Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Greg Kuhl discusses why listed real estate could make for a winning campaign now.

What a last four years it has been! No politics here, but rather an acknowledgement that the last four years have generated quite a bit of material for the next generation of economics textbooks. A global pandemic on a scale not witnessed in 100 years, the highest levels of inflation in 40 years, and the most aggressive Federal Reserve (Fed) rate-hiking cycle in 44 years are just a few of the events that will be studied for decades to come.1

There is the potential for good news going forward: Observed inflation is rapidly approaching normalized levels, with three consecutive months of benign Consumer Price Index (CPI) prints, and the Fed has now confirmed it will cut rates beginning in September.

We believe a history lesson is important to “set the table” when discussing the current opportunity in REITs. Focusing on the two decades leading up to the events referenced above, many investors may not appreciate that from 2000 through 2019, U.S. REITs delivered an annualized total return of 9% (or 472% cumulative total return).2 These are healthy numbers, but even more so with the added context that the S&P 500® Index annualized 6% (225% cumulative) and the Bloomberg US Aggregate Bond Index annualized 5% (166% cumulative) over the same time period.

These 20 years were not all roses for U.S. REITs as they include the Global Financial Crisis (GFC), when commercial real estate was close to the epicenter, and REITs experienced the largest drawdown in their history. That REITs emerged from this and still managed to best other asset classes by such a wide margin for the overall period is a testament to their durability.

Are you better off than you were four years ago?

– Ronald Reagan, 1980

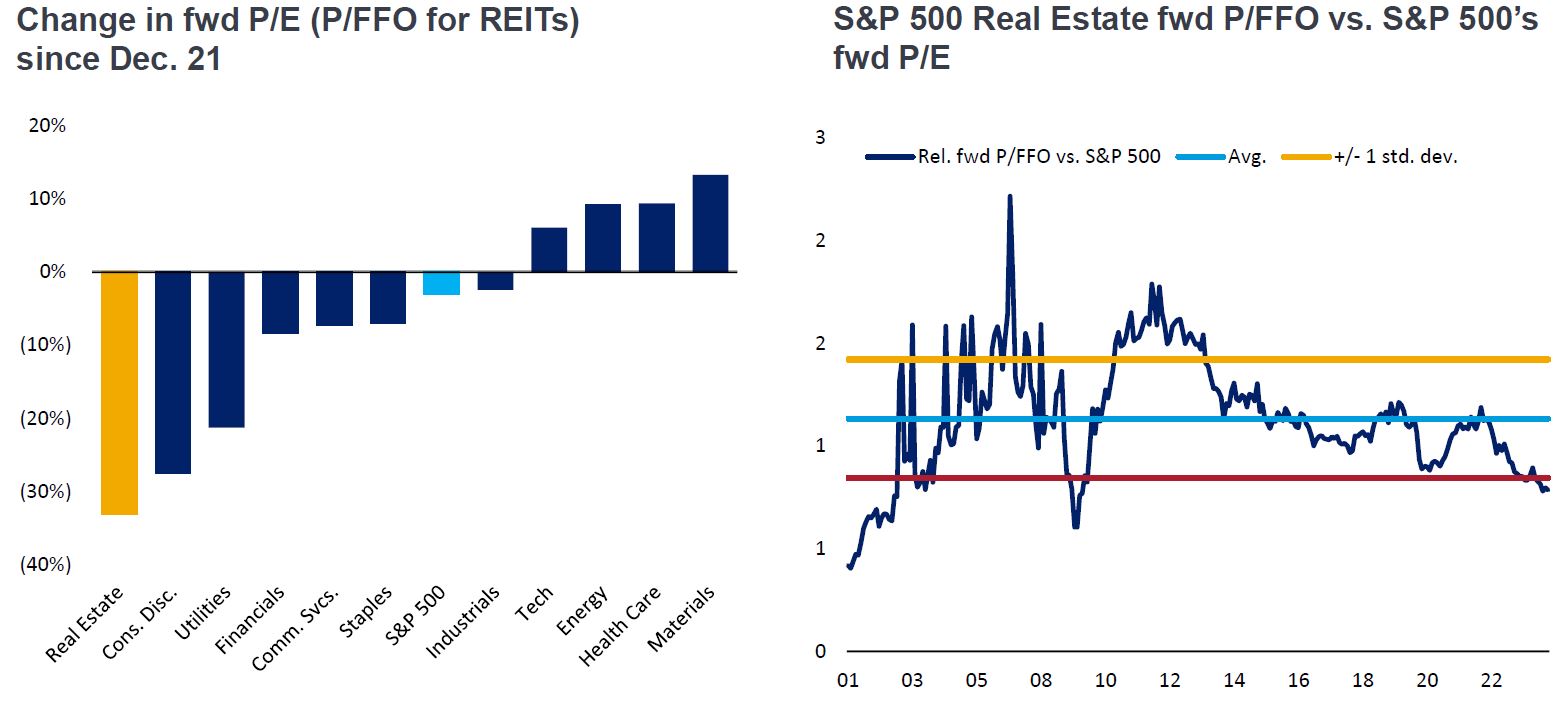

It can be human nature for the more recent past to loom a bit larger in the memory. Zooming in on the last four years, although U.S. REITs emerged from the pandemic largely unscathed (and delivered an annualized 15% return from the start of 2020 until the end of 2021), they have not fared as well during the Fed hiking cycle that followed. In fact, as measured by earnings multiples, U.S. REITs had de-rated more than any other equity sector since the Fed began its hiking campaign. This was caused by solid earnings growth, cumulatively 18%, at the same time that share prices declined by 22%.3 As a result, U.S. REIT valuations are just about as discounted relative to broader equities as they have been at any point this century (see chart below).

Some large institutional investors have taken notice of these attractive valuations, as evidenced by the $9.5 billion take-private of apartment REIT Air Communities (AIRC) announced in April for a 25% premium to its unaffected share price.4 In our recent conversations, however, we find that many investors have largely ignored REITs for the past few years because of their underperformance versus other types of equities, in addition to historically attractive yields available on instruments like money market funds.

Source: FactSet, NAREIT T Tracker, BofA US Equity & Quant Strategy, as of June 30, 2024.

Note: P/FFO =a REIT valuation ratio that compares the market price of a REIT and its funds from

operations (FFO). Past performance cannot guarantee future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Don’t swap horses in the middle of the stream.

– Abraham Lincoln, 1864

Five-percent yields on cash and tech stocks that triple in six months are nice, but can they last? REITs have historically delivered solid returns for long-term investors and maintained steady fundamental growth but have recently lagged because of a historically aggressive Fed hiking cycle.

But what should happen when the Fed rate cycle reverses? This is the question being posed to “voters” (read: investors) today, and the early polls should give REITs some cause for optimism. May’s CPI data, released in early June, was the first real positive surprise versus market consensus in some time and marked the second of four consecutive months of slowing inflation (April through July).

These recent CPI prints represented an important turning point for market expectations of Fed policy. From the release of May’s CPI data through the release of July’s CPI data, 10-year U.S. Treasury yields fell 60 bps to 3.8%, Fed speak turned borderline dovish, and the market began pricing in rate cuts with near certainty. This expectation was confirmed with Jay Powell’s speech at Jackson Hole in which he indicated that Fed rate cuts will begin in September. Notably, since the May CPI data release, U.S. REITs have returned 15.4% compared to the S&P 500 at 5.1%.

An unrelated but important datapoint since the May CPI print is that the largest U.S. initial public offering in almost three years happened at the end of June. And it was not a tech company, but a REIT – Lineage Logistics.

Aside from highlighting a burgeoning investor receptivity for REITs, the deal exemplifies what we think will be an important theme in public REITs for the coming decade: Access to capital. Listed REITs spent the decade following the GFC de-leveraging their balance sheets, and today they have never been healthier, with the vast majority now being investment-grade corporate bond issuers. This contrasts with private real estate, which generally has never stopped trying to max out leverage using cheaper short-term debt.

In the coming years, we expect to see listed REITs take advantage of their access to both equity and debt capital markets to go on offense and acquire quality real estate from private owners facing balance sheet pressure. On top of historically steady/predictable cash flow growth, growth from acquisitions can be another important source of upside for listed REITs in the years to come.

Yes we can.

– Barack Obama, 2008

In an environment of lower uncertainty around Fed policy, the prospects for listed real estate presently look as good as ever. In our view, underlying real estate fundamentals remain steady, there are new growth opportunities ahead, public REIT balance sheets have never been stronger, and valuations have rarely ever been more discounted relative to broader equities. Meanwhile, interest rates look to be turning from a headwind into a tailwind.

In this election year, investors need to decide if it’s going to be “four more years” of once-in-a-generation macro events, or if it’s perhaps time for a return to something more like a longer-term “normal”. There is early evidence of a rotation back into REITs. If this is the beginning of something like the first two decades of the 2000s, investors may be well rewarded for paying attention.

1 YoY CPI, Fed Hiking Cycle intensity measured by the slope of Fed Funds Target while rates are rising

2 Bloomberg, FTSE NAREIT Equity REITs Index. Past performance does not predict future returns.

3 Bloomberg, FTSE NAREIT Equity REITs Index, Past performance does not predict future returns.

4 Blackstone Real Estate Partners fund X announced the take private of AIRC on 4/8/24 for $39/share.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

FTSE Nareit Equity REITs Index: The FTSE NareitUS Real Estate Index Series is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the U.S. economy. The index series provides investors with exposure to all investment and property sectors. In addition, the more narrowly focused property sector and sub-sector indexes rovide the facility to concentrate commercial real estate exposure in more selected markets. The FTSE Nareit Equity REITs index contains all Equity REITs not designated as Timber REITs or Infrastructure REITs.

Investment grade: a bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Leverage: the amount of debt that a REIT carries. The leverage ratio is measured as the ratio of debt to total assets.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.