ESG stands for environmental, social, and governance. These three buckets represent non-traditional but financially material considerations companies should take into account when evaluating their business practices and investment decisions. At a glance, these risks and opportunities include:

- Environmental considerations relate to the natural world. Examples include carbon emissions, waste and pollution, climate change mitigation or adaptation, deforestation and biodiversity loss.

- Social considerations relate to how a company treats its key stakeholders, particularly its employees. Examples include human capital management, diversity, equity and inclusion (DEI) opportunities, health and productivity of workspaces, and rules around product mis-selling to customers.

- Governance considerations relate to a firm’s corporate behaviour, governance, and decisions and accountability. Examples include executive remuneration, tax practices and strategy, and board independence and structure.

There is a growing recognition of the financial impact ESG-related risks and opportunities can have on company cash flows, valuations, cost of capital, and ultimately investment returns. An ‘integrated’ approach to ESG is the consideration of E, S, and G factors that may directly influence the long-term financial success of a company.

| Our ESG integration approach: We believe integrating financially material ESG factors is instrumental to fulfilling our fiduciary duty to our clients. |

Are ESG factors ‘financially material’?

The term ‘financial materiality’ is used to describe the financial implications of specific environmental, social, or governance factors. An ESG issue is financially material if it affects (or could affect) the future value of a company or its ability to repay lenders. Which ESG issues are financially material can vary significantly between companies and industries. For example, a material ESG metric that may influence the future value of an industrial company is how it deals with toxic waste. If the company does not dispose waste in an environmentally sustainable manner, it may be exposed to litigation, fines, loss of reputation, or loss of customers. However, this issue will be largely immaterial for a software company where social issues, such as how it manages cybersecurity concerns, might be more critical to its future success.

At the heart of ESG integration is the simple idea that evaluating and understanding a company from both traditional financial analysis and ESG financial materiality analysis allows for a more complete perspective of a company’s future performance than either alone.

While the focus is often on the management of risks associated with ESG factors, these same factors often create opportunities. Companies that are improving on critical ESG measures or are exposed to ESG-driven growth trends could represent attractive investment opportunities. For instance, a company that is at the forefront of developing a lower-carbon version of its products

Importantly, ESG analysis—like traditional financial analysis—is not so much about what a company is doing today, but about the future. Our research focuses on how a company is managing ESG risks and opportunities and the impact on future cash flows or valuation.

Why is ESG so important?

At Janus Henderson, we believe consideration of financially material factors is vital to long-term risk-adjusted returns over time and is consistent with our fiduciary duty to clients. We believe ESG integration is increasingly important given the scale and extent of disruptive megatrends, such as climate change or the rise of artificial intelligence. Such challenges can represent substantial long-term financial risks and opportunities to investor portfolios.

How does Janus Henderson integrate ESG into its investment approaches?

At Janus Henderson, we believe investment teams should have the freedom to interpret and implement ESG factors in the way best suited to their asset class and investment strategy objective, as they do for any fundamental investment factor.

For actively-managed portfolios, ESG integration can help investors maximise risk-adjusted returns. In addition to those investment teams that apply an ESG integrated approach in our portfolios, we recognise that many clients want us to go further and implement specific ESG objectives. For those clients, we have built a suite of ESG-focused strategies, called our JHI Brighter Future Funds. These ESG-focused strategies have dual objectives – an explicit ESG objective, alongside a financial objective.

Figure 1: Janus Henderson’s ESG investment approaches

As of 30 June 2024, 85% of the firm’s assets under management are considered ESG-integrated and 2% are ESG-focused strategies within our Brighter Future Funds range.

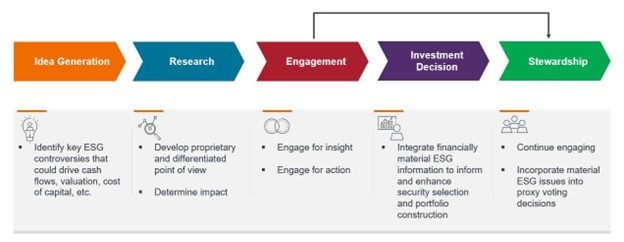

Figure 2: ESG in our investment process

Our approach to ESG integration has been crafted to be thoughtful, practical, research-driven, and forward-looking. When evaluating a company, we think about its products and services, its behaviour, conduct, supply chain management, and other considerations in running a business. Our ESG analysis considers not only a company’s current ESG practices, but also its strategy and future commitments.

We leverage our differentiated research to drive optimal outcomes for our clients. Our central Responsibility Team is a specialised in-house group that partners with both our investment teams and non-investment teams across an array of ESG functions. The Responsibility Team partners with our investment teams for research and company engagements on financially material ESG themes that are integral to the generation of actionable investment insights.

We engage with our portfolio companies for both insight – to understand company strategies and actions and leverage that information in our investment process, and we engage for action (outcome-oriented engagements), to encourage companies better manage financially material ESG risks and opportunities and to make decisions that are in the best interest of long-term sustainable cash flows. Such research is integral to Janus Henderson’s mission

Our commitment to clients: We care about ESG because we are passionate about fulfilling our fiduciary duty to our clients to help them meet their long-term financial goals. We understand responsible investing continues to evolve and mature, however we also believe a critical enabler of meeting these goals and client aspirations includes integrating financially material ESG factors into our investment decisions, as we do other financially material factors, and acting as effective stewards of their capital.

Environmental, Social and Governance (ESG) also known as sustainable investing, considers ethical factors beyond traditional financial analysis.

Sustainable/Socially responsible investment (SRI): An investment that considers both financial and moral objectives in investment decisions. An example would be to avoid companies that are involved in the tobacco, firearms or fossil fuel industries, while actively seeking out companies engaged with environmental factors or socially sustainable projects.