Subscribe

Sign up for timely perspectives delivered to your inbox.

In the first of our chart to watch series, Adam Hetts, Global Head of Multi-Asset, spotlights the contrast between U.S. rate cut expectations and the broad economic growth trajectory, which remains remarkably robust for a rate cutting environment.

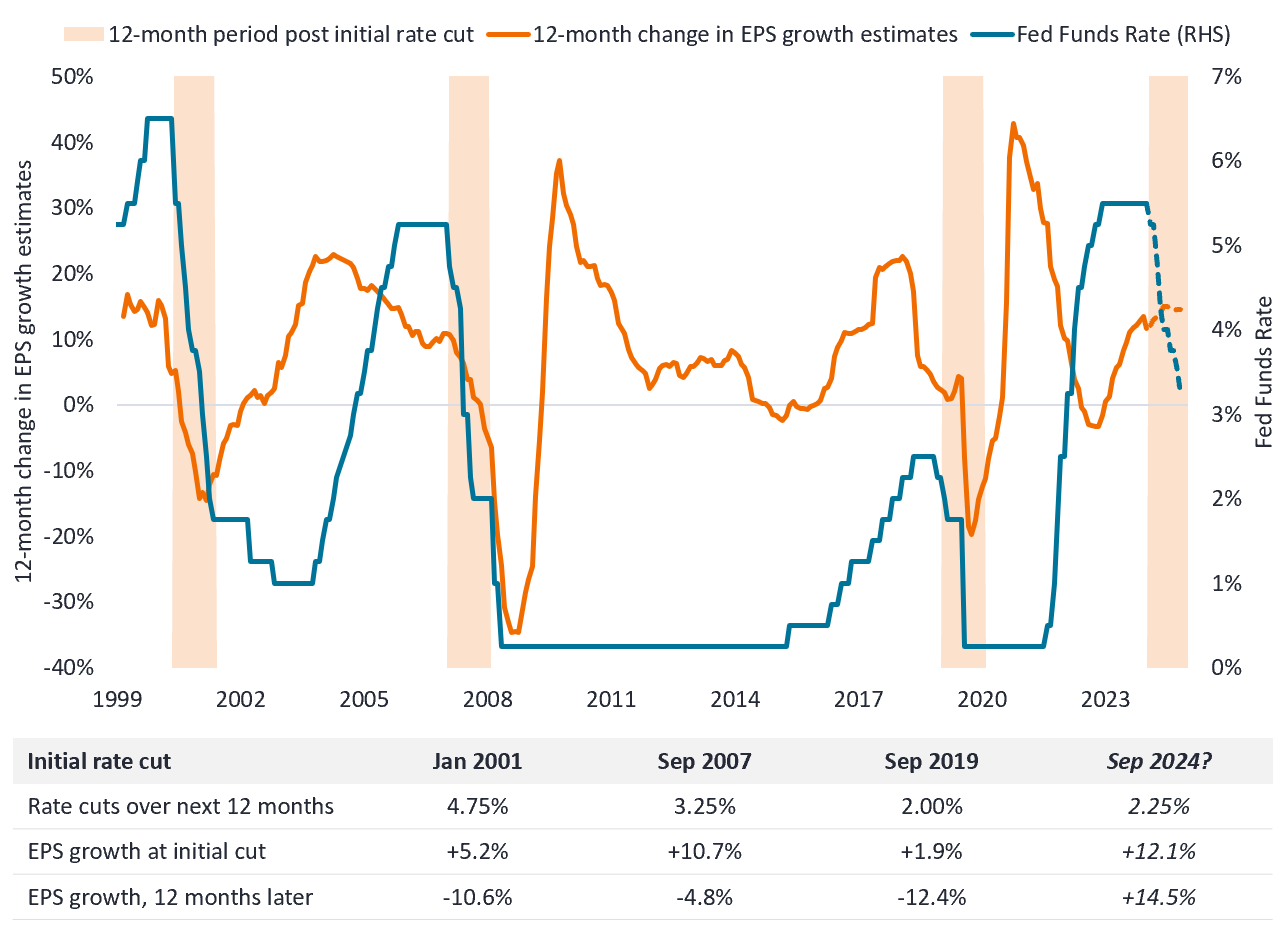

Earnings per share (EPS) growth estimates and Federal Funds Rate (dotted lines are forecasts)

Source: Bloomberg, at 11 September 2024, September data are based on market forecasts

The chart is one illustration of the potentially unique rate cutting environment ahead. Historic cuts have been accompanied by economic weakness (as illustrated by S&P 500 EPS growth downgrades). Yet, currently the market is forecasting cuts alongside double-digit EPS growth.

This would of course be the best kind of soft landing outcome, but it would be an historical aberration and we believe investors are well-served to hope for the best but plan for some disappointment. –Adam Hetts, Global Head of Multi-Asset

In these conditions, Adam’s team notes three important implementation considerations:

1. Embrace broad equity exposure

Certain areas like small cap and international ex U.S. developed equities might respond better to lower rates and continued economic stability, but their large-cap growth counterparts can provide important defense if the economy wobbles.

2. Active management will be key

The August 2024 sell-off and subsequent recovery is an example of where broad, nimble exposure was most desirable. Active management can help avoid concentrations and react quickly to events.

3. Embrace a ballast of high quality fixed income

With this late cycle environment likely characterized by more volatility, investment grade fixed income is essential for its current yields, potential return benefits derived from rate cuts, and downside protection.

The chart to watch series highlights data trends that matter. Our investment teams provide insight on what these mean for investors.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

There is no guarantee that past trends will continue, or forecasts will be realized. Past performance does not predict future returns.