The recent selloff in software stocks in the wake of advancements in native AI ignores many of these businesses’ inherent strengths.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

The fourth quarter of 2025 featured powerful secular themes that the Research Team believes will continue to create compelling opportunities across sectors in the year ahead.

Three years after the launch of ChatGPT, we are still in the early innings of the AI revolution, with most of the technology’s economic gains yet to be realized, says Denny Fish.

In their 2026 outlook, Lucas Klein and Marc Pinto discuss how AI and structural reforms, especially in Europe, present opportunities for selective investors.

AI adoption, reshoring trends, and M&A activity could create long-duration growth tailwinds for small- and mid-cap domestic firms.

AI is reshaping industries with applications ranging from cancer detection to surgical training, underscoring the need for active research and responsible engagement.

Declining costs and technical progress have made commercial space businesses more economically viable, creating diverse investment opportunities.

Recent deals within the AI ecosystem seek to align major players in the effort to meet voracious demand.

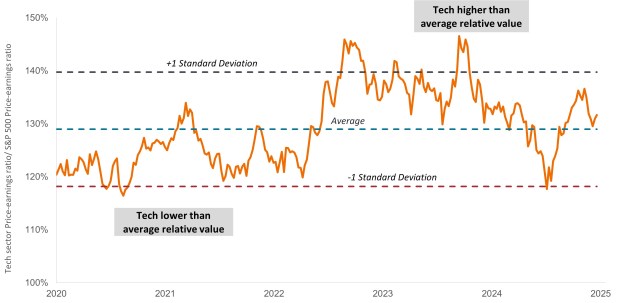

Tech sector volatility can lead to attractive entry points for investors seeking to increase exposure to powerful secular themes.

AI disruption has sparked debate about the future of software companies, but the reality is more nuanced than the prevailing doom-and-gloom narrative suggests.

AI chatbots like ChatGPT are rapidly gaining traction for routine search queries.