In a market flooded with fixed income exchange-traded funds (ETFs), we prioritize your needs by providing specialized, actively managed ETFs.

What could our specialized expertise do for you?

Janus Henderson is a pioneer in active fixed income ETFs. We tap into our extensive fixed income investment capabilities to offer exposures at multiple points across the curve.

2nd

fastest-growing actively managed fixed income ETF provider for taxable bond ETFs

4th

largest active fixed income ETF provider by AUM

9th

overall active ETF provider

Source: Morningstar Asset Flows, based on U.S. markets as of December 31, 2025

Active Fixed Income ETFs

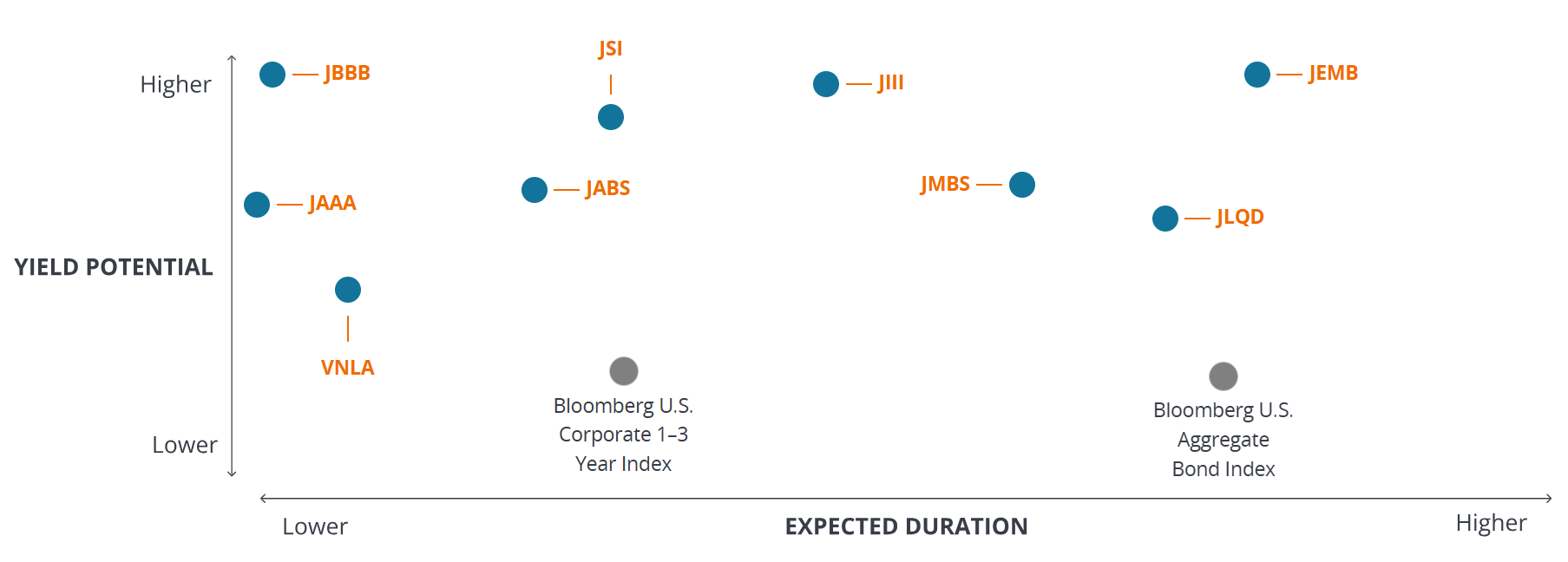

Our ETFs are actively managed, enabling us to leverage our strong convictions to explore segments of the market that are often neglected or underrepresented by market indices and passive investments.

Our unique Disciplined Alpha approach involves careful security selection aimed at driving alpha while still closely mirroring the benchmark’s duration and credit quality to ensure high correlation.

| Ticker | Name | Primary exposure | Style | Fixed income framework role | Target credit quality |

|---|---|---|---|---|---|

| JAAA | AAA CLO ETF | Securitized: AAA CLOs | Disciplined Alpha | Preserve | AAA |

| JBBB | BBB CLO ETF | Securitized: BBB CLOs | Disciplined Alpha | Increase income | BBB |

| JMBS | Mortgage-Backed Securities ETF | Securitized: Agency MBS | Disciplined Alpha | Defend | AA/A |

| JABS | Asset-Backed Securities ETF | Securitized: ABS, CMBS, CLOs | Disciplined Alpha | Defend | A/AA |

| JSI | Securitized Income ETF | Securitized: ABS, CMBS, MBS (credit/Agency), CLO | Total return | Diversify | A/BBB |

| JIII | Income ETF | Multi-Sector Credit | Total return | Diversify | BBB/BB |

| JLQD | Corporate Bond ETF | Corporates: US IG | Disciplined Alpha | Defend | A/BBB |

| VNLA | Short Duration Income ETF | Corporates: Global IG | Total return | Preserve | A |

| JEMB | Emerging Markets Debt Hard Currency ETF | Sovereign EMD: Hard Currency | Disciplined Alpha | Increase income | BBB |

Leverage our ETF specialists

Our ETF Client Product Specialists offer deep expertise in exchange-traded funds and provide strategic guidance on implementation and portfolio construction. Connect with our team for tailored solutions and actionable insights.

Managing Director, ETF Client Product Specialist

Executive Director, ETF Client Product Specialist

Executive Director, ETF Client Product Specialist

Executive Director, ETF Client Product Specialist

Associate Director, ETF Client Product Specialist

Insights delivered to your inbox

Our latest thinking on the themes shaping today's investment landscape, delivered every two weeks.