ABOUT THIS FUND

A moderately positioned, small-mid-cap growth fund seeking to provide consistent relative returns with lower volatility than the index. The Fund invests in small-cap companies with differentiated business models and sustainable competitive advantages that are positioned to grow market share regardless of economic conditions.

WHY INVEST IN THIS FUND

Unique Business Models

Seeks small-cap companies that stand out from competitors – through differentiated business models, innovative approaches or unique products or services – that are using their competitive advantages to grow over a multi-year time frame.

Deep, Specialized Team

In-depth fundamental research supported by a team of analysts, a team of small mid-cap specialists and a portfolio management team with experience looking for small-cap companies early in their life cycle that have the potential to grow into mid-size companies.

Moderate Approach to Growth

The Fund offers the potential for capital appreciation through exposure to small companies having the potential to quickly grow into mid-size companies with a focus on resilient business models positioned to weather a variety of market environments.

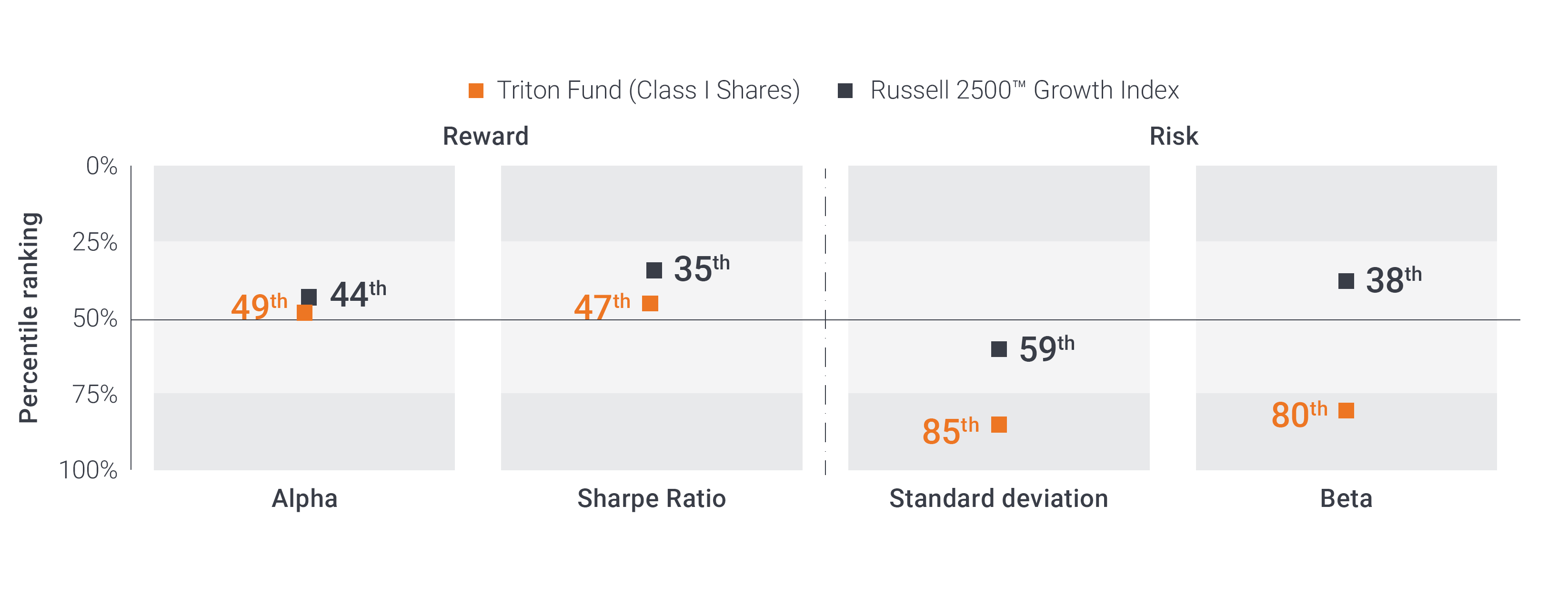

Strong Risk-Adjusted Performance vs. Peers

10-Year Rankings in Morningstar Small Growth Category (480 funds) as of 12/31/25

Triton Fund 3-Year rankings in Morningstar Small Growth Category as of 12/31/25: Alpha –52nd percentile ranked 291 of 535 funds, Sharpe Ratio – 54th percentile ranked 298 of 535 funds, Standard Deviation – 95th percentile ranked 504 of 535 funds and Beta – 91st percentile ranked 483 of 535 funds.