Subscribe

Sign up for timely perspectives delivered to your inbox.

Wealth Strategist Ben Rizzuto shares his experience working with this year’s Greenwood Project interns and the insights he gained into how young Americans view the financial industry and their own financial futures.

For the third summer in a row, Janus Henderson Investors had the pleasure of hosting interns from Greenwood Project.

Since 2016, Greenwood Project (GP) has worked diligently to create career paths in the financial services industry for Black and Latino college students. GP rigorously trains its scholars in specific career-track skills they will need to succeed in finance, then partners with financial services companies to place students into highly competitive summer internships across the country.

I’ve been fortunate to be able to interact with these college students and learn about their thoughts on financial literacy, how they view those of us who work in financial services, and how they envision their financial futures.

This year, we’re highlighting the views and opinions of GP interns Adin Farmer (The University of Illinois-Chicago, 2027), Kai Washington (Washington University, St. Louis, 2026), Arelys Estrada (DePaul University, 2026), Anthony Armstrong (DePaul University, 2027), Manny Wiley (University of Illinois Urbana-Champaign, 2026), and Imani Noel (DePaul University, 2026).

I believe the ideas and data we’re able to gather from our interactions with GP participants provide those of us who advise and educate clients and their families with valuable ideas on how to better reach the next generation as well as help narrow the financial and knowledge gaps that exist for underserved communities. Their insights provide important clues on how our industry should think about young people, what they’re looking for from us, and how we can better educate and engage with younger investors.

“Investing needs a Netflix docuseries.”

-Imani Noel

In March 2019, most Americans had never heard of Max Verstappen or Daniel Riccardo. And the only times most people thought about car racing was on Memorial Day or in late February when they stumbled on news about the Indy 500 or Daytona 500.

That all changed when Netflix put out the “Formula 1: Drive to Survive” docuseries. The show, now in its sixth season, attracted a huge following and turned a lot more Americans into fans of the sport.

“Formula 1” gave viewers a better understanding of something that had previously seemed foreign and captured the imagination of fans as they considered what they would do if they were in the driver’s seat.

And that was one of the top takeaways from my time with our interns: The idea that we in financial services need to do a better job of capturing their imaginations. Imani put it best when she said, “Investing needs a Netflix docuseries!”

Imagine a docuseries that has interesting characters, explains the intricacies of investing, and allows viewers to see themselves in the driver’s seat. Admittedly, this may be difficult to pull off since budgeting, investing, and financial planning can be quite boring for most people. (And let’s face it, reinvesting your dividends every quarter or redoing your budget after a life event isn’t quite as exciting as turn one in Baku during the Azerbaijan Grand Prix.)

But while it might not be easy, it is up to all of us in financial services to find new and compelling ways to portray our industry and work as inspiring, meaningful, and, yes, exciting. And I truly believe that solid, approachable financial education content may help advisors play a larger role in the lives of young people.

“Social media creates a cat and mouse game.”

-Adin Farmer

It’s important to know that young people want more financial education. In fact, Janus Henderson’s 2024 Investor Survey found that 96% of millennials are very or somewhat interested in building their financial literacy.

Too often, however, as Manny stated, “Younger generations rely on the algorithms of social media as their primary source of news information and finance-related material. This negatively affects young Americans’ financial literacy because of information overload from inadequate or inaccurate sources.”

Along with that, lower-income and minority groups are often targeted with educational resources that are not tailored to their specific needs and interests. Arelys talked about this issue from her standpoint. As the daughter of a young mother with family members in Mexico, she felt financial services firms need to do a better job understanding and speaking to families like hers.

Adin also talked about how rap culture plays an outsized role in how minority communities view money and finances. In his words, it has created a “cat and mouse” game for young people who are trying to find success but haven’t developed the right habits or may not have the financial foundation to sustain a “successful” lifestyle. At the same time, rap culture captures young people’s imaginations; that why it’s easy for a hip-hop artist who seems to have everything to be a young person’s hero.

Arely’s and Adin’s comments highlight how important it is for us to investigate how different backgrounds and family histories affect an individual’s understanding of and access to financial education, and how we can better tailor educational offerings to make them more relevant and relatable. This will allow us to “amplify the right voices,” as Imani put it. The way I see it, those are the voices of financial advisors who are consistently going into underserved communities to better understand and educate them.

“Generational wealth is not only wealth but the knowledge of how to build it.”

-Anthony Armstrong

We all know that education leads to progress. But the key is staying in front of underserved communities and providing the right education so that this generation is able to build for the next generation.

That brings us to an important point Anthony brought up. He astutely stated: “Generational wealth is not only wealth but the knowledge of how to build it.” He recounted the story of a babysitting job he had for a white family where the 10-year-old he was watching was talking about investing and was, to Anthony’s surprise, familiar with index funds!

On that note, I once again found this year that these young people are willing to step up to the plate and take the lead.

For example, Manny said he views himself as “the financial advisor” of his family. Kai talked about how the conversations she is having with her family have grown to include discussions on savings account interest rates, credit cards, and credit scores. She noted that as she has learned more about finances and investing, she has found herself becoming the teacher for her parents. And Anthony mentioned how, when he returns to Chicago after his internship, he wants to devote more time to helping his mom learn about investing and finances.

“The Kids are Alright”

-The Who

Thinking back to the title of the 1966 song, I am happy to report that, yes, the kids are alright.

Every year, I walk away from my time with the GP interns feeling more hopeful about those who will lead us in the future. But those of us who serve in positions where we can educate, provide opportunities, and create financial literacy-related content can’t just “walk away.” We need to walk toward these groups, no matter what our background or ethnicity is, to help build them up their knowledge of finances and investing. Once we do that more consistently, we’ll all be more than alright.

As part of their internship at Janus Henderson, GP participants took part in a survey to uncover their attitudes and plans for the financial future. Below are a few noteworthy findings:

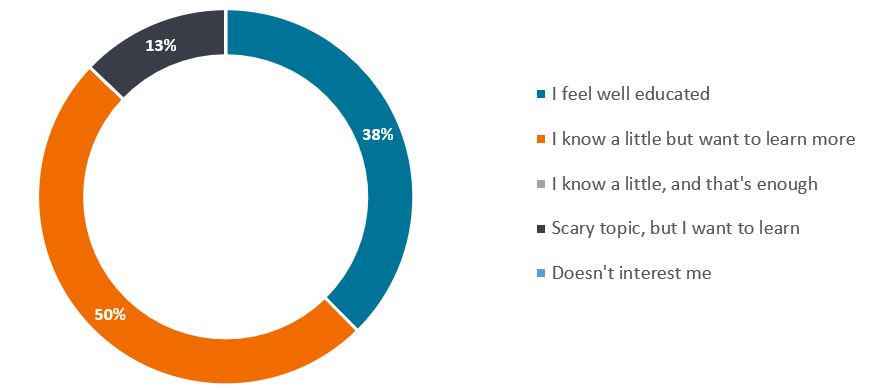

How comfortable are you with financial concepts? (For example, stocks, bonds, investing, inflation, interest rates, and saving for retirement)

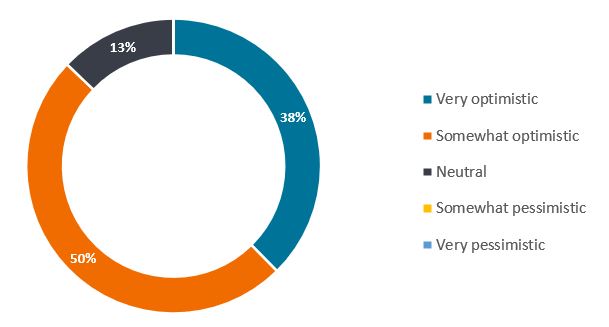

How optimistic are you about your financial future?

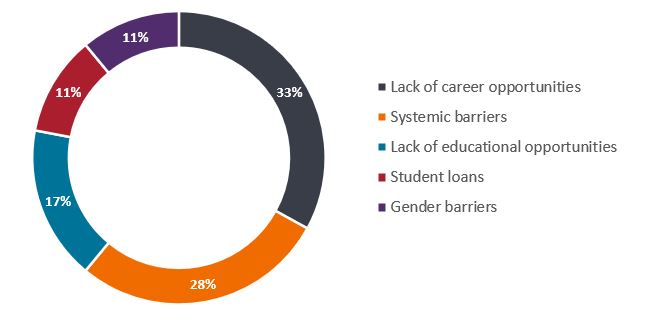

What hurdles exist when thinking about your ability to reach your financial goals? Choose all that apply.

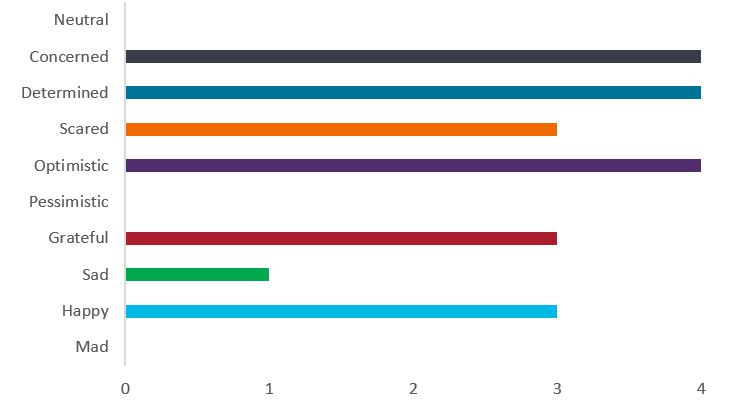

Consider the following words and choose the one that most closely describes how money impacts your life or makes you feel.