About this Portfolio

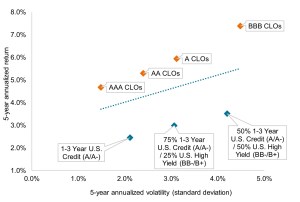

This multi-sector income strategy seeks high, current income with lower volatility than a dedicated high-yield strategy. Our approach leverages dynamic allocation and a bottom-up, fundamentally driven process that focuses on identifying the best risk-adjusted opportunities across fixed income sectors.

Why Invest

Our Team

Same portfolio management team since inception of the strategy with more than 75 years of combined investment industry experience and complementary expertise in high yield credit, investment grade credit and securitized assets.

Disciplined Risk Budgeting

We dynamically allocate risk across market cycles and build a Strategic Asset Allocation (SAA) of more optimal allocations designed to serve as a better starting point than traditional benchmarks.

High Conviction

Best ideas portfolio, with bottom-up research expected to drive excess returns and an ability to invest in smaller, hard-to-access issuers not widely covered across industry analysts.