of adapting to change. We believe this research-based culture is particularly well-suited to the higher-cost-of-capital and innovation-led environment ahead and look forward to helping clients position for a brighter investment future.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

IMPORTANT INFORMATION

Active and passive investments may both lose value when valuations fall and market and economic conditions change.