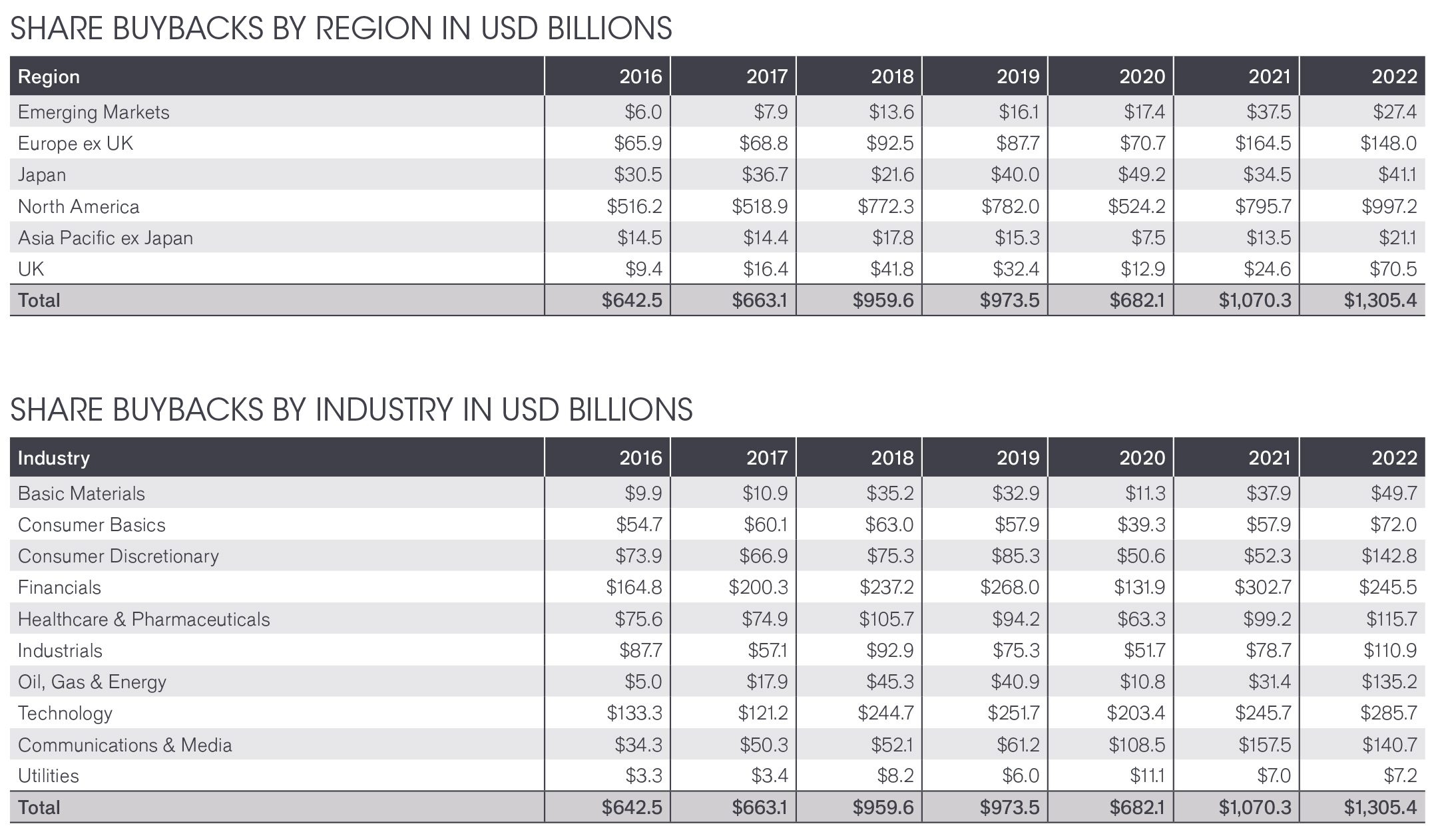

- Share buybacks jumped 22% to a record $1.31 trillion in 20221(latest data available)

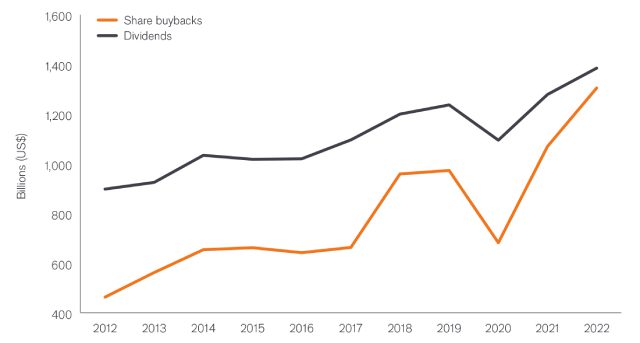

- Share buybacks have tripled in value in ten years, compared to a 54% increase in dividends

- In 2012, share buybacks were just half the size (52%) of dividends but almost equalled them (94%) in 2022

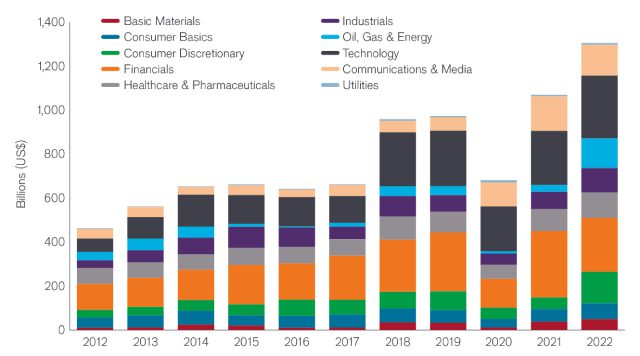

- Oil companies made the largest contribution to share buyback growth in 2022

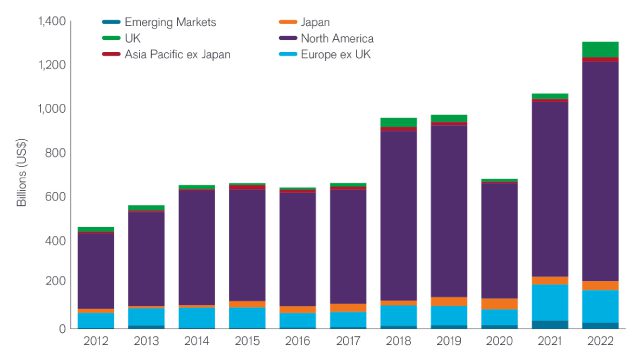

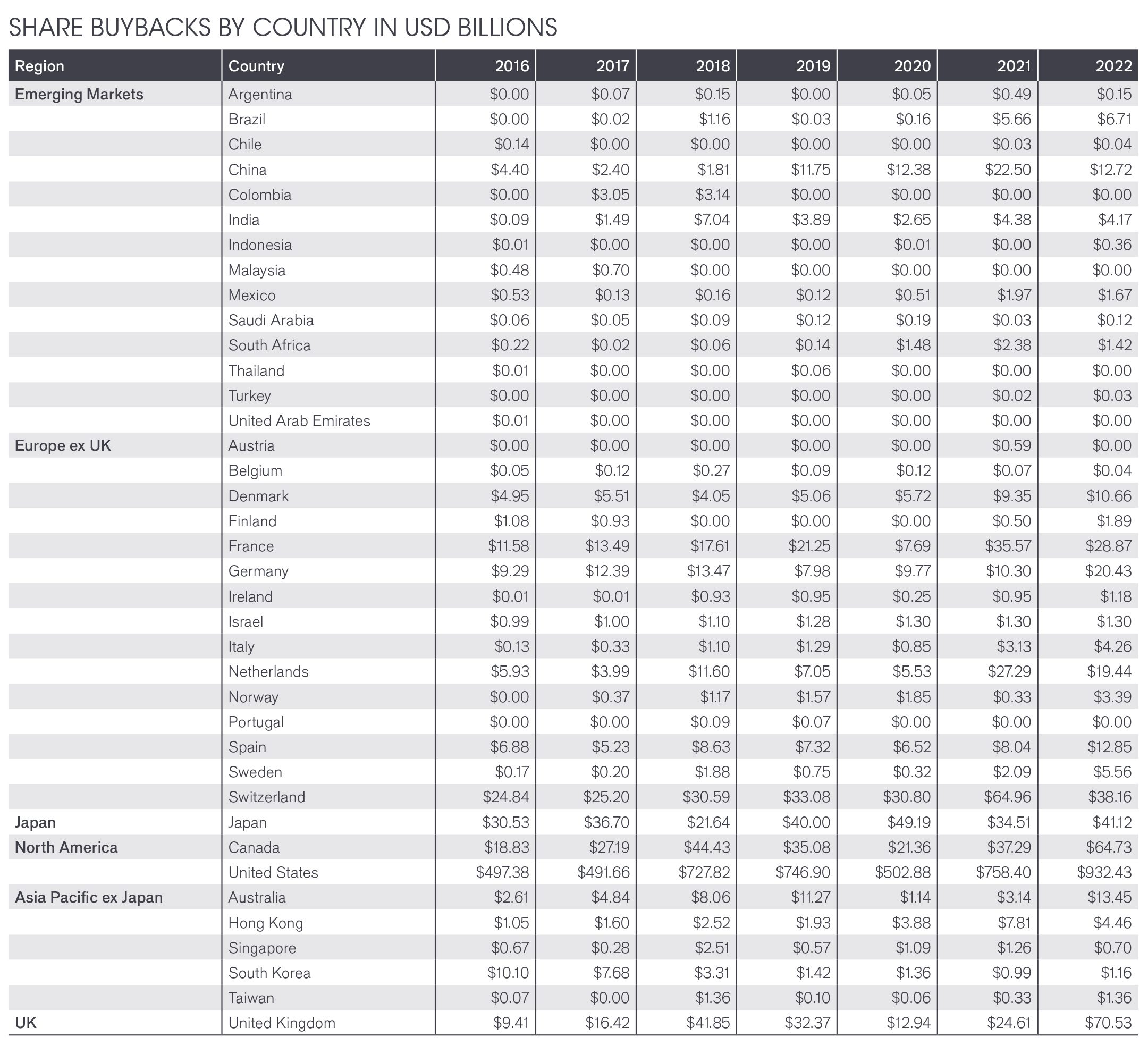

- Every region and almost every country and sector has increased its use of buybacks in the last 10 years, but there is wide variation in the balance between dividends and buybacks

- Just 10 companies, nine of which are in the US, accounted for almost a quarter of 2022’s buybacks

Share buybacks vs Dividends

Share Buybacks – by Industry

Share Buybacks – by Region

Share buybacks have soared to a new record almost matching dividends in 2022 (latest data), according to a special supplement of the Janus Henderson Global Dividend Index.

Company results published in Q1 2023 revealed the full extent of share buybacks undertaken around the world in 2022. The world’s top 1,200 companies bought back a record $1.31 of their shares, almost equal to the $1.39 trillion the same firms paid in dividends during the year. Moreover, the total was 22% higher than 2021, which had set the previous record.

By far the biggest contributor to growth in 2022 came from the oil sector, in which companies bought back $135bn of their own shares, more than four times as much as 2021. Almost all this oil-sector cash was spent by companies in North America, the UK and to a lesser extent Europe.

The rapid growth in buybacks is not a one-year phenomenon. Astonishingly, buybacks have almost tripled in value since 2012 (+182%), easily outpacing the 54% increase in dividends over the same period.

Every region, almost every country and almost every sector have seen them grow strongly. The biggest jump came in 2018 and was mainly caused by US technology companies ramping up their buyback programmes.

The consequence of this rapid growth is a significant increase in the importance of share buybacks. In 2012, globally they were equal to just 52% of dividends, ranging from 3% in emerging markets to 102% in North America2. In 2022 the global figure had jumped to 94%, ranging from 18% in emerging markets to 158% in North America3.

The sector variation is even starker. In the media sector, for example, which includes Facebook owner Meta and Google owner Alphabet, neither company pays a dividend, but both are big buyers of their own shares. The global value of the sector’s share buybacks was 8x larger than dividends paid in 2022. By contrast, in the high dividend-yielding utilities sector, dividends were 8x larger than buybacks. Adding buybacks and dividends together, the so-called total shareholder yield, significantly reduces the differences.

The figures are very concentrated in a few companies. Apple is one of the world’s largest buyers of its own shares, worth an astonishing $89bn for its financial year 2022, almost 7% of the global total. The ten largest buyers accounted for almost a quarter of the global total and only one of these, Shell from the UK, was outside the US. Nestle was one of Europe’s largest buyers of its own shares last year.

Ben Lofthouse, Head of Global Equity Income at Janus Henderson said: “The rapid growth in buybacks in the last three years reflects a strong profit and free cash flow performance and a willingness to reward shareholders without setting unintended expectations for dividends. Buybacks cannot always be relied on to enhance shareholder returns. Their discretionary nature makes them more volatile – as evidenced in 2020’s Covid disruption when they fell dramatically. In addition, they don’t always create shareholder value and some shareholders who rely on an income stream from their investments often prefer dividends. The global cost of capital is now significantly higher than in the last few years. The big question is what this will do to share buybacks in the months and years ahead. When companies could essentially access finance at almost zero cost, there was a huge incentive to issue debt and buy back shares as this added immense value. For companies generating very large amounts of cash, like Apple or Alphabet, this is not a major factor. For others, especially in the US, that have used borrowing to fund buybacks, the calculations will now be much more finely balanced.”

-ends-

_____________________

1 Latest data available, top 1,200 companies – (Source: Janus Henderson & Factset, April 2023)

2 USA 111% in 2012

3 USA 162% in 2022

Source: Janus Henderson Global Dividend Index & Factset, April 2023

Press Enquiries

Janus Henderson Investors

Nicole Mullin

Director of Media Relations

T: +44 (0) 207 818 2511

E: nicole.mullin@janushenderson.com

Notes to editors

Janus Henderson Group is a leading global active asset manager dedicated to helping clients define and achieve superior financial outcomes through differentiated insights, disciplined investments, and world-class service.

As of March 31, 2023, Janus Henderson had approximately US$311 billion in assets under management, more than 2,000 employees, and offices in 24 cities worldwide. Headquartered in London, the company is listed on the NYSE and the ASX.

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

This press release is solely for the use of members of the media and should not be relied upon by personal investors, financial advisers or institutional investors. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Henderson Secretarial Services Limited (incorporated and registered in England and Wales, registered no. 1471624, registered office 201 Bishopsgate, London EC2M 3AE) is the name under which company secretarial services are provided. All these companies are wholly owned subsidiaries of Janus Henderson Group plc. (incorporated and registered in Jersey, registered no. 101484, with registered office at 13 Castle Street, St Helier, Jersey, JE1 1ES).

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.