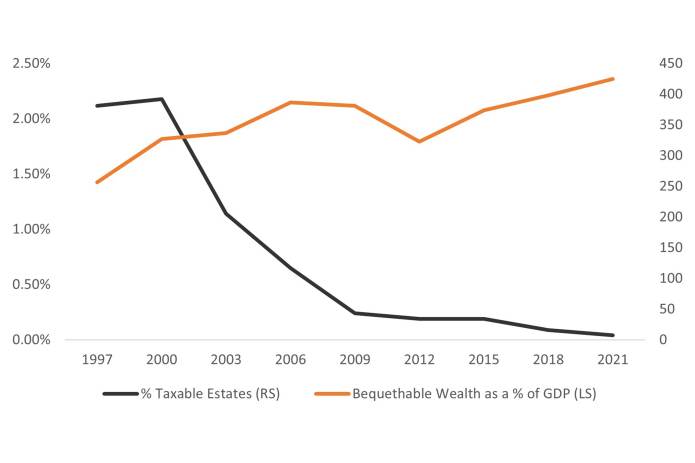

Sources: “A Preliminary Report on Taxing the Great Wealth Transfer,” Brookings Institute, January 2025; Penn Wharton Budget Model.

Even though families may not have to worry about a federal estate tax liability, there is still planning that can be done. Simply making a plan and communicating with family members can help solve many of the financial and non-financial issues that go along with legacy planning.

*Tax Policy Center, 2025.

The information contained herein is for educational purposes only and should not be construed as financial, legal or tax advice. Circumstances may change over time so it may be appropriate to evaluate strategy with the assistance of a financial professional. Federal and state laws and regulations are complex and subject to change. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of the information provided. Janus Henderson does not have information related to and does not review or verify particular financial or tax situations, and is not liable for use of, or any position taken in reliance on, such information.