Targeting the “worst 60”

In a significant development on “liberation day”, new tariffs were introduced that surpassed initial expectations. Effective from 5 April, a baseline universal tariff of 10% has been set, with additional targeted “reciprocal” tariffs on the “worst 60” trading partners coming into effect on 9 April. These tariffs, ranging from 10-50%, primarily aim to drive down the US trade deficits with each country. This layered tariff structure has brought the average tariff rate to around 22-23%, as seen in the 1890s.

Figure 1: Reciprocal tariff on top 30 trading partners

| US discounted reciprocal tariffs (%) | US discounted reciprocal tariffs (%) | ||

| China | 34 | Israel | 17 |

| Vietnam | 46 | EU | 20 |

| Thailand | 36 | Costa Rica | 10 |

| Taiwan | 32 | Singapore | 10 |

| Switzerland | 31 | Australia | 10 |

| Indonesia | 32 | El Salvador | 10 |

| Pakistan | 29 | Dom Republic | 10 |

| South Africa | 30 | Peru | 10 |

| South Korea | 25 | Colombia | 10 |

| Kazakhstan | 27 | Chile | 10 |

| Malaysia | 24 | UK | 10 |

| Japan | 24 | Turkey | 10 |

| India | 26 | Argentina | 10 |

| Jordan | 20 | Brazil | 10 |

| Philippines | 17 | Egypt | 10 |

Source: JP Morgan, White House, World Bank WITS, USTR, PwC, Tax Foundation, USITC, 3rd April 2025.

An uneven impact across EMs

Such measures underscore the advantages of diversifying investments through the emerging market debt (EMD) asset class, discussed in our recent piece “EMD resilience underappreciated due to emerging market (EM) label”. Comprised of 69 countries [1], this asset class offers a broad spectrum of opportunities, mitigating the risks of concentrated impacts from such tariffs. As the diverse country composition allows for smaller individual exposures, it can enhance the overall resilience of investment portfolios against market volatility.

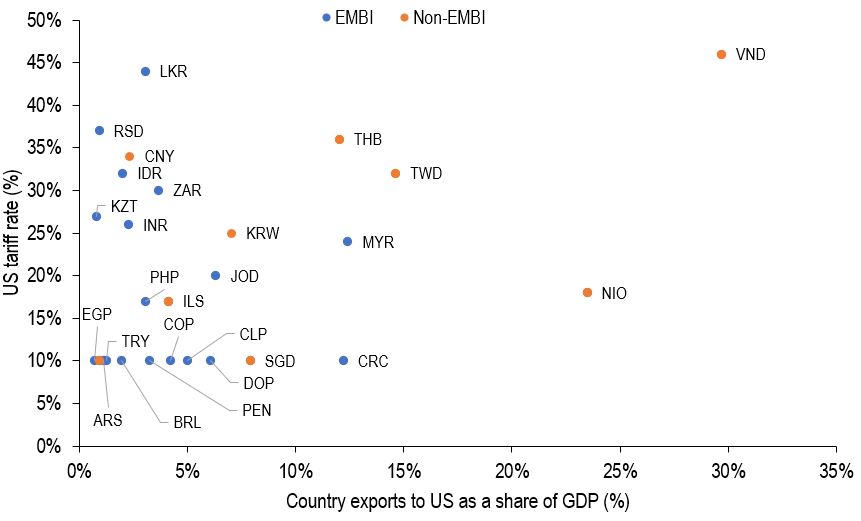

In Figure 2 below, other than Costa Rica and Malaysia, no country in the JP Morgan EMBI Global Diversified Index currently exports more than 10% of their GDP to the US, with most exporting much less.

Figure 2: Country export versus US reciprocal tariff

Source: JP Morgan, Haver Analytics, US Census Bureau, White House, 3rd April 2025.

Horizontal axis: Country exports to US (12m rolling sum, US$bn) as a share of national GDP (4Q rolling sum, US$bn); %; Vertical axis: US discounted reciprocal tariff rate announced by President Trump on 2 April; %. Countries are represented by their currency. LKR: Sri Lanka Rupee; RSD: Serbian Dinar; CNY: Chinese Yuan; IDR: Indonesian Rupiah; ZAR: South African Rand; KZT: Kazakhstani Tenge; INR: Indian Rupee; KRW: South Korean Won; MYR: Malaysian Tinggit; VND: Vietnamese Dong; THB: Thai Baht; TWD: New Taiwan Dollar; NIO: Nicaraguan Córdoba; JOD: Jordanian Dinar; PHP: Philippine Peso; ILS: Israeli New Shekel; EGP: Egyptian Pound; TRY: Turkish Lira; COP: Colombian Peso; CLP: Chilean Peso; CRC: Costa Rican Colón; SGD: Singapore Dollar; DOP: Dominican Peso; BRL: Brazilian Real; PEN: Peruvian Nuevo Sol; ARS: Argentine Peso.

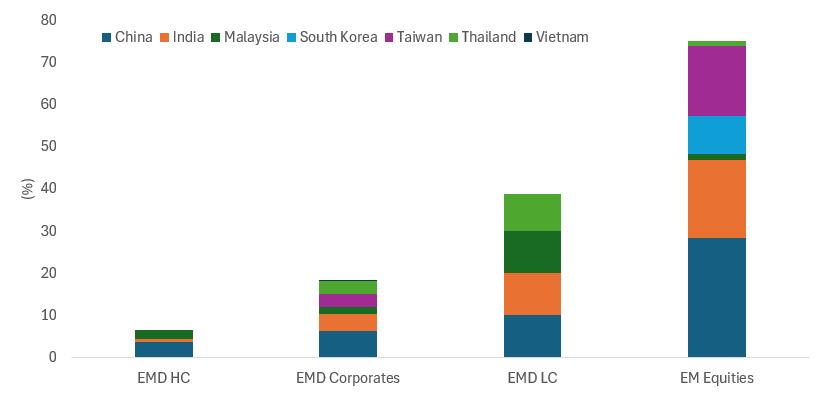

Of the hardest hit EM countries, Vietnam, Thailand, Taiwan, China, and South Korea, play a larger role in the equity and local currency (LC) debt of EMs and frontier markets than in the hard currency benchmark (Figure 3).

Figure 3: Key country exposures in EM and frontier markets debt and equity indices

Source: JP Morgan, Bloomberg, MSCI, as at 31 March 2025. EMD HC: JPM EMBI Global Diversified; EMD corporates: JPM CEMBI Index; EMD LC: JPM GBI-EM Index; EM equities: MSCI EM Equity Index.

While the direct tariff impact seems less severe for EMD, what is of more concern are secondary effects such as changes in risk sentiment, falling commodity prices, and a Chinese economic slowdown. These factors influence EMD credit spreads, given the primary driver of sovereign spreads is volatility and risk sentiment. Although we have seen some relief with the weakening of the US dollar, spreads could face widening pressure in the near term. However, we expect underlying US Treasury yields to act as a buffer to such sovereign spread moves, as evidenced when the tariffs were announced, helping to mitigate the impact on returns.

Monitoring the evolving economic landscape and adjusting investment strategies as necessary to balance opportunity and risk will be crucial in navigating these changes effectively. As we continue to monitor these developments, the benefit of investing in EMD remains where the diversity and country diversification of the asset class provides better resilience than one might expect.

Footnotes

[1] JPM EMBI GD, as at 31 March 2025.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.