Subscribe

Sign up for timely perspectives delivered to your inbox.

As part of their mid-year outlook, Matthew Bullock and Lara Castleton from the Portfolio Construction & Strategy Team discuss how thematic investing provides access to the forces reshaping the global economy – if approached in the right way.

Thematic equities offer investors the opportunity to gain exposure to the innovation and transformative changes reshaping the global landscape. Healthcare, property, technology, and sustainable equity investing can capitalise on, and in some cases help drive, seismic structural shifts. From an investment perspective, funds in this area possess distinct characteristics and have unique drivers of return. This means they can be important parts of a toolkit that, with the right approach, can be actively blended to optimise portfolio composition for a range of outcomes.

As explored in a recent article on regime change, investors need to reassess their portfolio construction and return expectations. Identifying future winners is more important than ever as economic uncertainty brings an end to the “a rising tide lifts all boats” scenario. With consumer preferences shifting quickly and disruptors accelerating change, short-term noise can seem loud. There is therefore value in taking a step back and assessing the longer-term drivers.

At Janus Henderson, we see three key macro drivers that will impact investment views, returns, risks, and opportunities over the coming decade:

These macro drivers are combining to create an environment in which healthcare, technology, property, and sustainable equity funds and strategies can thrive. They are increasingly an important and powerful complement to a broad investment portfolio.

Equally, themes can skew or tilt portfolios and bring unintended concentration risk. Therefore an expert approach is needed to benefit from the unique characteristics and return drivers of exposure to themes.

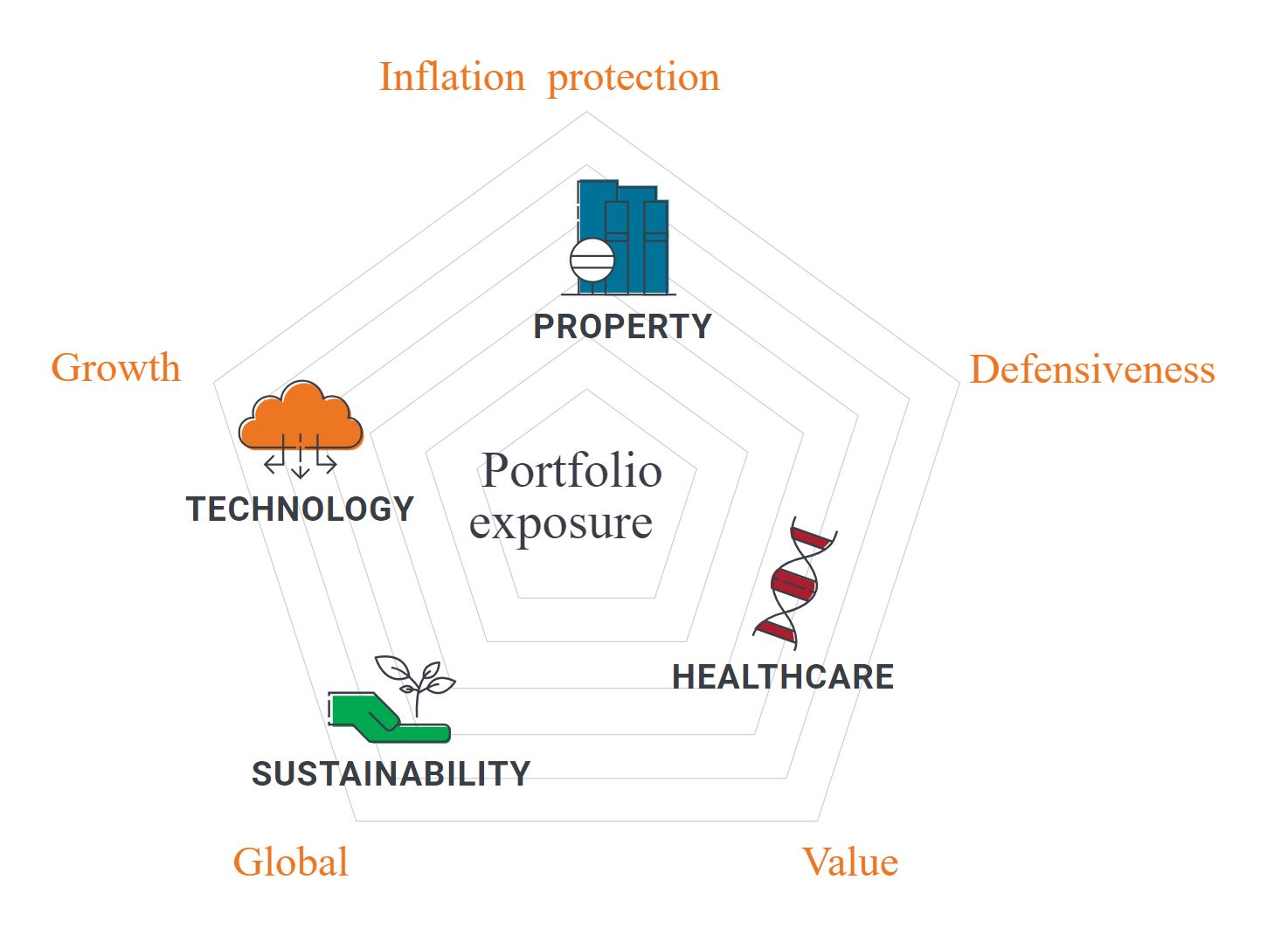

For example, technology is currently on higher valuations but offers strong growth potential; healthcare typically provides a more defensive and value tilt; property can provide inflation protection given rents are often inflation-linked, while sustainability is in focus globally and prioritises environmental, social, and governance considerations.

Using the Janus Henderson Edge™ proprietary analytics platform it is possible to determine the key factor drivers behind each theme. As shown in exhibit 1, the themes exhibit meaningfully different attributes – such as growth, value, global, defensive, and inflation protection characteristics. This means that getting the blend right can create a portfolio of compelling opportunities that can be resilient through a variety of market cycles.

Exhibit 1: Maximise the distinct characteristics of thematics

Source: Janus Henderson Investors. The positioning of the themes on the graphic is indicative based on data from broad-based global indices.

When looking at how to integrate thematics in a portfolio, there is an important point to understand – what is the difference between a thematic and a sector fund? At a high level, a theme is the structural change occurring in society. A thematic fund can be focused solely on that theme. This can have benefits but in our view many of the thematic funds that we see are too narrow in focus. In contrast, a sector fund may have exposure to a number of themes. Or simply be a collection of holdings from across a sector chosen with no reference to overarching themes. Again, detailed analysis of the funds in question is important to ensure the exposure provided is as intended.

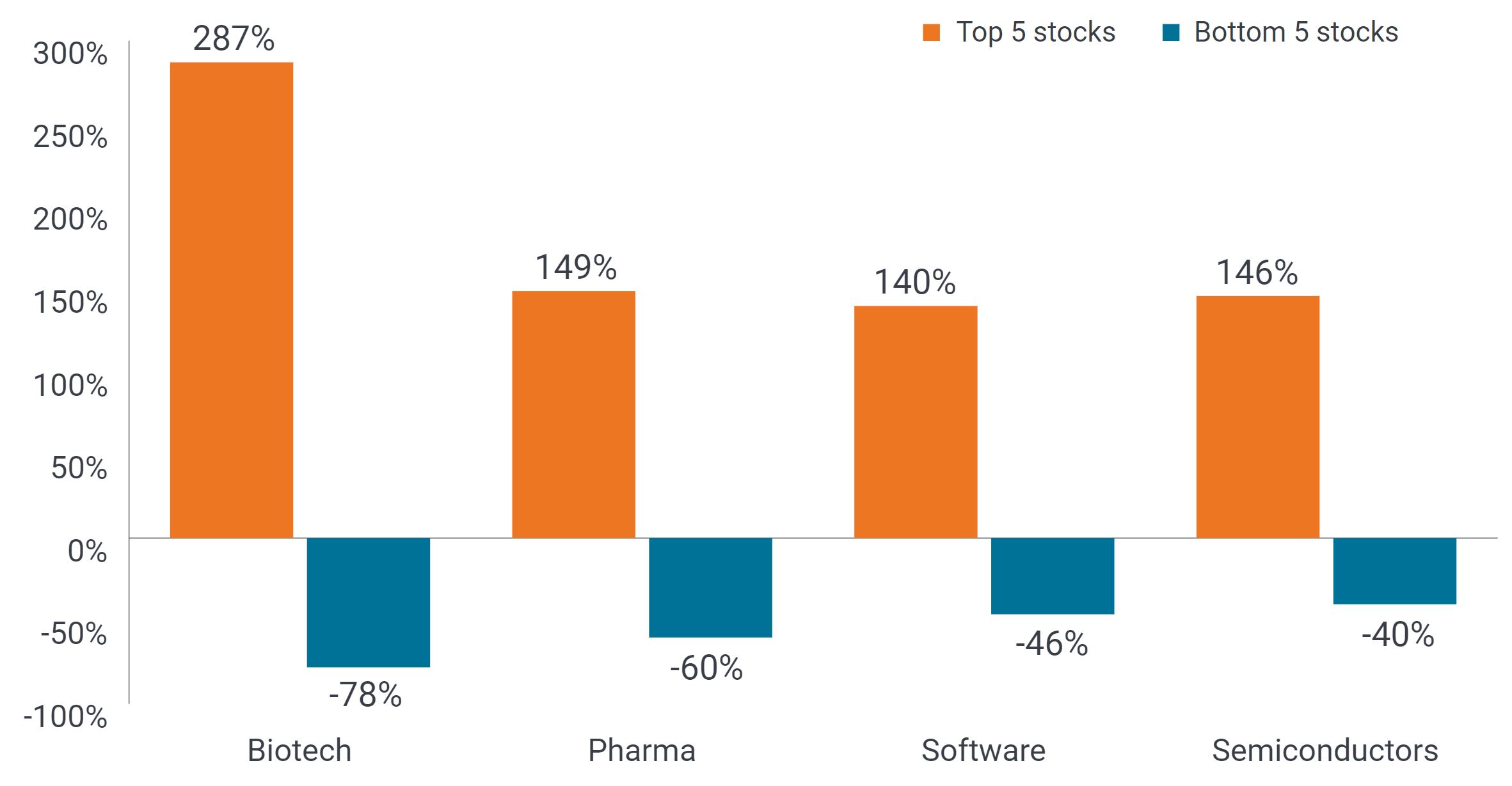

We believe thematic investing, done in the right way, offers the potential to generate outperformance of broader markets over the long term and meet certain investor objectives. But cutting through the mass of offerings to find what’s right is challenging. A number of passive thematic funds are available, but we urge caution. Many have loose links to a theme at best with it unclear why certain names are held. In addition, with the higher cost of capital comes pressure on weaker businesses and this leads to a greater dispersion between the winners and losers. We therefore believe strongly in the importance of fundamental research and active stock picking in this space.

For example, in healthcare and technology there has been a high disparity between the top-and-bottom performing stocks for many years. These more niche or specialised areas, such as biotechnology and semiconductors, require a highly-skilled manager’s insight, experience, and depth of expertise to identify the future winners and avoid the losers.

Exhibit 2: Disparity of returns in specialist areas shows the importance of an active approach

Source: Wilshire 5000 Index. 10-year average disparity of returns for the top five and bottom five stocks of each sector from 31 December 2012 – 31 December 2022. Includes average performance of stocks over US$500M in market cap. Past performance does not predict future returns.

In summary, we believe that thematic strategies can be an important and powerful complement to a broad investment portfolio. However, it is important to take a considered approach and look beyond the hype to ensure investor portfolios are being enhanced. As such, when assessing thematic funds, there are important questions to ask:

The Janus Henderson Portfolio Construction and Strategy Team, which analyses more than 20,000 model portfolios each year based on consultations with 4,900 financial professionals, is on hand to assist you with working through these questions.

Concentration risk: a portfolio concentrated in a small number of holdings or with high weightings to its largest holdings. These portfolios typically carry greater risk than more diversified portfolios, given that an adverse event could result in significant volatility or losses, but the potential to outperform is also greater.

IMPORTANT INFORMATION

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.